RICS survey, mortgage lending, farmland prices, and US interest rates

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

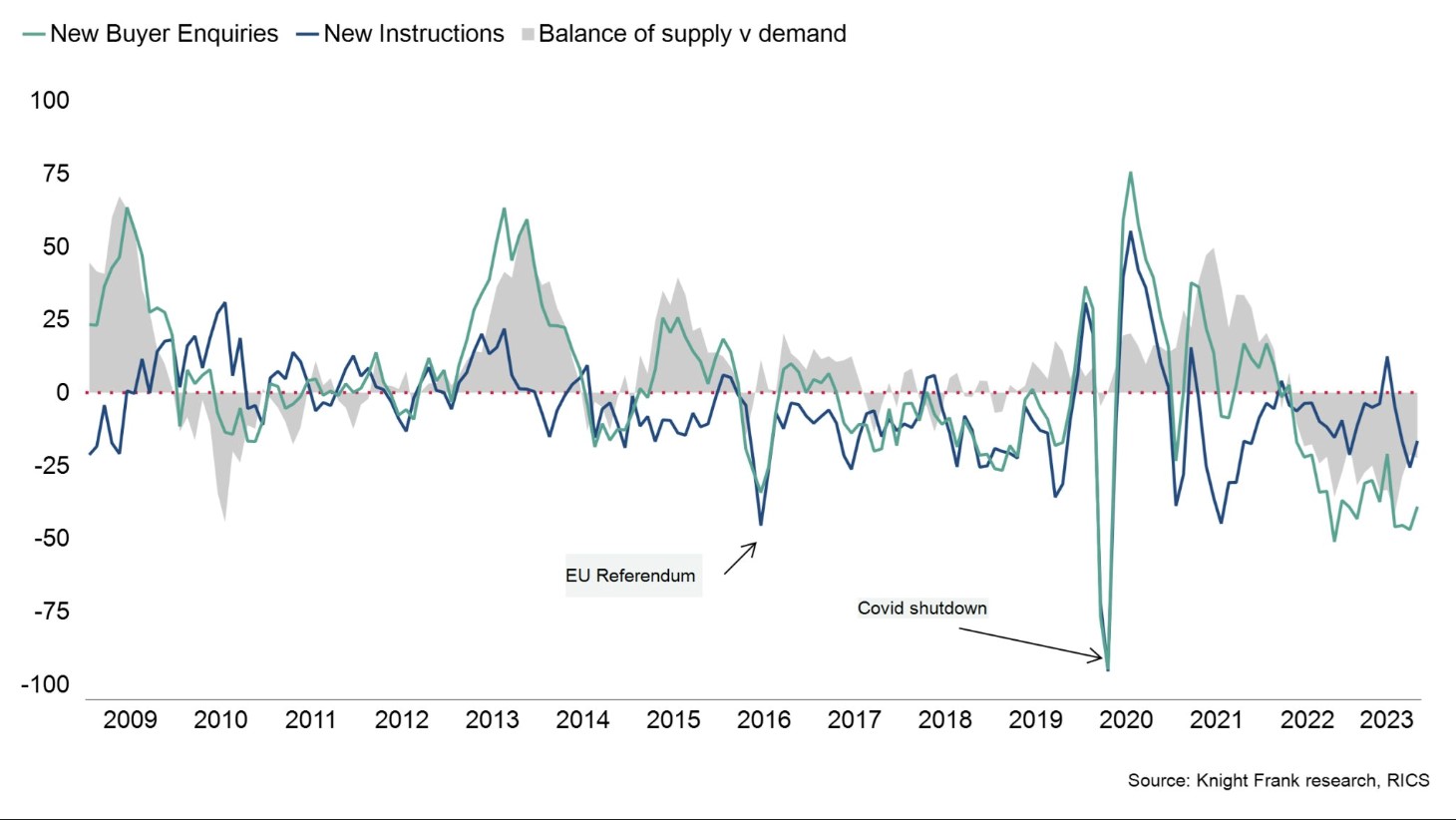

Near-term measures of sales rates, demand and house prices remained downbeat in September's RICS Residential Market Survey, but the outlook a year from now is starting to look more stable.

The net balance for new buyer enquiries came in at -39% during September. A negative net balance implies that more respondents are seeing decreases than increases. The reading is weaker than in the aftermath of the Brexit vote in 2016, but not as downbeat as during the Covid market shutdown in spring 2020, according to Anna Ward (see chart).

Agreed sales registered -37%, a marginal improvement from -46% the previous month. The net balance for sales volumes in the coming three months sits at -24%, but moves to +3% at the twelve-month time horizon. New instructions have fallen for three consecutive months and the rate of new appraisals mean that "any immediate changes in supply levels available across the market seem unlikely," the group said.

The imbalance between supply and demand in the lettings market shows no signs of abating. A net balance of +43% of survey participants saw an increase in tenant demand in September, while the balance of new listings registered -24%. Respondents have pencilled in close to 5% growth in rental prices across the UK (on average) over the next twelve months.

