A crucial moment for the US housing market

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The UK economy grew a better-than-expected 0.3% in January, according to official figures out this morning, although construction had a bad month, shrinking 1.7%.

Firmer ground

The January RICS Residential Market survey of estate agents was about as downbeat as it gets. Metrics spanning new buyer demand, sales, fresh listings and prices all fell deeper into negative territory. It wasn't until you turned to the back of the report, where researchers collect anecdotal remarks from surveyors, that signs of resilience started to emerge, as we covered in this note on February 10th.

Those anecdotal remarks are now showing in the data, according to the just released February report. The headline reading for new buyer enquiries rebounded to a net balance of -29% (measured on a seasonally-adjusted basis), compared to -45% in January. Still a month-on-month decline, but less marked. Similarly newly agreed sales registered a net balance of -26%, improving from -36% in January.

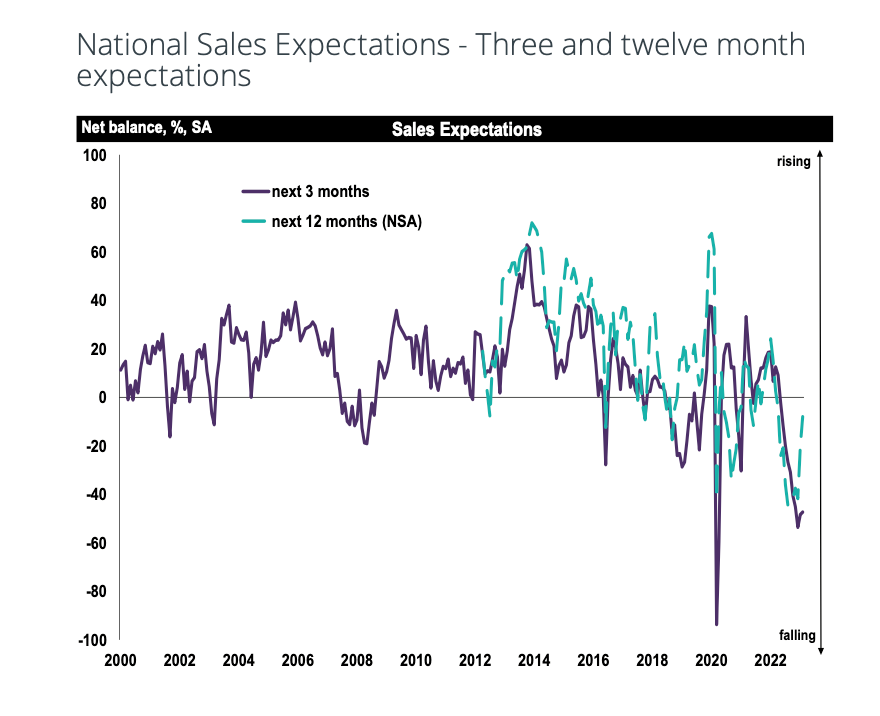

These are negative readings, but alongside the other metrics we've covered in recent months it's clear that the market is finding firmer ground. While sales are expected to fall further over the coming three months, the near-term sales expectations net balance came in at -47%, the comparable metric for the twelve-month time horizon came in at -8%. That's up from -20% in January and -45% back in August (see chart).

Separately, in a trading update this morning, The Berkeley Group said sales since the end of September 2022 were around 25% lower than the strong first five months of the financial year - in-line with levels identified in its September interim results.

Arrears

Financial Conduct Authority figures released this morning build on themes from the RICS survey. The regulator now expects that 356,000 mortgage borrowers could face difficulties making payments by the end of June 2024, a substantial cut from its September forecast of 570,000.

That September forecast was predicated on the base rate peaking at 5.5%, which the FCA has now pared back to 4.5%. Struggling customers rolling off a fixed rate deal could end up paying £340 a month more on average.

Londoners and people living in the south east are 55% more likely to struggle than those living elsewhere. Almost 6% of the 1.8 million mortgage holders in the capital and surrounding areas are at risk of being financially stretched by mid-2024.

Active Capital

We think 2023 will be the strongest year for cross-border private capital since 2019, as outlined by our Capital Gravity Model from Active Capital, and via last week's launch of The Wealth Report 2023.

Potential hesitancy from institutions amid higher rates and the uncertain outlook has created a window of opportunity - and indeed many are already taking it. Private investors were the most active buyers in global commercial real estate markets in 2022 with US$455 billion invested, accounting for 41% of the total, according to RCA. That's private buyers’ highest share of global commercial real estate investment on record and is the first time private investment has surpassed institutional investment.

Investors from the US are forecast to be the most active this year, accounting for roughly half of all global private cross-border capital into commercial real estate. Likely targets include offices in the UK, Japan and Singapore, as well as industrial assets in Germany, Japan and South Korea. Private investors from Singapore, Germany, the UK and Canada are also expected to be active this year.

Many of these themes are encapsulated by Blackstone's deal at St. Katharine Docks, covered in this morning's FT. The company has sold a £395mn waterfront office complex near the Tower of London to a Singaporean investor, who said turmoil in the UK had created a buying opportunity.

"When I am talking to investors out of Asia, my perspective is that they see an attractive entry point into sterling,” James Seppala, Blackstone’s European head of real estate tells the paper. “My sense is that global capital might have been on pause during some portion of quarter four, but that hiatus could well lead to a rebound in activity over the course of 2023.”

US mortgages

US jobs data, due out later today, is likely to put further pressure on the Federal Reserve to return to interest rate hikes of at least 50bps at this month's policy meeting. The economy is forecast to have added 225,000 jobs, less than half of January's blow-out report, but well above figures that would indicate an easing of price pressures, according to forecasts compiled by the FT.

It's a crucial moment for the housing market. Various indicators through January and February suggested the market had bottomed out amid a four-month easing in mortgage rates. Sales of existing homes slipped just 0.7% between December and January, for example.

January's hot jobs report put a stop to easing mortgage rates amid fears that the Fed would turn more hawkish. The latest figures from Freddie Mac has the average 30-year fixed loan at 6.73%, the highest since the November peak, when borrowing costs hit 7.08%.

In other news...

NFTs - down but not out? Andrew Shirley considers the outlook for Bored Apes.

Philippa Goldstein on the recovery of UK hotels.

Elsewhere - Manhattan apartment hunters see little relief from near-record rents (Bloomberg).

Photo by Benjamin Rascoe on Unsplash