UK property data presents mixed picture but stability returns

Mortgage approvals appear to bottom out while higher-value markets show resilience.

4 minutes to read

Mortgage approvals, a leading indicator of future activity, registered their first increase in February for six months.

However, at just over 43,500, volumes remain considerably down on the 66,700 average monthly approvals seen in 2019.

The strength of the recovery as we move further from the disruption caused by the mini-Budget last September remains to be seen.

However, the latest quarterly survey from the Bank of England confirmed that lenders are expecting a pick-up in demand for mortgages during the next three months.

After reporting falling demand in Q4 2022 and again in Q1 2023, a sizable number of respondents anticipate that demand for both re-mortgaging and house purchase will pick up during Q2.

It remained a mixed picture when it came to house price data and the direction of travel during March. We’ve taken a look at why you should handle house price data with care, especially as transaction volumes are low at the moment.

Nationwide said that average prices had declined for a seventh month in a row with a fall of 0.8%. This took the annual contraction to 3.1%, which was the largest decline since July 2009.

Meanwhile, Halifax found average prices increased by 0.8% in March, albeit this was a slowdown from an increase of 1.2% in February. The annual rate of change also slowed from 2.1% to 1.6% in March.

With the latest employment data for February proving robust - the unemployment rate remains historically low at 3.8% - household sentiment has continued to improve after turning negative at the end of last year.

According to the IHS Markit Household Sentiment Survey, the index score for future house price expectations (values in 12 months’ time) climbed from 49.8 to 55.6 in March.

A score of 50 indicates no change. Figures above or below that indicate price growth or falls, with the higher the figure the stronger the expected change.

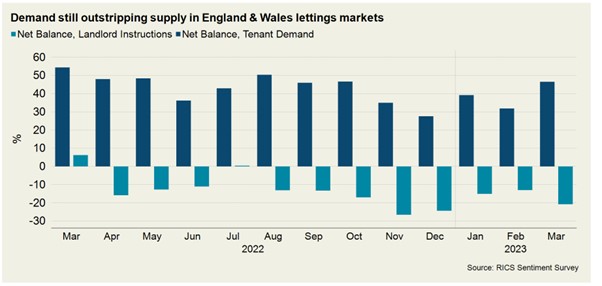

While key sales indicators remained subdued with new instructions and buyers both down, according to RICS, the letting market continues to see demand outstrip supply (see chart).

The balance of new instructions fell from -13% to -20.7% in March, meaning the measure remains firmly in negative territory with more respondents seeing a fall than an increase.

At the same time demand strengthened, up from +32% to +46% in March suggesting little respite for tenants facing price inflation and limited choice.

Despite this imbalance, landlords face both higher mortgage and maintenance costs. They also have the challenge of upgrading the energy efficiency of their properties, something that has left the sector facing a potential £17.9bn upgrades bill.

Prime London Sales

If you compare the 12-month period to February with the preceding year in London, a whole range of indicators show little change (in a market not averse to dramatic movements).

In March 2023, average prices were just 1% lower than three years ago, when the pandemic first struck. Over the last 12 months, the movement has been even smaller (+0.5%).

It has been slightly more eventful in prime outer London (POL), with average prices in March 2.4% higher than a year ago after a flat six months.

It’s not only prices that have been subdued. The number of sales in the year to February was only 1.8% higher than the previous 12 months, Knight Frank data shows.

Prime London Sales Report - March

Prime London Lettings

In the three years since the pandemic struck, rental values have risen by 27% in prime central London (PCL) and by 23% in prime outer London (POL).

Supply dwindled while demand surged, which means tenants have struggled with surging rents and properties that were let out before being advertised.

The frenetic conditions of the last 18 months have calmed down but not disappeared altogether. Annual rental value growth in March was 16.9% in PCL and 15.2% in POL, the lowest figures since November 2021 but still high by historical standards.

Prime London Lettings Report - March

Country Market

Poor weather and the Easter holiday have meant a slower start to the spring country market than initially predicted.

Pricing will be tested in the coming months but from a relative position of strength, with the bounce in demand seen since the start of 2023 sustained as the impact of the mini-Budget fades.

Viewings and new prospective buyers were in line with the five-year average in March. Supply is continuing to build too, with market valuation appraisals up 32% and instructions 18% ahead of the five-year average in March.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here