February brings a brighter outlook for UK property market

As the distance from the mini-Budget increases key indicators are trending upwards.

4 minutes to read

It’s becoming clearer that the further we move away from last September’s mini-Budget, the brighter the outlook is becoming for the UK residential property market.

February’s data showed an improving picture overall, although questions remain over whether the market will achieve a soft landing this year.

Nationwide reported that annual house price growth had turned negative for the first time since the closure of the UK property market in 2020.

With a monthly decline of 0.5% in February, average prices were down 1.1% on an annual basis, consistent with the direction of travel seen in the past few months.

But wait. According to rival lender Halifax, average prices climbed 1.1% month on month, which left the annual rate of growth at 2.1% for the third month in a row.

It suggests that a more gradual unwinding of the pandemic price boom is possible.

There has been grimmer news around future sales volumes.

Mortgage approvals in January were 39,600 compared to 40,500 a month earlier, which was the lowest monthly total since June 2020. The impact of the mini-Budget is clear, which caused a pause in activity at the end of last year.

Since then, activity has bounced back. It is why we still believe there will be an annual decline in house prices in the UK market of 5% this year as buyers’ reduced spending power and higher supply feeds through to pricing.

Assumptions about the strength of the UK property market will be tested in the coming weeks during the spring market but sentiment remains fragile, despite a general uptick in UK consumer confidence and GDP growth of 0.3%. Following the Budget, the UK is now forecast to avoid technical recession in 2023, too.

According to the IHS Markit Household Sentiment Survey, the index score for current house prices fell 3.5 percentage points to 47.2 in February after a rally in January, while future house prices (values in 12 months’ time) slipped by 5 percentage points to 49.8.

A score of 50 indicates no change. Figures above or below that indicate price growth or falls, with the higher the figure the stronger the expected change.

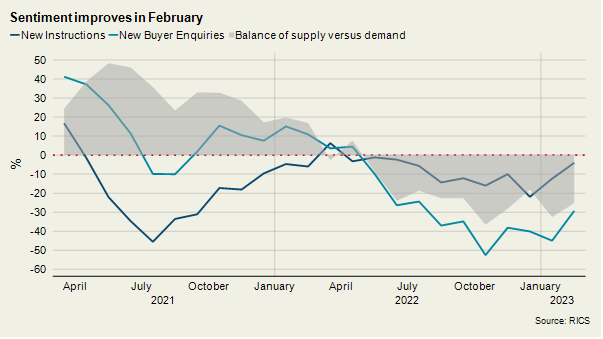

The latest RICS Sentiment Survey (see chart) also remained in negative territory but, consistent with the generally more upbeat surveyor comments contained in the back of last month’s edition, the outlook is brightening.

New buyer enquiries climbed from -45% last month to -29% in February. Net new listings were -4%, compared with -12% in January. The net balance score represents the difference between the number of respondents that saw an increase in the month and those that saw a decrease.

In the lettings market, where demand has consistency outstripped supply, the status quo prevailed. Tenant demand at +32% in February remained in expansion territory (January +39) while landlord instructions -13% (January -15%) remained in retreat.

Prime London Sales

After a weak final quarter in 2022 price declines in prime London markets appear to be bottoming out.

Average prices were flat on a quarterly basis in prime central London in February, which compares to the decline of 0.6% recorded in the three months to December.

Meanwhile, prices in prime outer London recorded their first monthly rise (0.2%) in February since September.

Demand remains strong against the relatively stable economic backdrop and the number of new prospective buyers registering the first seven weeks of the year in London was 28% higher than the five-year average.

Prime London Sales report – February

Prime London Lettings

Last month we explored how supply was increasing in the prime London lettings market. The trend may prove to be short-lived.

The reason is a stronger-than-expected sales market, which means more owners are attempting to sell their property rather than becoming landlords.

Compared to the first two weeks of 2023, the number of lettings instructions in London was 21% lower in the second fortnight of the year and 12% down in the following two-week period.

It means prospective tenants could face the frustration of supply that stays lower for longer. Rental values grew by 18% in the year to February in PCL, while the equivalent rise in POL was 15.6%.

Prime London Lettings report – February

Country market

Prime regional markets maintained momentum in February, suggesting a busy spring market ahead.

New instructions, prospective buyers and viewings outside of London were in line with the five-year average, as the relative bounce seen since a slow end to 2022 continued.

Meanwhile, market valuation appraisals, a leading indicator of future supply, were up 19.8% ahead of the traditionally busiest period for new listings. Supply, having been in a deficit for so long, is at a two-year high.

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up to our newsletters below.

Subscribe here