Country House prices come under pressure as borrowing costs rise

Prevalence of cash buyers at top end of the market is supporting sales activity.

3 minutes to read

Prime Country House Index 279.7 / Quarterly price change -2.6% / Annual price change -4.2%

Country house prices came under pressure in the second quarter of the year, as the ‘escape to the country’ trend reset, and buyers re-calculated their budgets due to higher borrowing costs.

The average price of a property fell 2.6% in the second quarter, according to the Prime Country House Index (PCHI). It was the largest quarterly fall since the global financial crisis in Q2 2008. It came after a decline of 0.5% in Q1.

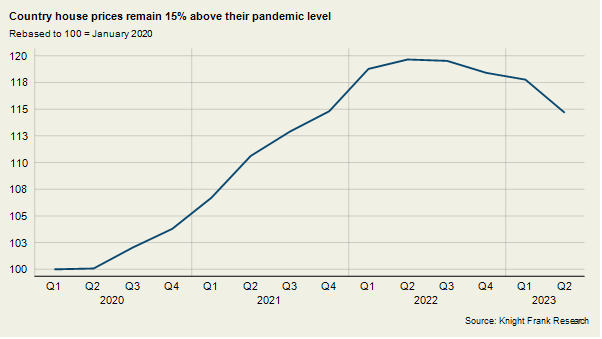

It left country house prices down 4.2% since their peak in June 2022, although the average property is still worth 15% more than before the pandemic (see chart), which supported a surge in prices as people upgraded their homes and took advantage of a period of stamp duty savings.

Affordability stretched in UK property market

With the Bank of England having increased the bank rate 13 times since December 2021, taking it to a 14-year high of 5% as it attempts to rein in inflation, buyers have had to trim budgets in recent months.

This has put downwards pressure on prices despite resilient demand outside of London, with new prospective buyers down 9% in Q2 versus the five-year average (excluding 2020).

Our latest sentiment survey confirms that a third (33%) of buyers have seen their spending power fall due to the increase in borrowing costs. For 17% of respondents the drop in spending power has been more than 10%.

It has led to a period of price discovery, with price expectations between buyers and sellers currently at their widest since the reopening of the property market after the first UK lockdown in Q2 2020, something we look at in detail here.

Cash buyers remain active in higher price brackets

The increase in the cost of borrowing has put equity rich and cash buyers in a strong position, as we’ve previously explored.

Higher value bands saw a smaller quarterly fall than the main PCHI in Q2, with the £4m to £5m bracket down 1.8% and £5m+ down by 1.4%.

While the number of cash buyers in prime regional markets outside London was 40% in 2022, at £5m+ it is more than three-quarters (77%). Unlike in the capital, domestic demand has been the main force at play in the high value prime regional market. This has provided some insulation from high borrowing costs.

Supply, although improved from pandemic lows, remains tight at the top end of the market, which is providing some support to prices.

Exchanges outside of London were down 24% in Q2 versus the five-year average (excluding 2020) but they increased by 37% in the £5m+ value band. On the same basis, the number of offers made was down 20% overall in the second quarter but up 22% for properties valued at £5m and above.

We expect prices to fall 10% through the remainder of this year and next, although a strong wage growth and jobs market, forbearance from lenders, and availability of longer term fixed-rate mortgages should limit further falls.