Country market still feeling mini-Budget hangover

Resilient demand, stable prices and strong supply underpinning recovery in UK country market.

2 minutes to read

Prime Country House Index 287.3 / Quarterly price change -0.5% / annual price change -0.8%

With the escape to the country trend that fuelled a record performance for the prime regional UK market during the pandemic fading, we’ve talked a lot about a return to a ‘normal’ spring market.

However, the decline in UK property transactions since last year’s poorly received mini-Budget illustrates that the tax-cutting fiscal event has cast a long shadow.

In prime regional markets this, combined with poor weather and a series of bank holidays, has contributed to a late start to the spring season. However, both demand and supply has continued to recover during this calendar year.

An analysis of the prime regional market in the first four months of 2023 lays bare the consequence of deals that weren’t done at the backend of last year because of the economic and political uncertainty unleashed by the mini-Budget.

The number of exchanges outside of London in the first four months of 2023 are down 31% on the same period last year, and 14% down compared with 2019, before the pandemic.

However, despite the rising cost of borrowing and the impact of high inflation on the cost of living, demand remains stronger than before the pandemic.

The number of new prospective buyers registering with Knight Frank in the first four months of 2023 outside of London remained the third highest in a decade (behind 2022 and 2021 respectively) and 14% higher than the same period in 2019.

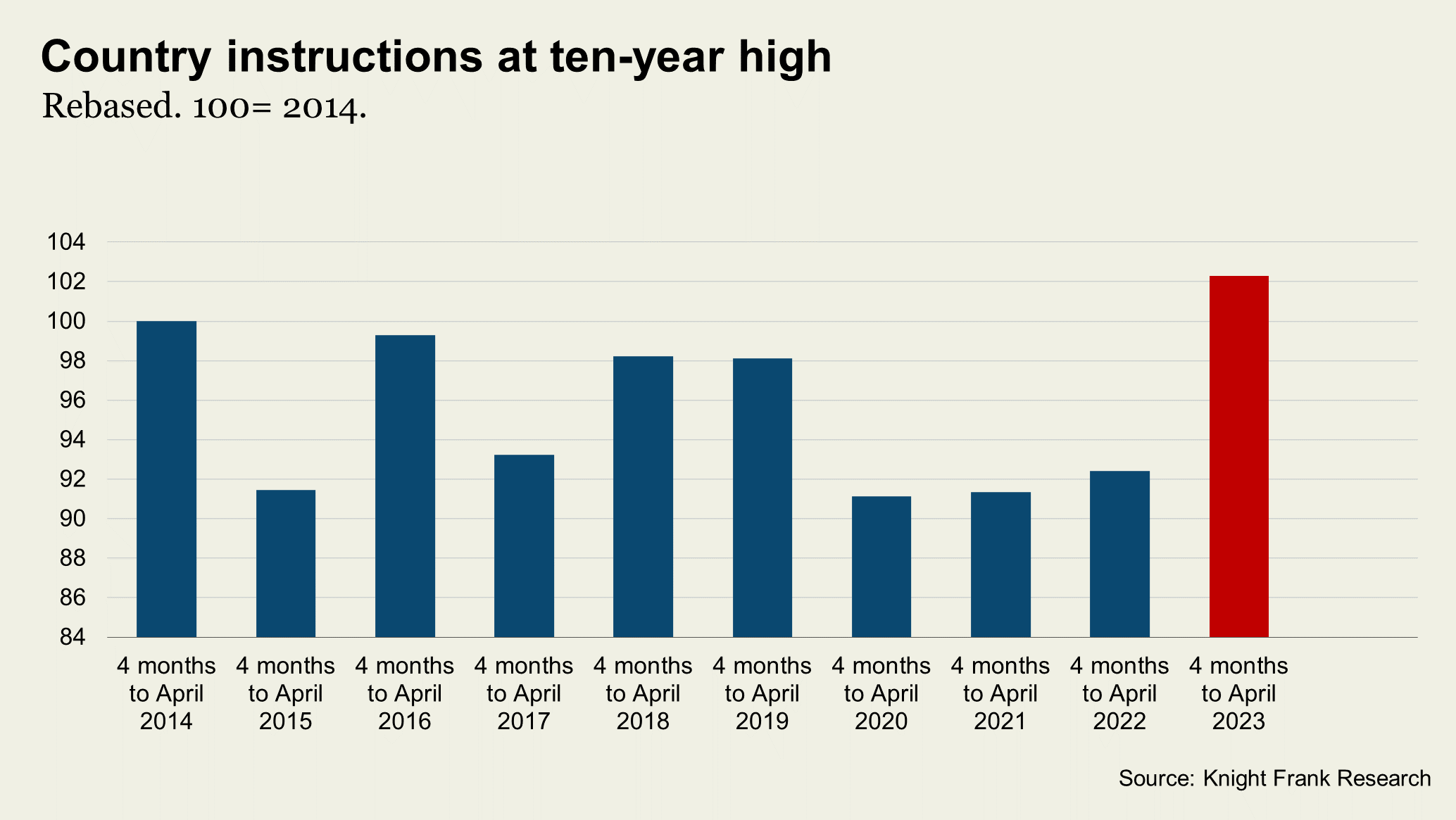

Supply levels have also recovered from pandemic lows. Instructions in the first four months of 2023 were at a decade high, 11% ahead of the same period in 2022 and 4% up on 2019 (see chart).

Market valuation appraisals are up 2% on last year and 9% on 2019 at an eight year high, which will support activity.

“The spring market will be the litmus test for demand and pricing in 2023. However, after a bumpy end to 2022, regional property markets have shown their resilience in the opening months of this year and we expect transaction levels to climb,” said Chris Druce, senior research analyst at Knight Frank.

Price growth steady in prime regional market

After a period of very strong price growth during the pandemic, which saw prime regional prices narrow the gap to prime Central London prices by 20%, the average price of a property in the Prime Country House Index was down 0.5% in the three months to March, taking the annual change to 0.8%.

Ultimately, despite resilient demand, we expect the reduction in spending power caused by the increase in the cost of borrowing and improved supply to see prime regional prices decline by a few percentage points in 2023.