UK rural property: Government in a spin

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

8 minutes to read

Opinion

Government spin doctors have had a busy few days after a series of announcements, detailed below, stoked up a barrage of criticism. Animal welfare campaigners, including some current and former ministers, have furiously decried the announcement that the Kept Animals Bill has been scrapped. A plan to introduce food price caps on staples such as milk was widely ridiculed, and the government’s response to the Rock Review has not got down well with the report’s author. Given farm-gate milk prices are falling sharply any plans to curb retail prices seem ill-timed. Given the growing disparity between farm and average household incomes, also mentioned below, the countryside needs to have confidence the government is in control and has a clear plan to help the food and farming sector to prosper. Let me know if you think that’s the case AS

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley Head of Rural Research; Mark Topliff, Rural Research Associate

In this week's update:

• Commodity markets – Horn up, cord down

• Tenancies – Government responds to Rock Review

• Food prices – Capping plan slammed

• Animal welfare – Government drops bill

• Farm incomes – English earnings fall

• Farming in the uplands – New support announced

• Wildfires severity – Met Office monitoring website

• Interest rates – Review now as inflation endures

• Farmland Index – Prices rise in quarter 1

• The Wealth Report – 2023 edition out now

• Farmland Index – Agri-land 2022's top-performing asset

• On the market – Commercial Zambia arable opportunity

Commodity markets

Horn up, corn down

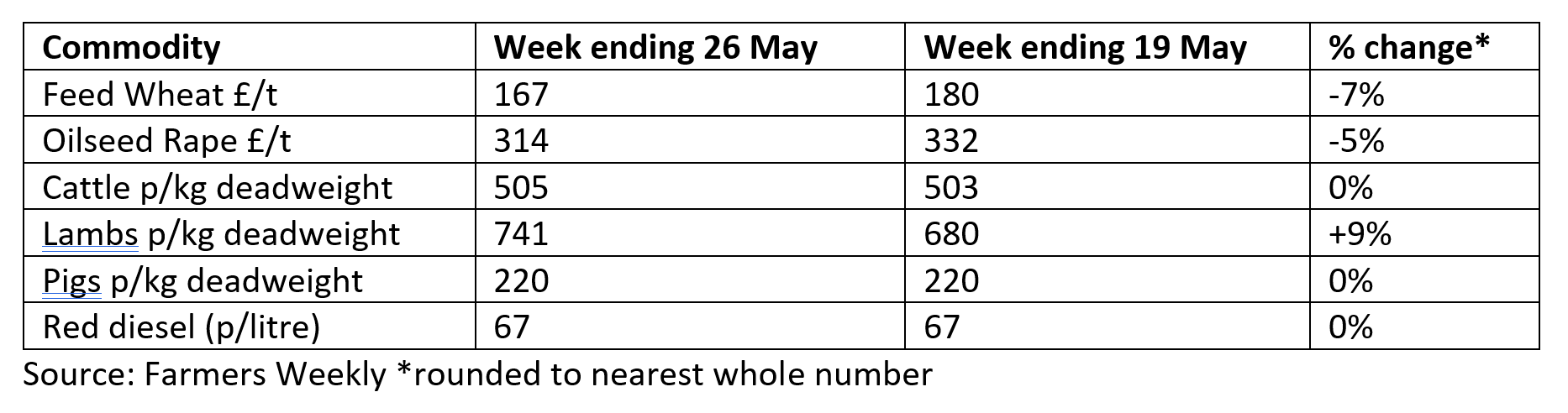

Wheat prices are widely held to be a bell weather for the fortunes of farming, but that fails to take into account the implications for livestock farmers who purchase a significant proportion of the grain produced in the UK to feed their animals. You won’t find too many pig producers complaining that feed wheat values fell by another 7% last week. In fact, they are more likely to be celebrating that they could be just about breaking even for the first time since 2020 as feed and energy costs fall while pork prices hit record highs. The arrival of some sunshine has also helped to keep beef prices at record highs as more burgers and steaks get chucked on the nation's BBQs AS

Talking points

Tenancies – Government responds to Rock Review

The government’s newly published response to the Rock Review’s 74 recommendations, which was commissioned by former Defra minister George Eustice to help create a more resilient tenanted sector has received mixed reviews. The Tenant Farmers Association claims the government has adopted a pick-and-mix approach and is concerned further consultation on some of the recommendations such as creating a Tenant Farmer Commissioner risk kicking things into the long grass. The CLA, meanwhile, says the response represents a sensible and pragmatic way forward for all that will offer renewed confidence in the tenanted sector. Baroness Rock, the report’s author, is said to be disheartened that a significant number of its recommendations have not been adopted AS

Food prices – Capping plan slammed

Mooted government plans to introduce a cap on the price of basic food items will not help tackle the rising cost of living, retailers have warned. Annual food price inflation exceeded 19% in April, but the British Retail Consortium (BRC) said the measures would not make a "jot of difference" and could thwart efforts to cut inflation. A voluntary agreement with major retailers could see price reductions on basic food items like bread and milk. There are no plans for a mandatory price cap, Number 10 sources have stressed AS

