UK house price forecast, office returns and construction contracting

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

On this day last year the mortgage market was in a state of chaos. Large lenders withdrew large numbers of products during the weeks following the mini-budget as investors balked at the government's proposed tax cuts. The average two-year fixed rate mortgage topped 6% for the first time since 2008, marking the beginning of a turbulent year for borrowing costs amid the shifting outlook for inflation.

Rising prices remain a threat, but the medium-term future now looks more benign. Inflation eased by more than economists had expected in September and the Bank of England is at or approaching the end of its tightening cycle.

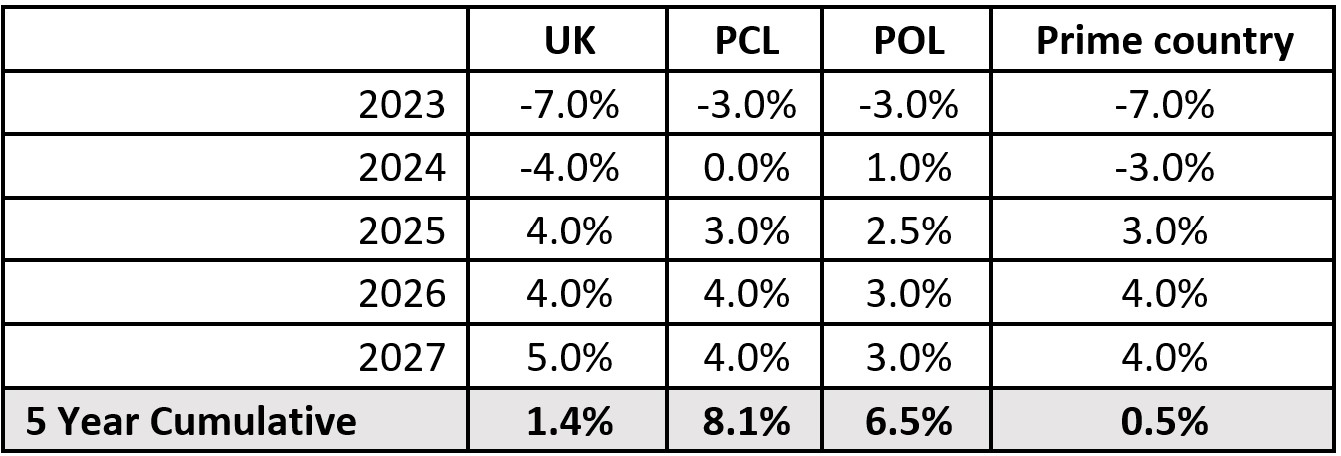

This makes it a good time to revisit our forecasts for UK house prices and rents. We think the volatility of the past twelve months will extend price falls this calendar year to 7%, up from our March forecast of a 5% drop. We're now expecting a 4% fall next year, slightly smaller than the 5% drop we forecast earlier this year. Growth returns from 2025.

Prime residential markets

We still think prime central London (PCL) will experience a smaller correction, due to a combination of more cash sales (around half inside zone 1), the fact prices are still more than 15% below their last peak in mid-2015 and the fuller return of international travel (see table below). We've trimmed this year's fall in prime outer London to 3%, from 4%, and we now expect a marginally stronger recovery from 2026 onwards. POL continues to benefit from demand that is more domestic and needs-driven.

We expect prices in Country markets to fall 7% this year, rather than 5% we forecast in March. Strong growth during the pandemic means that declines in values this year and next would leave prices 3% above their pre-pandemic level.

In the rental market, we think there will be stronger growth this year and next in PCL and POL as the imbalance between supply and demand takes more time to correct. You can read the full set of forecasts.

Returning to the office

In three years’ time, 64% of global company leaders want people who were office-based before the pandemic to have returned full-time. The figure stands at 63% for the UK.

That's according to a KPMG Global CEO Outlook survey of 1,300 chief executives, including 150 in the UK. The data suggests we're only at the beginning of a long, slow process when it comes to the repopulation of cities during the working week.

The findings are consistent with (Y)OUR SPACE, which showed a clear swinging of the workplace pendulum back towards our starting point when COVID struck. Whether the return to the office will be encouraged via carrots or mandated with sticks is still being worked out, though the KPMG survey suggests bosses are now clearly favouring the former - 83% in the UK said it was likely or very likely that employees who made an effort to come into the office would be rewarded with favourable assignments, raises or promotions.

"The return to office narrative will get tougher and more emotive as the year progresses," Lee Elliott, Knight Frank's Head of Global Occupier Research, told me yesterday. "This brings us into the territory of recession/economic challenges driving presenteeism rather than some concerted effort to create an effective work style and workplace. Some in the market have referred to this as a Return to the Past. The counter-balance to this position is the apparent strength of labour markets where employees arguably still (for now) are in charge, particularly in sectors such as tech."

Construction craters

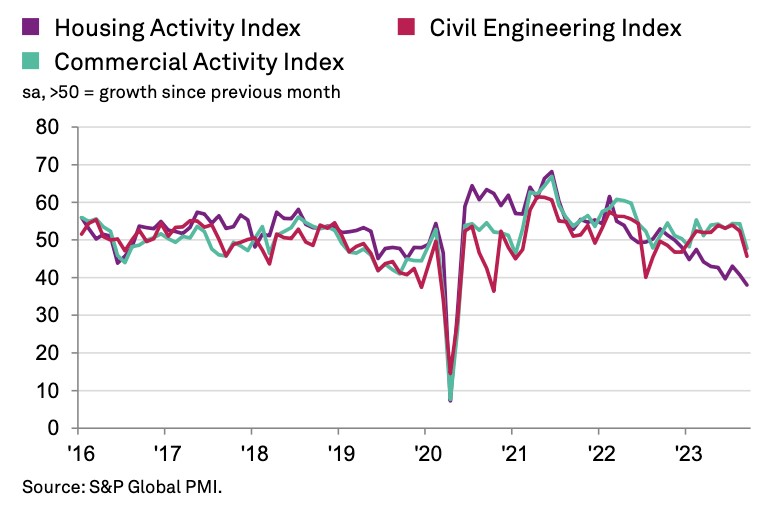

Construction activity contracted sharply during September, led by housebuilding.

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index registered 45.0 during the month, down sharply from 50.8 in August and below the neutral 50 value for the first time since June. The residential part of the index dropped to 38, which is the steepest fall since 2009.

The sharp rise in borrowing costs and headwinds created by inconsistencies in the planning system has caused housebuilders to act more defensively. Consultancy Capital Economics expects a decline in housing starts of around 40% next year compared to 2022.

Purchasing activity decreased at a solid pace in September amid efforts to reduce inventories. Supplier performance once again improved at a robust rate. Delivery times for construction products and materials have now shortened in each of the past seven months.

In other news...

World economy on course for ‘soft landing’ despite headwinds, IMF chief says (FT).