How are housebuilders responding to Help to Buy ending?

Now the deadline has passed for completing home purchases using the government equity support scheme, we look at what housebuilders think will support sales this year.

4 minutes to read

The end of Help to Buy has coincided with a challenging period for housebuilders: the fallout from the mini budget in September, rising costs and a downturn in the housing market.

It closed to new applicants in October 2022, with purchases needing to complete by March this year.

How are UK housebuilders responding so far?

Our quarterly survey of volume and SME housebuilders suggests they are taking direct action on plugging the Help to Buy sales gap, with the majority currently leaning towards offering incentives. Others are also exploring the possibility of selling houses and flats to investors and operators in the growing build to rent sector.

At its peak, Help to Buy was supporting the sales of around 50,000 new build homes per year in England between 2017-2020, easing to just over 40,000 for 2021.

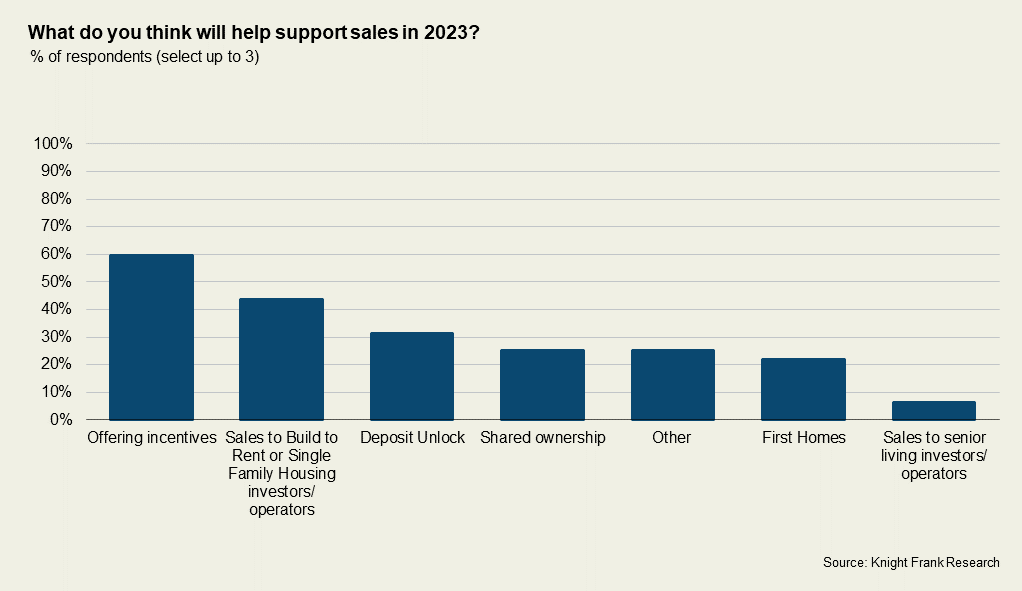

We asked volume and SME housebuilders what they thought would support sales this year in the absence of Help to Buy, which closed for new applications in October last year. Nearly 60% selected ‘offering incentives’, up from just 20% when we first asked them in Q2 last year.

Some major housebuilders are now publicly advertising incentives to boost sales momentum. Incentives could include a mortgage contribution, deposit contribution, or help towards buyers’ moving and running costs.

Housebuilders are also looking to sell more units off to investors and operators in the build to rent sector. A third of respondents said that they were seeking partnerships or bulk sales deals with institutional investors in the private rental sector this year. Overall, 44% of respondents said they thought sales to build to rent or single-family investors and operators would help support the new build market in 2023, up from 25% in Q2.

Deposit Unlock

Another sales support for the industry is Deposit Unlock, a scheme devised in collaboration with lenders and housebuilders. Some 50 housebuilders and counting are currently signed up, up from around 17 in June, according to the House Builders Federation.

Our survey found that just under a third of housebuilders thought the scheme would support sales this year, up from 20% in Q2 2022.

Deposit Unlock enables first time buyers and existing homeowners to purchase a new-build home with a 5% deposit. The scheme sees housebuilders pay the cost of insuring mortgages through a percentage of income through house sales. So instead of the lender taking out insurance, the housebuilder pays for it.

There is an ambition to support 20,000 new homes sales annually through the scheme.

However, so far only a handful of lenders are participating in the scheme: Nationwide, Newcastle Building Society and Accord Mortgages.

The government’s mortgage guarantee scheme, recently extended until 31 December 2023, has more lenders participating in it.

Shared ownership

In its current form, the minimum share a buyer can purchase of a shared ownership home is 25%, but the government’s new model for the scheme has seen this reduced to 10% from April 2021.

Previously, owners could buy additional shares in their shared ownership home – via a process known as ‘staircasing’ – in chunks of 10% or more. The new format gives shared owners more flexibility and allows them to staircase in 1% increments.

A quarter of respondents said shared ownership would help support sales this year, up from 5% in Q2 2022.

First Homes

There has not been much further news around the First Homes scheme, since we last wrote about it in June last year. A 1,500 home pilot is still underway launching on a site-by-site basis. The largest site is in Hampshire which will have 310 homes to buy through the scheme. The pilot is due to conclude in September 2023.

First Homes is a new for-sale affordable housing product prioritised for local first-time buyers. The government has confirmed First Homes will be sold at a discount of at least 30% below market value subject to two regional price caps.

These are £420,000 in London and £250,000 in the rest of England after the discount has been applied to all initial sales.

Our survey found that only a fifth of housebuilders think this scheme will help support sales, up from 15% in Q2 2022.

Other options?

A quarter of our respondents also pointed to other sales supports in the market. They highlighted the government’s mortgage guarantee scheme, which, as mentioned above, was extended by a year to the end of 2023. The scheme was initially brought in during the pandemic to help buyers during the initial economic hit. The scheme helps buyers on the property ladder with a 5% deposit by encouraging lenders to offer 95% loan-to-value mortgages for properties worth up to £600,000.

Higher energy efficiency is another sales driver highlighted in our survey for new builds, especially in light of rising energy costs. There are also tighter regulations coming in that will eventually make older homes a lot more expensive to run.