Lenders provide a big bounce in mortgage approvals

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

More green shoots

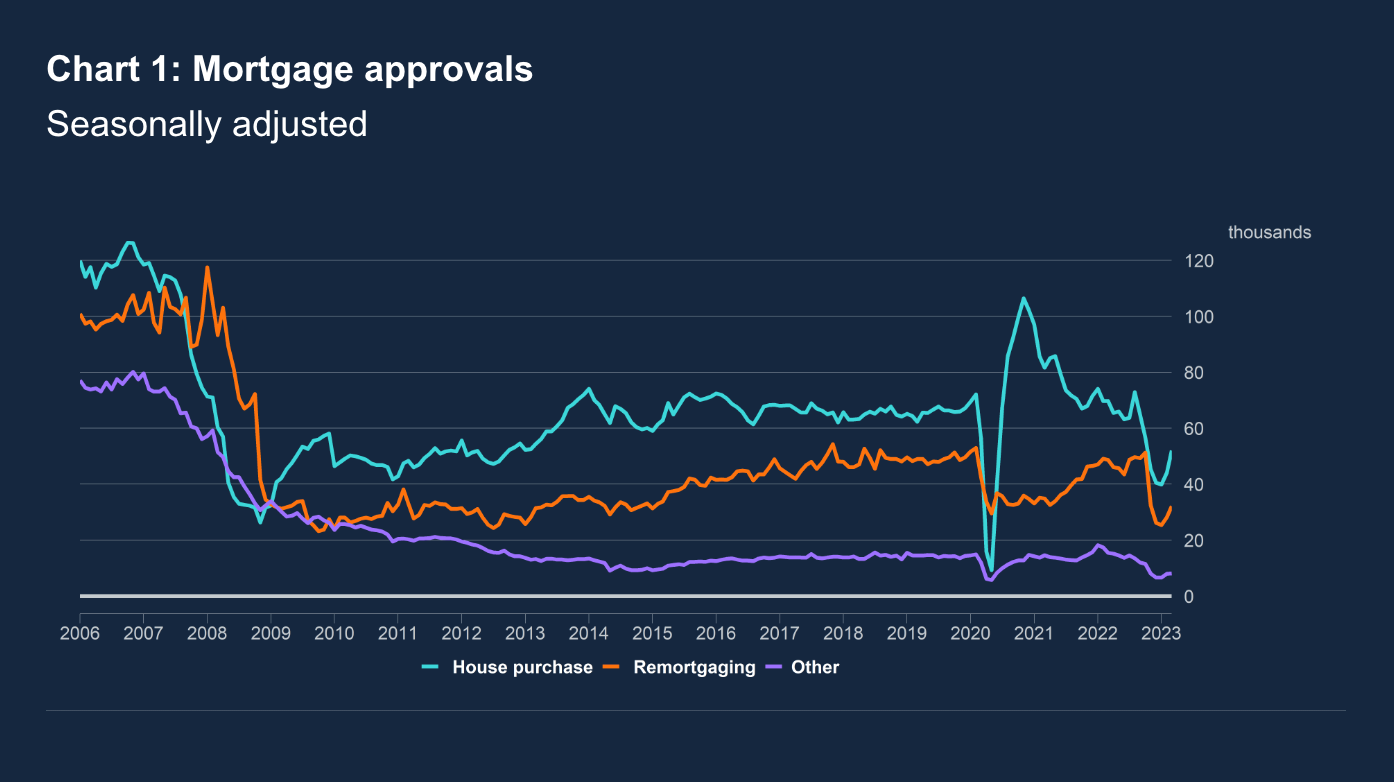

UK lenders approved 52,000 mortgages for the purchase of homes during March, up 18% on February's figure, according to Bank of England data out yesterday. The reading - a good indication of future borrowing - surpassed expectations and comes after Nationwide this week reported a monthly increase in house prices following seven consecutive contractions.

This is starting to look a lot like a recovery, though it's still early days. Mortgage approvals averaged 62,700 a month last year and, as I said on Wednesday, the Bank of England will likely raise the base rate again, perhaps more than once. More than 1.4 million households with fixed-rate mortgages are due to refinance this year, more than half of which were taken out with interest rates below 2%, according to the ONS. There is still pain to come.

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 17 basis points to 4.41% in March, according to the BOE figures. Several of the largest lenders notched up rates this week and there are now only a handful of sub-4% five year fixed mortgages left on the market, according to Hina Bhudia of Knight Frank Finance:-

"It’s hard to say whether this constitutes the beginning of a trend of rising rates or is simply the lenders trying to manage service levels by avoiding being the cheapest on the high street. Activity is rising quite quickly and borrowers are extremely sensitive to interest rates at the moment, so the cheapest lender tends to get swamped.”

Housebuilding

Pricing and sales rates now look stable, to say the least - both Persimmon and Taylor Wimpey said as much last week (see Friday's note). Barratt Developments yesterday said its net private reservation rate had bounced back from 0.30 in the final quarter of 2022 to 0.71 for the twelve weeks through the 23rd April. The average of 0.65 for January to April is down about 30% on the "exceptionally strong" 2022, the company added.

We've talked a lot in recent notes about the UK planning system. Between nutrient neutrality, water neutrality and recreational impact zones, as many as 45,000 new homes are being rejected each year, according to Home Builders Federation estimates. The decision to scrap mandatory housing targets could see output cut to roughly 156,000, from 233,000, the group said earlier this year, citing data from Lichfields.