Animal welfare – Government drops bill

Campaigners have strongly criticised the government after it scrapped the Kept Animals Bill last week. The bill introduced to parliament over a year ago was set to introduce a wide range of animal welfare measures amongst them manifesto pledges that included the banning of live exports of farm animals for fattening and slaughter from the UK. However, Farming minister Mark Spencer said individual bits of the bill would be legislated for separately. “We remain fully committed to delivering our manifesto commitments, and this approach is now the surest and the quickest way of doing so, rather than letting it be mired in political game-playing.” AS

Farm incomes – English earnings fall

It will not surprise many to hear, but household incomes on English farms have been under pressure in recent years. Defra's latest release from its Farm Business Survey figures for 2021/22 confirms that average farm household earnings from on-farm and off-farm sources were lower than in 2014/15 – down 11 per cent to £17,800. The latest figures were taken at a time when Covid restrictions were still in place, and it was also the first year of the tapering down of the Basic Payments. The proportion of household income from off-farm work also fell between the last two survey years, from around a third to a quarter of the total.

Diving into the detail reveals that most farm types suffered a drop in earnings, apart from upland grazing livestock farms which had a slight increase. The very large and medium-sized farms saw relatively little change, whereas the spare/part-time, small and large units had notable drops in household income. But it's when you compare it to the average UK household income that you see a stark difference in income level and trends. Between the two survey years of 2015 and 2022, UK household earnings rose about eight per cent in contrast to the 11 per cent fall on farms. The gap between the two household averages was nearly £15,000. With this level and disparity in the average household income, the cost of living crisis over the last 12 months will have been most keenly felt on the farms and rural businesses in our countryside. MT

Need to know

Farming in the uplands – New support announced

Defra minister Thérèse Coffey last week announced a series of extra support for farmers in the English uplands. There had been criticism that the government’s post-Brexit farming policy, in particular the Environmental Land Management Scheme, wasn’t doing enough for these areas. Following feedback from uplands farmers and industry representatives, the government is now:

- Making payment rates in environmental land management schemes equal for both upland and lowland farms where they are carrying out the same actions. This means increased rates for upland farmers in four Countryside Stewardship options.

- Reviewing and amending a further seven Countryside Stewardship options make them more accessible to upland farmers.

- Improving engagement with upland farmers with focused advice and support to help them access schemes.

Wildfires severity – Met Office monitoring website

Farms and estates prone to wildfires will carefully monitor the current dry, warm spell. With climate change and more of the public escaping to the countryside, the risk of wildfires has been increasing. The Met Office provides a website that monitors how severe a fire could become if one were to start. An interactive map shows the fire severity index across England and Wales. For the week beginning on 29 May, the area described as exceptional fire severity, the highest index, is forecast to expand across much of the southern half of England. These indexes are also used to trigger fire prevention restrictions on access land mapped under the Countryside and Rights of Way Act 2000 (CroW). To see the latest forecast, follow this link MT

Interest rates – Review now as inflation endures

UK inflation remains stubborn, with the latest figures from the Office of National Statistics showing the annual rise of the consumer prices index was 8.7% in April. Although a drop from March’s figure of 10.1% the slide was less than expected. Comments from Chancellor Jeremy Hunt suggest he feels interest rates need to rise further and it’s highly likely that the Bank of England will raise the base rate again when it monetary policy committee next meets on 22nd June. Bradley Smith of Knight Frank Finance says: “In response, some banks are dropping their margins to below 2% over the bank’s base rate. For borrowers on variable rates, now may be a good time to review your borrowing options with a broker.” AS

Knight Frank Research

Farmland Index – Prices rise in quarter 1

Agricultural land proved resilient in the first three months of 2023. While residential property values weakened, the average price of bare farmland rose by 2%, edging closer to £9,000/acre, according to the Knight Frank Farmland Index. The hike takes the annual rise to 11%, reinforcing farmland's reputation as a good hedge against inflation. Read the full report for more data and insight

You can also listen to the latest edition of our Intelligence Talks podcast where I discuss biodiversity net gain and nutrient neutrality schemes with my Rural Consultancy colleague Isabel Swift AS

The Wealth Report – 2023 edition is out now

Knight Frank's leading piece of thought leadership on property and wealth trends was launched recently and includes an interview by me with one of Scotland's pioneering rewilders, as well as some thoughts on why farmland could be one of this year's most in-demand property investments. Download your copy to find out more AS

On the market

Zambia calling – Commercial arable opportunity

Tanya Ware from our Lusaka office has just launched Wheatlands Farm in Zambia’s Central Province. The 689-hectare arable commercial opportunity is in the Mkushi farming block, Zambia’s agricultural heartland. Over 500 hectares of centre pivot irrigated land deliver wheat yields of over 8t/ha and over 3t/ha of soyabeans. The farm has a 3.6 million cubic-litre irrigation permit. The guide price is US$5.5 million. Contact Tanya for more information.