Prime Central London, UK house prices, and affordable home targets

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

The Labour Party has for several months been signalling that it intends to capitalise on Conservative Party divisions over housebuilding. An August report in the Times suggested the party views infrastructure and housing as cornerstones of a plan to spend more on public services without raising taxes. Shadow chancellor Rachel Reeves will use her speech at the Labour Party Conference today to flesh out what that looks like.

Advanced copies of the speech given to the Times include the following pledges:

- The recruitment of 300 new planners for local authorities to help drive housebuilding, funded by an additional surcharge on stamp duty for foreign buyers.

- An overhaul of Britain’s “antiquated” planning system. That includes updating all national policy statements on planning to ensure that priorities like net zero and economic growth play a key role in decisions.

- Planning applications for battery factories, laboratories and 5G infrastructure will be fast-tracked.

Affordable homes

As is custom in the run up to elections, we also got an ambitious housebuilding target - Labour leader Keir Starmer said the party will oversee construction of 1.5 million homes in its first five years in power. Angela Rayner, the shadow housing secretary, said the party will ensure the country sees the biggest boost in affordable housing for a generation. Rayner pledged the following in an interview given to the Guardian on Friday:

- set up a new expert unit to give councils and housing associations advice to get the best deal during negotiations with property firms.

- publish guidance to prevent developers claiming that building more affordable homes was not viable, permitting them to challenge 106 rules only if there were genuine barriers to building homes.

- allow councils and housing associations to use a greater proportion of the grant funds they receive – currently capped at just 10% – on buying housing stock they would then rent out as affordable homes.

- adopt Law Commission proposals that would make it easier for leaseholders to buy the freehold or extend their lease - that would come as part of a leasehold reform bill if the Conservatives fail to deliver one next month.

UK house prices

UK house prices fell 0.4% in September, slowing from a 1.8% drop in September, Halifax said on Friday. Values are now down 4.7% on an annual basis.

