The Bank of England is brighter, but are mortgage rates about to rise?

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Rate hikes

This time last week it seemed reasonable to wonder whether central banks would keep raising interest rates amid so many signs of stress in the banking system. That was before the UBS takeover of Credit Suisse and the release of new inflation data showing prices are still rising much faster than policymakers would like.

The Federal Reserve on Wednesday opted to raise the Federal Funds Rate 25 basis points to a range of 4.75% – 5.00%. The Bank of England also chose to hike by 25bps to 4.25% yesterday. The BoE was dismissive of stress in the UK banking system, which due to "robust capital and liquidity positions" is "well placed to continue supporting the economy in a wide range of economic scenarios, including in a period of higher interest rates."

There has been a fair bit of commentary from figures including Blackrock chairman and CEO Larry Fink and Goldman Sachs chief executive Lloyd Blankfein about the prospect that banks will cut back on lending to shore up balance sheets, tightening credit conditions in a manner that will mimic rate hikes. The BoE minutes said "it was unclear how credit conditions" might be affected by banking stress, though Fed chair Jerome Powell was much more forthright when he said:

"We believe... that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes."

Economic resilience

Wednesday's hot inflation reading in the UK rattled investors. Market pricing quickly cut the probability that the Bank of England would pause its cycle of tightening from 50% to about 10%.

While that raised the prospect that the Bank would take a more hawkish tone in the MPC minutes, in fact we got the opposite. CPI inflation "increased unexpectedly" in the latest release, but it remains likely to "fall sharply" over the rest of the year, the MPC said. In fact, the Bank said it expected inflation to fall even faster than it had anticipated a month ago.

That's in part due a technicality. Large spikes in energy prices will soon drop out of the readings, but it's undeniable that the Bank's tone has shifted substantially in just a few months, particularly since November's forecast that the UK could endure its longest recession since records began, with the economic downturn expected to extend well into 2024.

Instead, GDP is likely to have been broadly flat around the turn of the year, and the Bank expects it to increase slightly in the second quarter, compared to the 0.4% contraction it expected only a month ago. Separate figures out this morning revealed consumer confidence is now at its highest level for a year.

Mortgage rates

Swap rates have been creeping up amid the heightened volatility, raising pressure on the banks to end several weeks of easing mortgage rates. At least two major lenders have increased mortgage rates on various products this past month and Thursday's decision raises the probability that they are unlikely to be the last, says Knight Frank Finance.

