UK country super-prime market sees record year even as pandemic winds down

Buyers face strong competition in residential property market as supply remains low.

2 minutes to read

Tight supply and resilient demand mean buyers looking to secure a prime property outside London are still facing strong competition even as the ‘race for space’ calms down.

There were 52 sales at £8m+ outside of London in the 12 months to March 2023, whole market data shows. This was an increase of 16% on 45 a year earlier and the highest total in 15-years.

Sales at £5m+ reached 122 in the same period, which was the second highest total in the last 15 years. There were 157 sales in the 12 months to March 2022.

As well as the ‘escape to the country trend’, strong demand for high-value property outside of London is the result of wealth creation that has taken place in recent years, as well as the relative value compared to London over the last decade.

There was a 14.4% increase in the number of high-net-worth individuals (HNWI) in the UK in 2021, taking the overall number to close to five million, according to The Wealth Report. A HNWI is someone with a net worth of US$1 million or more, including their primary residence.

In the decade to March 2020, the average price of a £5m+ property outside of London fell 5.5% while at the same price point prices in PCL climbed 14%.

Higher borrowing rates have also placed cash buyers - 77% of country buyers at £5m+ bought in cash last year – in a relatively stronger position, as we have explored.

“There are plenty of buyers in the market and the best properties are still selling quickly. Anything that needs updating or work done is taking slightly longer to sell as there’s less appetite among buyers to take on a project due to the increase in building costs,” said Tom Hunt from Knight Frank’s Country Department.

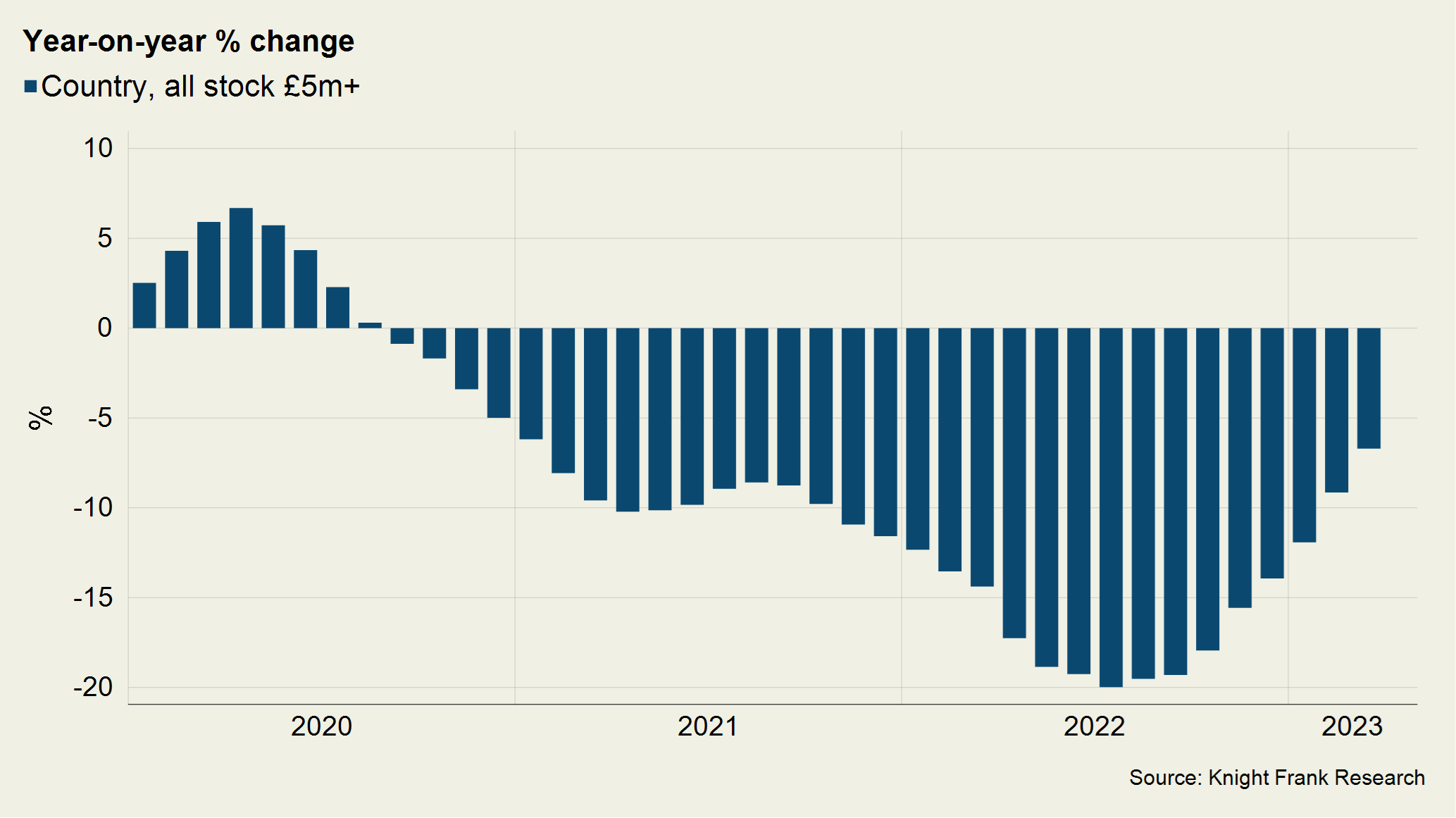

Supply was 7% down in the 12 months to March compared to the previous year, which shows how it is picking up from a low base.

Prime regional prices at £5m+ have increased by 36% over the course of the pandemic, although they declined 0.9% on a quarterly basis in Q4 2022. We expect prime regional prices to fall by a few percent this year.

The number of new prospective buyers looking for £5m+ property outside the capital has declined from a peak in the third quarter of 2020. However, it remained 13% above the five-year average in the first quarter of 2023.

“We’ve seen a shift in priorities. People deciding to move that rung further outside of urban centres knowing that they don’t have to be right on top of a station as they are now only in the office three days a week,” said Ed Rook, head of the Country Department at Knight Frank.