Mortgage lending

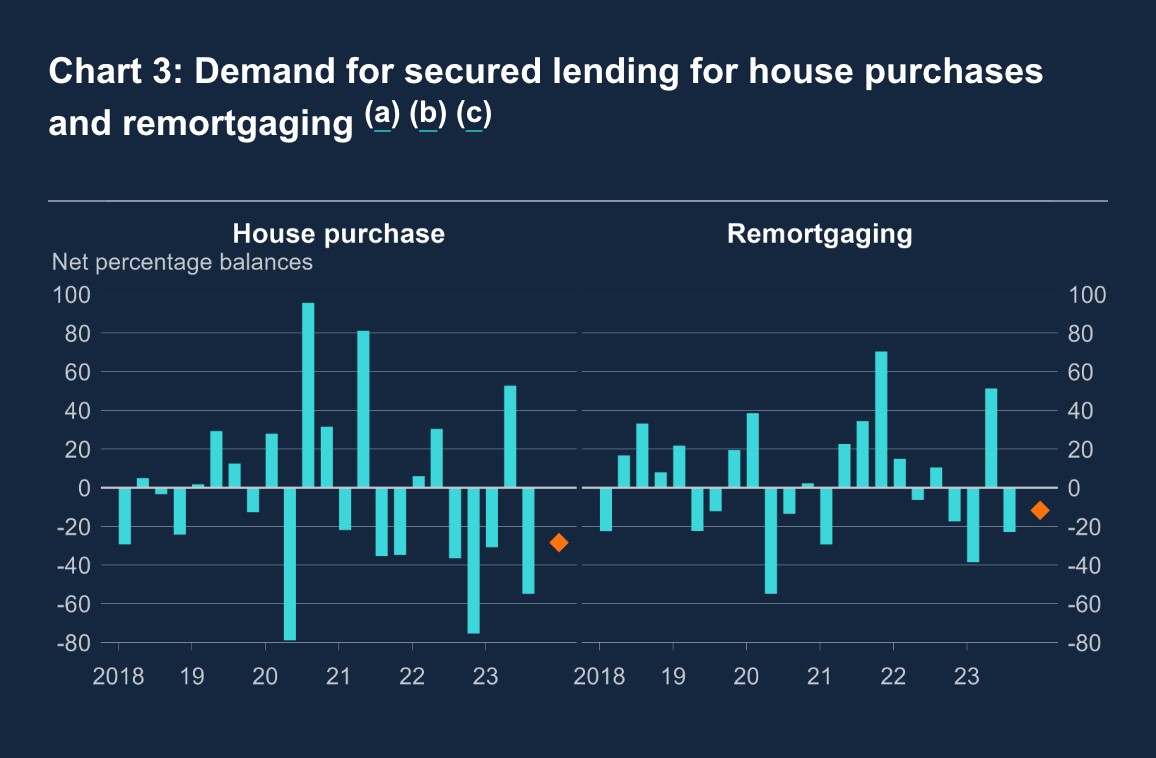

The Bank of England's quarterly survey of UK lenders tells a similar story of a sluggish sales market and falling demand for mortgages as borrowers put off refinancing where possible.

Lenders reported that demand for secured lending for house purchase and remortgaging decreased in Q3, and was expected to decrease further in Q4 (see chart). Spreads relative to the base rate or appropriate swap rate narrowed in Q3, but were expected to widen in Q4, which suggests lenders plan to rebuild margins that have grown thin over the course of the year. Here is Hina Bhudia of Knight Frank Finance:

"Transaction activity in the property market is slowing and many borrowers are still rolling off sub-2% deals and are eager to put off refinancing where they are able to do so. Borrowers that do act are generally opting for trackers. For many people, the risk that monthly payments increase in the event of another interest rate hike is worth taking if it gives them the opportunity to see cuts in their monthly outgoings next year. Typical two year trackers at 75% LTV are still above 5.50%, while retail bank tracker products sit a little over 1% above the base rate.

"The banks remain very eager to bring in more business. Most will be behind on their lending targets due to the subdued conditions in the property market. Private lenders have been trimming margins on tracker products to gain market share, but the margins at the high street banks are already pretty thin. We don't foresee large moves in mortgage rates through to the end of the year. That's reinforced by the fact that lenders believe spreads over the Bank Rate or appropriate swap rate will widen in Q4".

Peak farmland

The price of bare agricultural land in England and Wales rose by 1% to hit another record high in the third quarter of 2023, according to the latest instalment of the Knight Frank Farmland Index.

On average, an acre of land is now worth £8,951. That's up 8% compared to the same period a year earlier. This is at, or very close to the peak, writes Andrew Shirley:

"Average values may hit £9,000/acre by the end of the year, but after that 2024 looks set to be a period of consolidation as supply and demand become more balanced. Property markets also generally tread water in a General Election year.

"The volume of publicly advertised farmland is up by a quarter so far this year to around 80,000 acres, but this is still well below historical levels and there are few signs of a vast increase over the next 12 months, despite ongoing reductions in the amount of direct support payments that farmers are receiving from the government."

The last mile

The murky outlook for interest rates in the US continues to fuel volatility across a range of asset classes.

I talked on Wednesday about a rout in the bond market triggered by fears that the Federal Reserve would hold rates higher for longer than investors had anticipated. That rout had started to abate as of early this week as some officials pushed back against the prevailing narrative by suggesting the Fed is done raising rates.

We got more volatility overnight after a seemingly hot inflation report. The core consumer price index, which excludes food and energy costs, increased 0.3% in September, Bureau of Labor Statistics data showed yesterday. Services prices climbed by a very robust 0.6%.

Policymakers have for some time been warning that the so-called 'last mile' in bringing inflation back to target will be the hardest. That's now coming to pass as central bankers pore over noisy data and express doubts over whether rates are sufficiently restrictive.

"The bigger picture is that the trend is still quite encouraging, but the fight continues," Olu Sonola, head of U.S. regional economics at Fitch Ratings in New York, told Reuters. "They (Fed officials) may now want to extend the pause to December, given the recent increase in long-term rates."

In other news...

China on the brink of deflation (FT) and finally, UK economy grows 0.2% in August despite drag from higher interest rates (Times).