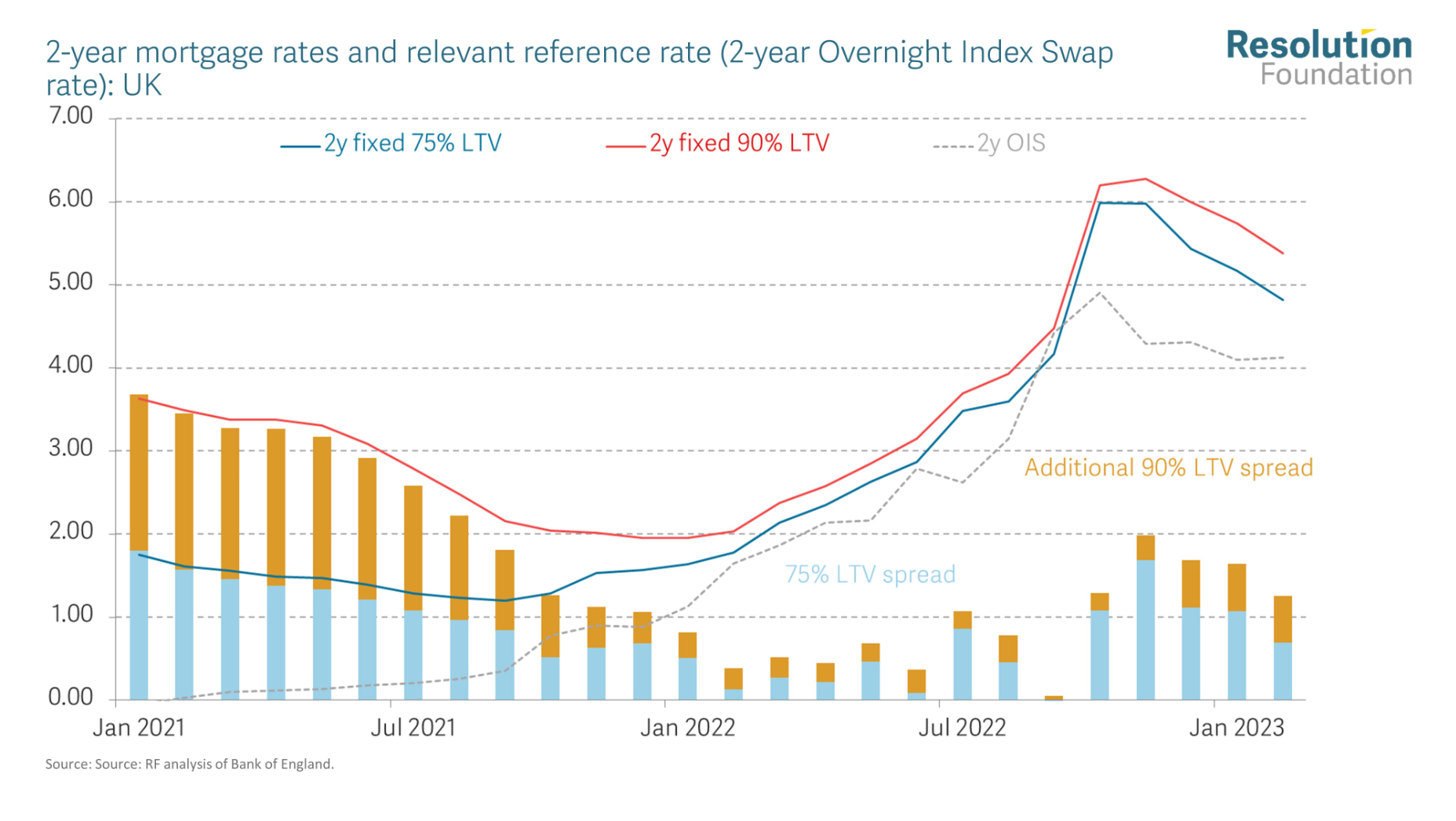

Indeed, spreads widened significantly following the mini-budget and have been coming down ever since - see chart below from Resolution Foundation research director James Smith. The BoE says it is yet to see clear signs that the recent increase in bank funding costs is feeding through to mortgage rates, but it's early days.

Housebuilding

We've been tracking improvements in the new homes market following the dire last quarter of 2022. Bellway, Redrow, Barratt Developments, Persimmon and Taylor Wimpey all reported meaningful improvements in activity through the early weeks of 2023 - see this note from March 3rd.

Crest Nicholson continued the theme yesterday. The company delivered 0.52 sales per outlet per week for the first eleven weeks of the calendar year, up from 0.35 for the eleven weeks beginning November 1st 2022. "The market is clearly softer than the previous two years of trading, however it remains resilient," the company said.

Similarly Vistry on Wednesday said average private sales rates per site per week for the year to date stood at 0.54 and had increased to 0.62 in the most recent four weeks.

Supply builds

We'd expect activity to rise as Spring approaches and it looks like buyers will have more to choose from.

Supply in prime regional markets gathered momentum in February, according to the latest update from Chris Druce. New instructions, prospective buyers and viewings were in line with the five-year average, having retreated at the end of last year. However, market valuation appraisals, a leading indicator of future supply, were 19.8% ahead of the five-year average. This came after a fall of 7% and 5% in December and November respectively.

“Many of the market appraisals I handled before Christmas were for people that had no intention of selling. Three of the four I handled last week became instructions on the day,” says Florence Bliss, a senior negotiator covering Devon and Somerset at Knight Frank. “Buyers are also coming out of the woodwork, and property with land is still attracting competitive bids. The big change on a year ago is you must be realistic on pricing."

In other news...

Key takeaways from The Wealth Report 2023 for European UHNWIs, plus the French senior housing sector outperforms the residential market.