May GOPPAR performance surges in London hotel market

London hotel GOPPAR growth on par with 2019 with positive future predictions.

2 minutes to read

London hotels recorded 28% RevPAR growth in May, tracking ahead of inflation, with real growth versus 2019 of 7.3%.

This strong top-line performance led to London’s monthly GOPPAR growth surging 26% ahead of 2019 profits for the month of May.

For further analysis, download Knight Frank’s UK Hotel Dashboard.

We provide a detailed overview of key performance indicators for both London & Regional UK, summarising trends in revenues, expenses, and profitability.

In this month’s edition we spotlight on the performance of London’s Upper-Mid and Upscale hotels and Regional UK’s branded Midscale hotel sector.

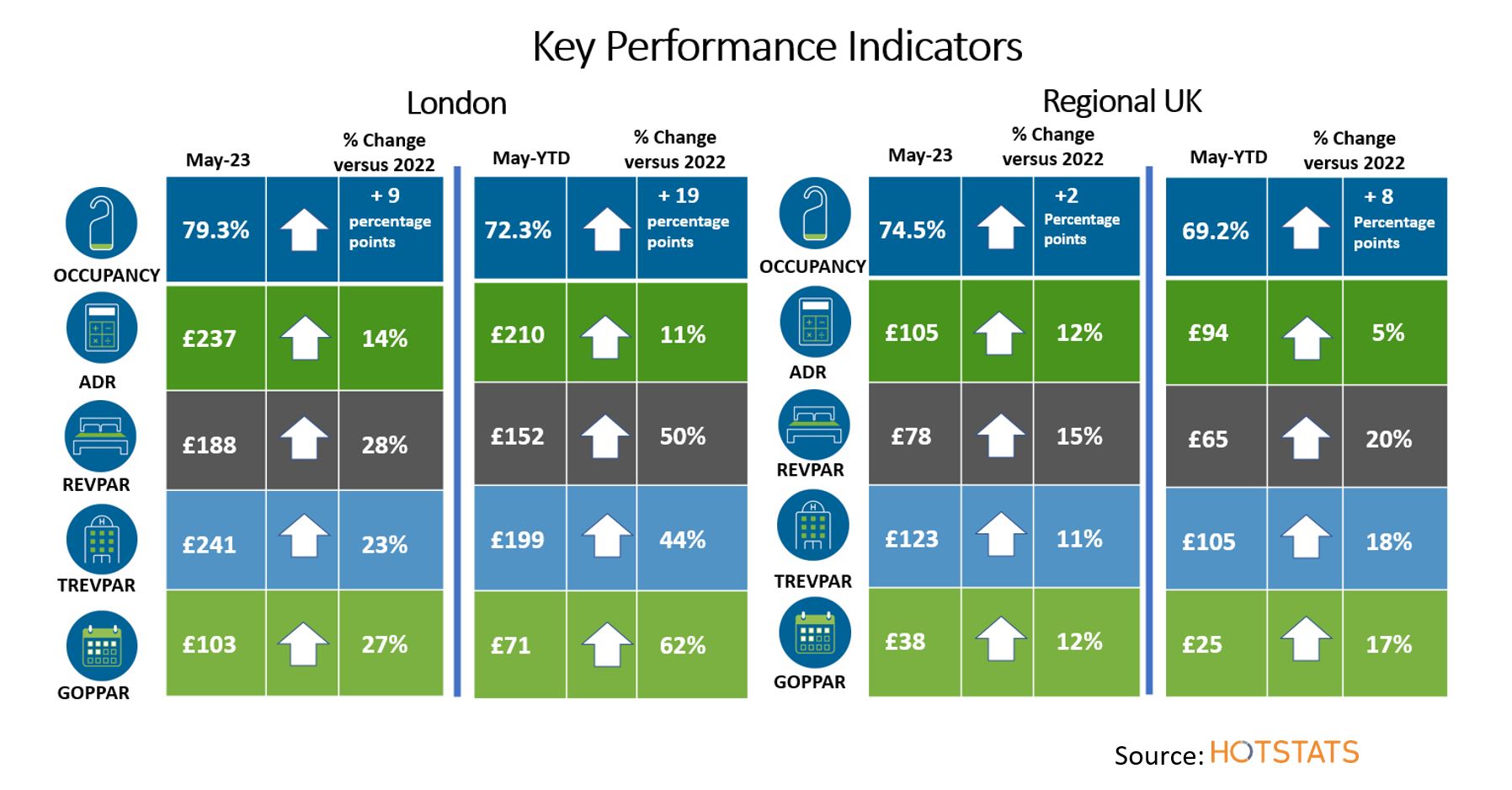

UK hotel performance at a glance

London hotels achieved occupancy of 79% in May, on par with 2019, following a rise of 8.6 percentage points versus May-2022. Combined with double-digit growth in ADR, London’s RevPAR was 28% ahead of the previous 12 months. As at May year-to-date (YTD), RevPAR is up 50% versus the same period in 2022.

Regional UK hotels achieved occupancy of 74.5% in May, two percentage point uplift on May 2022, but continues to lag 2019 performance by 5.9 basis points. Strong ADR growth led to a monthly uplift in RevPAR of 15% in May, whilst YTD RevPAR is up 20% versus 2022.

The data shows monthly ADR growth of 14% in London and 11% in regional UK versus May 2022, indicating that hoteliers are continuing to increase prices above inflation. Total departmental operating costs increased by 7.1% in London and by 6.4% POR across regional UK over the same period.

An influx of overseas visitors, in part due to the King’s Coronation, saw Heathrow passenger arrivals from North America and the Middle East exceed 2019 levels in May, with a 12% month-on-month increase for US arrivals.

Utility costs increased by 48% in London and by 22% across regional UK in the 12 months to May. But, with wholesale prices falling and reduced hotel consumption in the spring, London hotels recorded a 12% reduction POR in May versus January 2023, whilst Regional UK hotels have seen a 24% reduction POR over the same period.

Total payroll costs for the month of May increased on average by 1.5% PAR across London, but with a monthly decline of 1.2% across Regional UK and a 3.2% decline in the top-12 regional cities. Year-on-year, total payroll costs PAR in London have increased by 20% versus May-2022 and by 10% in regional UK.

London achieved strong GOPPAR growth in May, with a month-on-month uplift of 27% and profits up 26% compared to May-2019. The strong monthly performance helped to recover the negative YTD performance, with May-YTD GOPPAR now on par with 2019 and with a positive trajectory for the months ahead.

Regional UK also achieved exceptionally strong month-on-month GOPPAR growth, up 35% on April, but more modest growth of 12% versus May-22 to £38 PAR. On a YTD basis, Regional UK hotels’ GOPPAR is tracking 1.5% below 2019 levels, but with the target to equal 2019 profits in the month ahead.

Download the latest hotels dashboard here