UK property market finally shakes off the mini-Budget

Decline in transactions bottoms out and mortgage approvals climb.

4 minutes to read

The Bank of England made its 12th consecutive rate rise this month, increasing the base rate by 25bps to 4.5%. This is its highest level since autumn 2008 and the onset of the global financial crisis.

It also struck a more upbeat tone about the UK economy in its latest Monetary Policy Report stating that it no longer expects a recession this year.

While this will improve sentiment in the general economy and by extension the housing market, affordability remains a key issue that will curb the extent of any recovery.

A report from the Resolution Foundation noted that close to 1.6 million households will see their fixed-rate deals expire this year, with an average annual increase to their mortgage bill of around £2,300.

It is, along with improving supply levels, why we expect house prices will fall by a few percent this year.

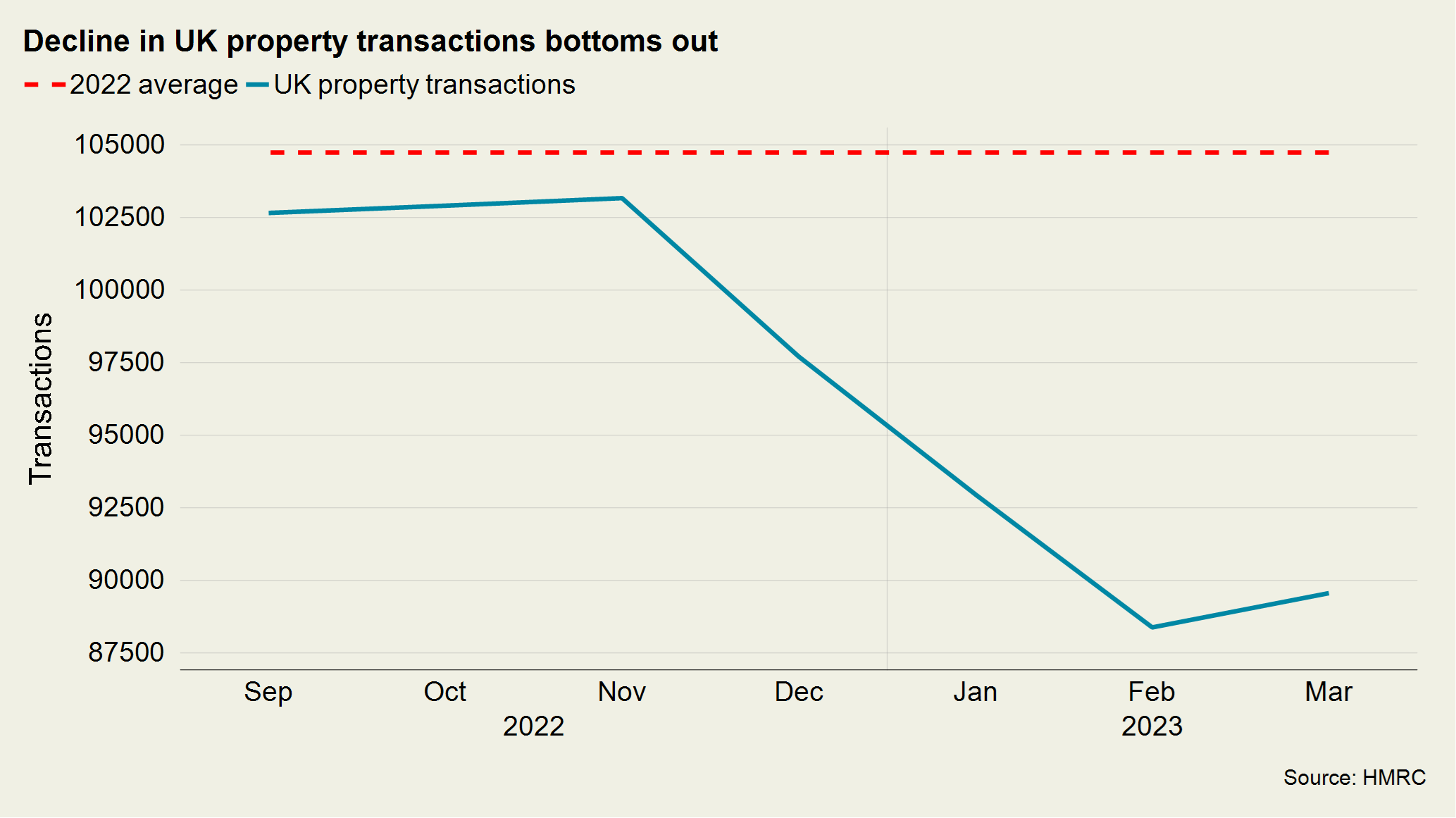

UK property transactions climbed by 1.3% to 89,560 in March, which was the first increase in five months.

Housing activity was thrown off course last autumn after the tax-cutting mini-Budget saw a spike in the cost of borrowing and temporary removal of hundreds of mortgage products.

However, transactions remain 14% lower than the 2022 average of more than 104,000 a month (see chart).

Adding to this sense of stability, UK Mortgage approvals, a leading indicator of future activity, registered their second consecutive increase in March. They climbed 18% from 44,126 to 52,011, although they remain 22% lower than the 2022 average of 67,000 approvals a month.

While the RICS sentiment survey continues to paint a mixed picture of the health of the UK residential property market, surveyors believe conditions will continue to improve.

Near-term sales expectations remained in negative territory but have turned progressively less downcast in each of the last four months (moving from a net balance of -52% in December 2022 to -20% in April).

On a twelve-month view, expectations are pointing to a largely stable trend in sales activity, registering a net balance of +3%.

The net balance is the proportion of respondents seeing an increase versus those reporting a fall.

The Nationwide and Halifax house price indices showed more uniformity in April, too. Nationwide reported a 0.5% increase in UK house prices taking the annual change to -2.7% (compared with -3.1% in March). Halifax said prices had declined by 0.3% in the month, reducing the annual rate of growth to 0.1% (compared with 1.6% in March).

With demand continuing to outstrip demand in the lettings market – RICS recorded a net balance of +40% for tenant demand in the three months to April and a fall of -31% in landlord instructions – there appears to be little relief ahead for tenants.

However, following the local elections and a likely general election next year, landlords will remain under pressure as housing policy becomes increasingly politicised, as we explore here.

Prime London Sales

After an extraordinary period, 2023 has the potential to be the most predictable year since the pandemic.

Demand is resilient and supply is recovering.

The number of new prospective buyers registering in the first quarter of this year was 42% higher than the five-year average excluding 2020 across London. Meanwhile, new sales instructions were up by 20%.

The number of offers made was 10% above the five-year average in Q1 2023 after being down by 11% in the final three months of last year.

Prime London Sales Report - May

Prime London Lettings

Demand has far outstripped supply in London’s rental market over the last two years.

To put that in stark numbers, average rents in prime central London grew by 50% in the 24 months to April 2023. In prime outer London, the equivalent increase was 41%.

Meanwhile, there were 42% fewer new lettings listings in the two years to April than the previous 24 months across both markets, Rightmove data shows.

While the supply/demand imbalance is improving it continues to do so slowly.

Prime London Lettings Report – May

Country Market

Although poor weather and the timing of Easter meant a later start to the spring market outside of London than initially expected, demand has proved resilient, and transactions are climbing as supply increases.

In the four weeks to 14 May new prospective buyers were 4% up compared with the five-year average, and a surge of supply has boosted viewings, which were up 14% in the same period.

Supply continues to build, with market valuation appraisals, a leading indicator of future supply, up 34% versus the five-year average in the same period and new instructions for sale up 16%.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here