Britain's political parties try to turn the tide on housebuilding

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

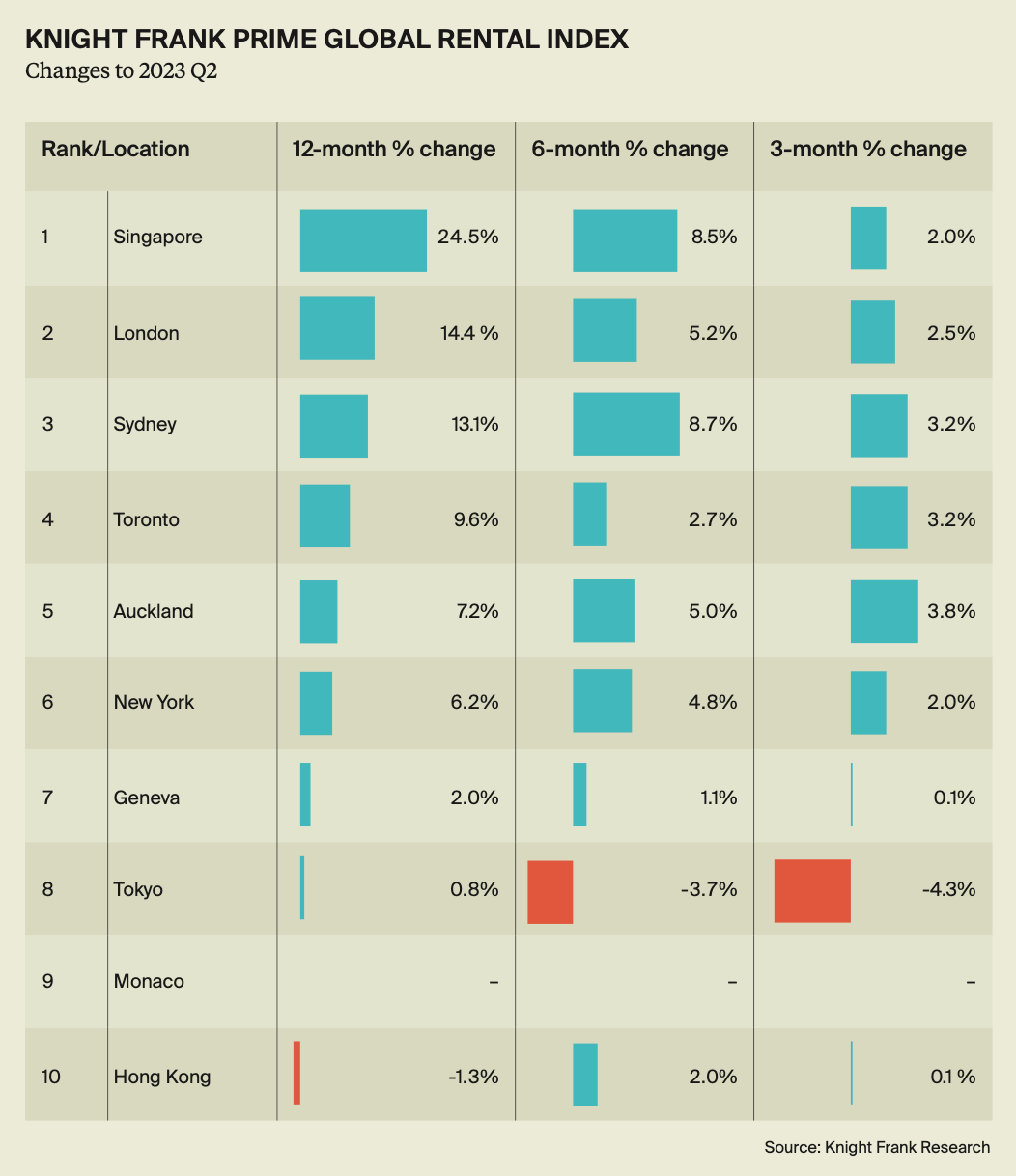

Rents in the ten cities covered by our Prime Global Rental Index climbed 7.5% during the year to June. While that's down from 8.2% in the year to Q1, it's still three times the pre-pandemic average.

Luxury rental growth has been easing since the first quarter of 2022, when the 12.2% annual growth marked the peak of the post-pandemic rental boom. The surge was triggered by residents returning to cities following lockdowns, the affordability squeeze as prospective buyers were priced out of sales markets following rate hikes, and weak new supply following the disruption of construction through the pandemic.