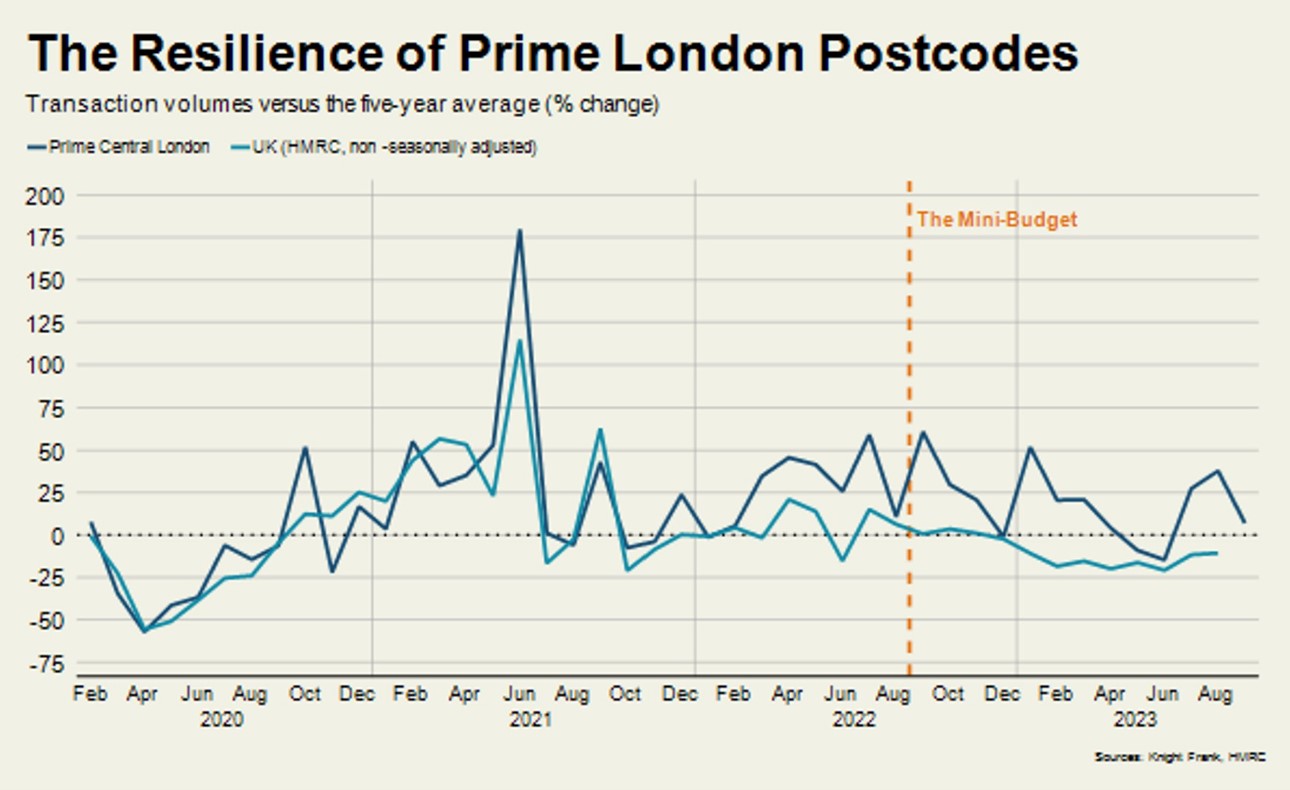

"The combination of the mini-Budget and fourteen consecutive rate rises have taken their toll on demand but buyers and sellers should return in greater numbers as a sense of stability returns," Tom Bill said in a statement issued to media on Friday. "The financial pain entering the system will continue next year as people roll off fixed-rate deals, but there will be an improvement in sentiment, that vital lubricant in the housing market. We therefore think most of the UK’s house price correction will happen this year and modest single-digit annual growth will return after the next general election.”

Indeed, last week we published updated forecasts for UK house prices and rents. We think the volatility of the past twelve months will extend price falls this calendar year to 7%, up from our March forecast of a 5% drop. We're now expecting a 4% fall next year, slightly smaller than the 5% drop we forecast earlier this year. Growth returns from 2025.

Prime Central London

We think prime central London (PCL) will experience a smaller correction, due to a combination of more cash sales (around half inside zone 1), the fact prices are still more than 15% below their last peak in mid-2015 and the fuller return of international travel.

Nevertheless, the capital’s more affluent postcodes are not immune from the deteriorating economic sentiment and the market in PCL is currently in a holding pattern, according to our latest PCL Index, out this morning. While UK house prices are down around 5% (4.7%, according to Halifax, 5.4%, according to Nationwide), prime central London has experienced a more modest 1.7% fall. In prime outer London, the decrease was 1.4%.

The number of new prospective buyers across the UK was 11% down in the third quarter of this year compared to the five-year average, while the figure for London was up by 13%, our data shows. Meanwhile there was a 14% increase in exchanges in the capital while sales volumes fell by 9% across the country. In a departure from what took place after the global financial crisis, property prices in London have been far less volatile than the rest of the country.

