How many square metres of prime property will US$1m buy you in Singapore?

Our Prime International Residential Index reveals how Singapore has performed in sales and rental markets in 2022.

3 minutes to read

The Knight Frank Prime International Residential Index, also known as the PIRI 100, tracks movements in luxury prices across the world’s top residential markets.

Singapore secured the sixth spot on the Prime Global Rental Index after its annual rental growth grew by 23% in Q3 to 28% in Q4 2022, with limited stock and strong demand driving prices higher.

The city-state closed 18 ultra-prime property sales (transactions valued at more than US$25 million each) and 121 super-prime property sales (valued at more than US$10 million each).

It is the sixth highest market for super and ultra-prime properties, and only one of the two markets in Asia – the other being Hong Kong – that made the top 10. This comes even though transaction volumes of prime homes eased from the most recent high in 2021.

Nicholas Keong, Knight Frank Singapore’s head of Private Office, states: “The rising number of wealthy individuals is fuelling upward pressure on prime property prices. Singapore is seen as a safe haven by high-net-worth individuals, as the government kept the economy and public health stable even in a period of global economic uncertainty and political tensions.

“This year, we expect a four per cent increase in prime prices in Singapore, amid upward pressure on property prices fuelled by a rising number of wealthy individuals.”

In Singapore, prime prices have continued to lag behind the overall growth of 8.6% for Singapore’s private residential properties, as well as behind the average increase of 5.2 % across residential cities in the PIRI 100.

Why have prime prices lagged?

Knight Frank Singapore’s head of Research, Leonard Tay, attributes this to the government’s efforts in reining in runaway prices, with the measures preventing prices from overheating beyond the pace of economic performance and household incomes.

Travel restrictions imposed in other countries such as China and Hong Kong also limited foreign investors’ interest in purchasing homes in Singapore until early 2023.

Given the dampening effect of the additional buyer’s stamp duty for foreigners, it could take time before the easing of border restrictions translates into transaction activity in Singapore’s prime home market.

Global super-prime markets grow

Meanwhile, New York retained its crown as the most active super-prime market with 244 sales of US$10 million or more while Los Angeles and London complete the top three with 225 and 223 respectively.

Overall, the index increased 10.3% in the year to December 2022, down from a peak of 11.8% in March 2022.

European cities have proved to be the most resilient; both Geneva and Paris saw their super-prime sales grow and London’s sales numbers dip marginally with only two fewer than 2021.

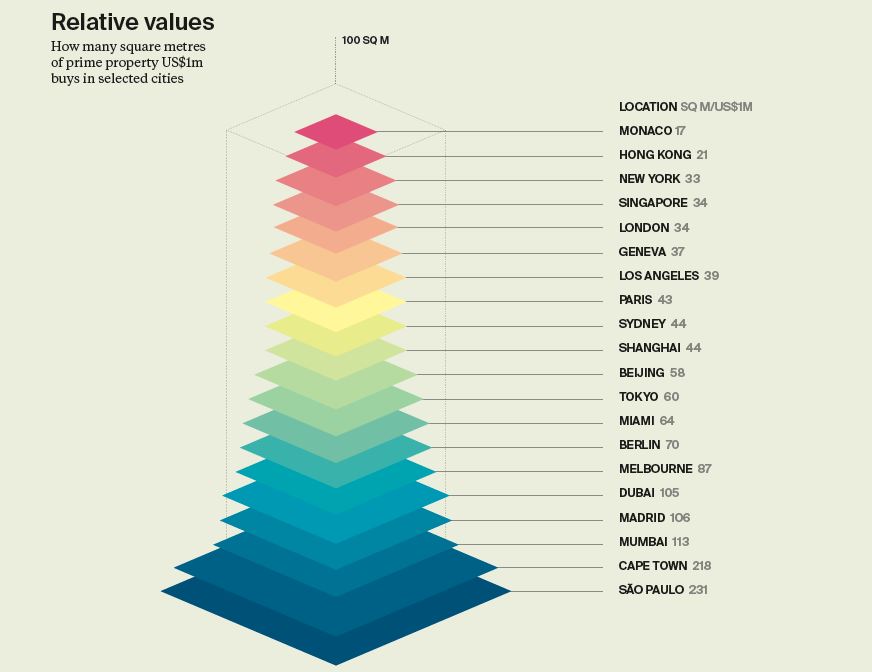

The UK capital, which shares the top spot with New York in the ultra-prime segment, recorded 43 sales of US$25 million or more – the highest level since 2014. Discover how much property US$1 million can buy you around the world by clicking on the article here.

Discover more

Download

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report

Subscribe

Subscribe for all the latest insights and additional content.

Subscribe