UK residential property: a bright start to January

Despite predictions to the contrary prime markets have begun 2023 strongly.

3 minutes to read

After a quieter end to last year, January brought an unexpected bounce in the UK residential property market.

Following September’s mini-Budget, a spike in mortgage rates led to some dire warnings about the fate of the residential property market.

However, the London property market started the year strongly. The third week of 2023 saw the fourth highest number of offers accepted in London during a single week in January in ten years, Knight Frank data shows.

New demand is also proving resilient. The number of new prospective buyers registering in the first three weeks of the year was 6% higher than in 2020, during the so-called ‘Boris Bounce’ that followed the December 2019 general election.

In fact, the only time more new buyers have registered in the equivalent period over the last decade was in 2022.

Meanwhile, on the supply side, the number of new sales instructions in the third week of the year was the highest figure for a single week in January for a decade.

A double-digit price fall does not exactly feel imminent, as our forecasts set out.

It has been a similar story outside of the capital. The number of offers accepted in the first four weeks of January was the second highest in ten years. Market valuation appraisals, a leading indicator of supply, proved resilient too. The weekly average in the same period was 2.5% above the weekly average for January 2020 to January 2022.

While we expect the increase in borrowing costs relative to a year ago to ultimately drag on pricing in prime markets, equity rich and cash buyers will find themselves in a strong position this year, as we have explored.

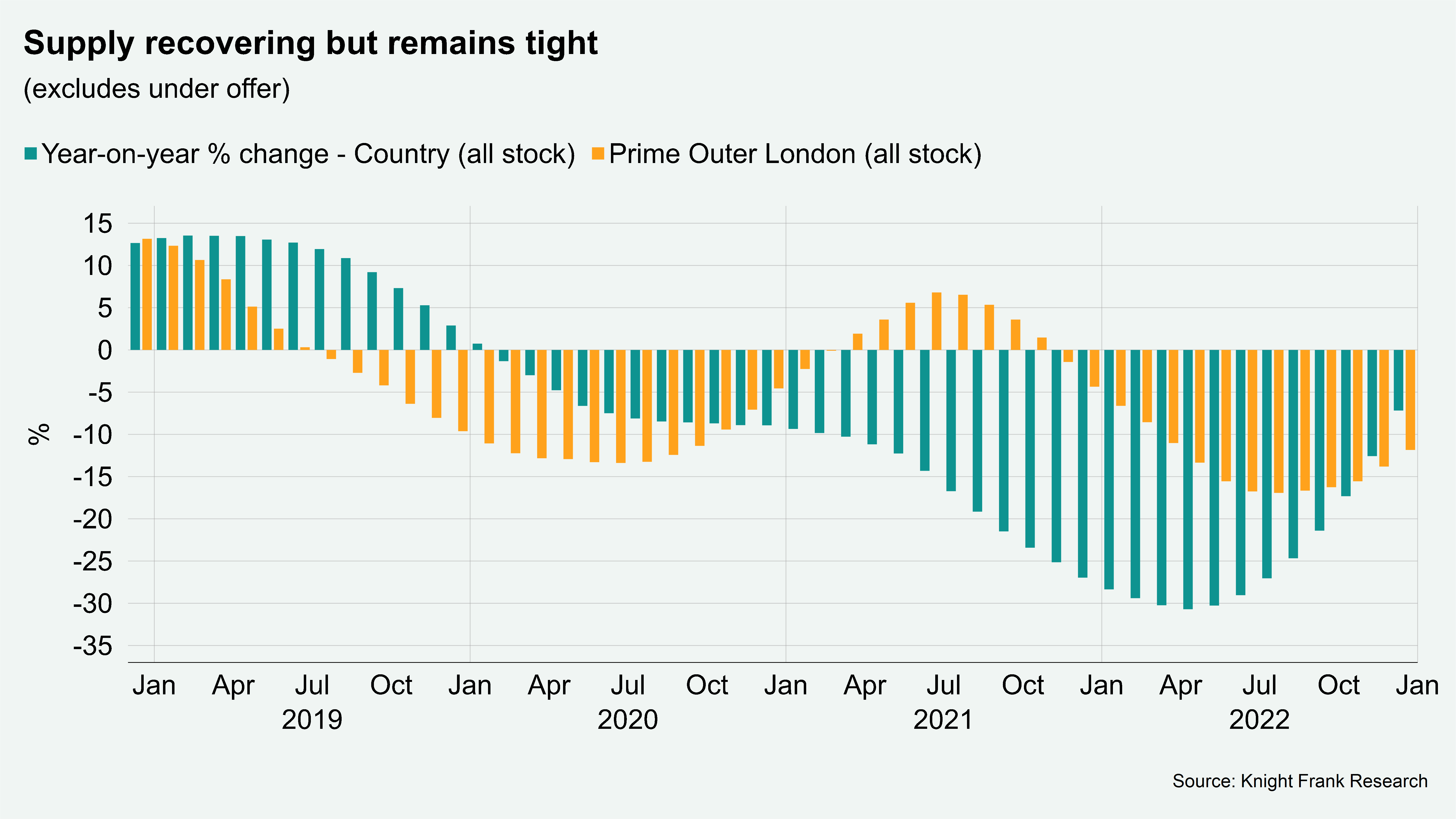

It also means that prime markets, which have a higher percentage of cash buyers than within the mainstream market, should be better insulated against downwards pressure on prices. Not least as supply still remains tight (see chart).

Busy lettings market

Supply is however finally improving in prime London lettings market.

Not to the point that it has become a tenants’ market, but more balanced conditions are returning.

Rising mortgage rates and the accompanying downwards pressure on prices means more owners are weighing up their options, which include letting out their property.

In the first three weeks of January, the number of new lettings instructions in London was 10% higher than the equivalent period last year, Knight Frank data shows.

As supply picks up, more tenants are exploring their options rather than renewing their tenancy agreement, particularly when it involves a rent increase. That, in turn, will increase supply further.

Average rental values in prime central London are 24% higher than their pre-pandemic levels. The equivalent rise in prime outer London is 22%, underlining the extent of the increase some tenants have faced.

Despite the growth, demand remains as strong as ever. The number of new prospective tenants registering the final quarter of 2022 was 30% above the five-year average.

So, while we expect upwards pressure on rents to relent as supply picks up from a low base, rental value growth won’t go into reverse, as we analyse in our latest forecast.

Read more or get in contact: Tom Bill, head of UK residential research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here

Photo by Tim Riesner on Unsplash