This is starting to look unsustainable. We talked on Wednesday about Labour's proposal to reintroduce mandatory housing targets, while the Conservatives may implement a new buyer support scheme akin to Help to Buy in the autumn. The Times on Wednesday published leaked messages from Conservative backbenchers revealing discontent over the current state of play. “We cannot become the party of nimbyism," said Simon Clarke, the former housing minister.

The hiking cycle

The Federal Reserve on Wednesday raised interest rates to the 5.00%-5.25% range, as expected, and dropped previously used language stating that it "anticipates" further increases will be needed. Whether or not this is really the end of the Fed's cycle is anyone's guess, and a lot depends on how the data looks in four weeks. It is, however, hard to see a persuasive case for further tightening while regulators appear unable to restore confidence in a large chunk of the banking sector.

The European Central Bank also opted for a 25bps hike on Thursday, moving the key rate to 3.25%. “We have more ground to cover and we are not pausing, that is extremely clear,” said ECB president Christine Lagarde. Eurozone inflation is running at an annual rate of 7% and core inflation is easing, albeit slowly. Economists expect a peak rate of circa 3.5% - 3.75%.

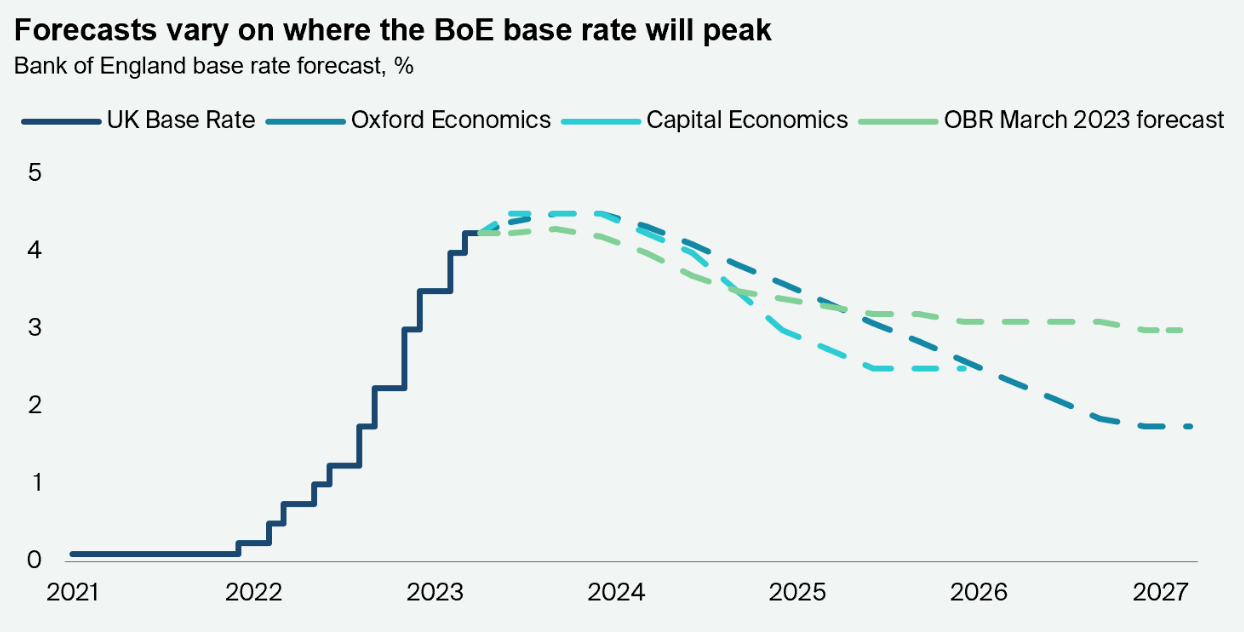

That leaves the Bank of England, which is due to make its latest decision on May 11th. My colleague Will Matthews gathered the various forecasts in his note yesterday (see chart). A hike to 4.5% looks likely, as does another hike in late summer. Anything beyond that will depend on the rate of inflation and degree we see credit conditions tighten due to the US banking crisis.

There were positive signs in the latest Bank of England Decision Maker Panel survey, out yesterday. Predictions for wage growth in the coming 12 months cooled in April to their lowest level for seven months. Companies expect inflation in a year's time to fall to 5.6%, the lowest reading since the series started in May last year.

Retrofit rates

Commercial property markets are increasingly split between well-located, amenity rich properties with high sustainability ratings, for which there remains significant interest from occupiers and investors, and everything else.

Derwent London yesterday said the capital is busy and people are back in the office, particularly in the West End. It signed £17.1 million of new lettings across its portfolio in the first quarter, on average 6.6% above Estimated Rental Value (ERV). The company's portfolio is 85.7% compliant with the Minimum Energy Efficiency Standard (MEES) regulations likely to come into force in 2027 that require all tenanted commercial property buildings to have an EPC rating of at least C.

Retrofit rates across the sector will need to rise substantially to meet the proposed new standards. Some 5% of commercial property already fails to meet current requirements. The 2027 deadline will render more than a third of properties unlettable, according to figures published on Wednesday by Knight Frank's head of ESG research Flora Harley.

In other news...

Billionaire Stephen Ross bets on new offices, sees havoc for old towers (Bloomberg).

Image by Shepherd Chabata from Pixabay