The overall index has risen 23% from Q1 2021 to date. Growth in specific cities has been even stronger – with New York, Singapore and London seeing rental growth of 56%, 53% and 51% respectively over the same period. Those growth hubs are now seeing moderations. In Singapore, annual growth eased from 31.5% last quarter to 24.5%; in London growth has decreased from 16.9% to 14.4%; and in New York, it has dropped from 10.6% to 6.2%.

See the report for more.

Nutrient neutrality

The government yesterday announced plans to scrap water pollution rules known as nutrient neutrality in an attempt to unblock 100,000 new homes between now and 2030. The Home Builders Federation has long been critical of the system - their detailed take on its shortcomings can be found here.

While the planning system is undoubtedly a drag on output, the housebuilders are currently grappling with a squeeze on demand due to higher interest rates, so will the changes actually boost housebuilding? It's not a magic bullet, according to Oliver Knight, Knight Frank's head of residential development research:

"The economics of developing new homes in England is challenging with a slower sales market, issues related to nutrient neutrality and local plan failures all forcing house builders to adopt more defensive strategies over the last 12 months.

"The HBF estimates that nutrient neutrality regulations alone have held up 145,000 plots in the planning system while a quarter of housebuilders we surveyed in England believe environmental and ecological regulations are posing a challenge to housing delivery. Against this backdrop, scrapping nutrient neutrality rules is arguably a positive bit of regulatory news for the sector - but it’s not a magic bullet.

"A lack of clarity around the future direction of planning policy has led to some local authorities pausing local plans, creating a delay in the volume of land being allocated for development. The government has recently removed mandatory housing targets and softened the five-year land supply requirement, while it is also considering introducing a new single national infrastructure levy on new development - all of which is leading to slower build out rates of new homes."

New Towns

Autumn is approaching, which means it'll soon be party conference season. An election is due in fewer than eighteen months, so this year's conferences will be the moment we get a detailed feel for what those campaigns will look like.

The Labour Party has for several months been signalling that it intends to capitalise on Conservative Party divisions over housebuilding. There is little money to spend on public services, so the party views "an infrastructure and housing blitz as a cornerstone of a longer-term plan to spend more on public services without raising taxes," according to a report in Saturday's Times.

The report is light on detail, but it does say that the party intends to fast-track onshore wind farms, nuclear reactors and other green energy infrastructure. It has also tasked the shadow housing minister with drawing up "detailed plans for an overhaul of planning rules to produce up to 100,000 more new homes a year."

It wants councils "to band together to draw up more strategic blueprints that can deliver fewer, bigger new developments locally with better infrastructure."

Immaculate disinflation

For several months, US inflation has slowed while maintaining healthy economic growth and high levels of employment - a process that has become known as "immaculate disinflation".

While that's good for much of the economy, it's been bad for the housing market. Conditions have given the Federal Reserve plenty of leeway to ensure it really stamps out inflation, and the rising likelihood of more interest rate hikes has caused mortgage rates to surge. The latest data from Freddie Mac puts the 30-year fixed rate mortgage at its highest level since 2001.

More evidence for "immaculate disinflation" appeared yesterday with the publication of the Job Openings and Labor Turnover Survey, or JOLTS report - widely known as the Fed's preferred gauge of labour market health. The number of available positions decreased to 8.83 million in July from 9.17 million the previous month. The reading was far lower than the 9.5 million that economists had been expecting.

"Although the labor market is still tight, the degree of excess demand is declining and is coming about through companies reducing the number of vacancies rather than increasing layoffs and unemployment," Conrad DeQuadros, senior economic advisor at Brean Capital in New York told Reuters. "There is plenty here to make the case that not only is the labor market rebalancing but at this point it is doing so without pushing up unemployment."

In other news...

Take-up of science-related space in the golden triangle totalled 314,325 sq. ft during Q2, an increase of 20% compared to the same quarter in 2022 and 125% above the five-year average, according to the latest figures from Jennifer Townsend. Oxford accounted for 52% of this activity, with take-up boosted by Moderna pre-letting 145,000 sq. ft. at Harwell Campus.

Elsewhere - UK proposes probe into large land holdings of top homebuilders (Reuters), UK house sales set for slowest year since 2012, says Zoopla (FT), and finally, French tax adds to woes of second home owners (Times).

Photo by Timo Volz