The road back to normality

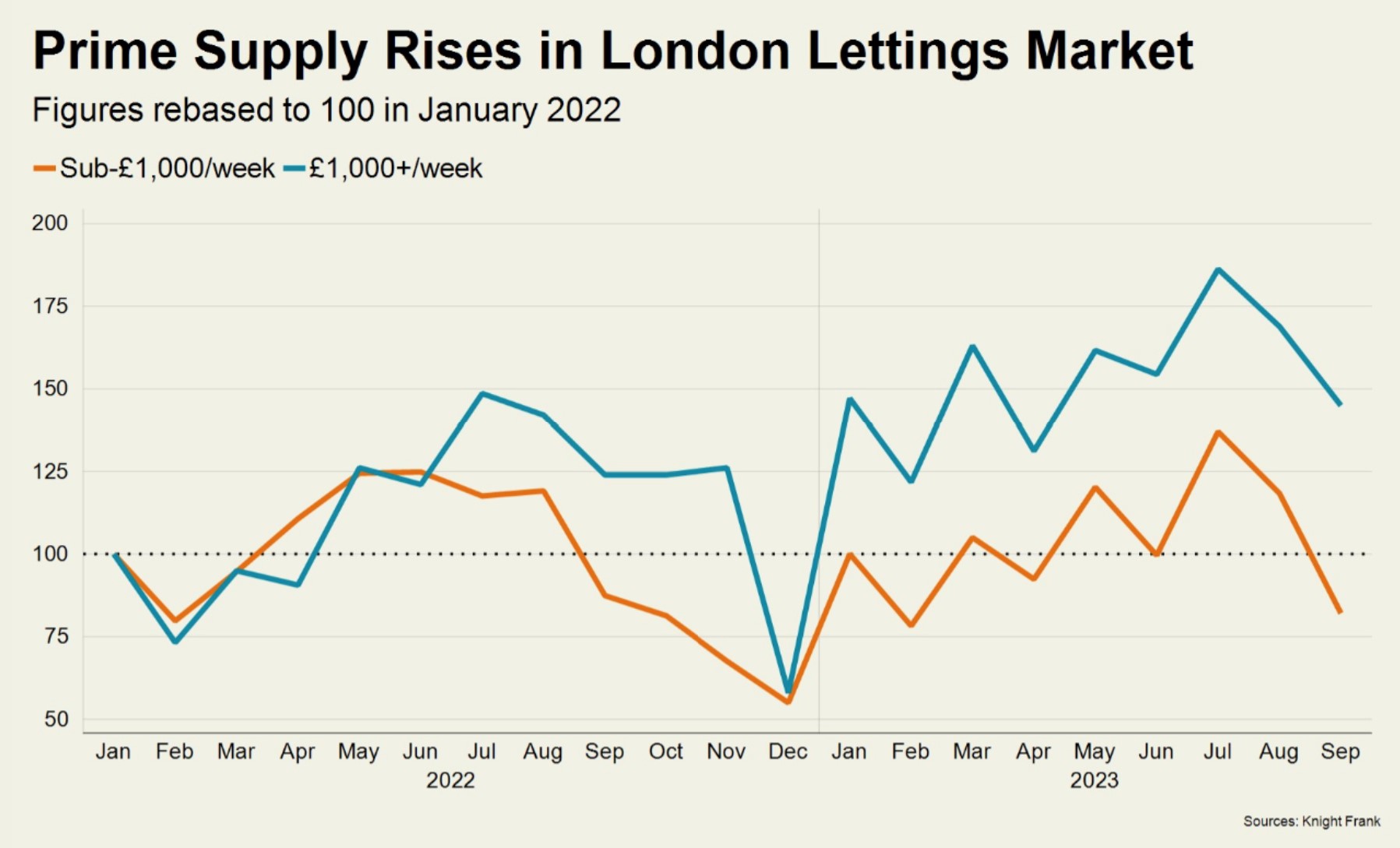

Easing of annual rental growth in prime London markets continued in September as supply increased and demand held steady.

Growth in prime central London (PCL) was 11.2% in September, which was the lowest figure in two years. In prime outer London (POL), an increase of 10% means that next month we are likely to be back in single digits. It was also the smallest rise in two years.

The number of new prospective tenants in prime London postcodes was flat compared to the five-year average in the third quarter of this year, our data shows. Meanwhile, listings in PCL were only 12% down, according to Rightmove, a figure that compares to a decline of 37% in the same quarter last year.

As the imbalance between supply and demand continues to reduce, we think rental value growth will return to more normal levels from 2024.

Net lending to commercial real estate was positive for the sixth consecutive month in August, rising by c.£1bn. This was its largest increase since April. Will Matthews has more.

Elsewhere - another hot US jobs report (AP), and finally, tenant woes widen the role of ‘build-to-rent’ investors (FT).