Your Leading Indicators | Rate Hikes | Soft Landings | Shift Towards Renewables

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

The Fed, BoE and ECB set to hike rates again this week

The US Federal Reserve (Fed) will make its next interest rate decision on Wednesday, while the Bank of England (BoE) and European Central Bank (ECB) will make theirs on Thursday. Economists anticipate a 50bps hike from the BoE, lifting its current rate to 4.0%. Oxford Economics expects this to be the final rate hike from the central bank, however, money markets and Capital Economics anticipate more rate rises past February, expecting the base rate to peak at 4.5%. For the Fed, money markets expect it to halt rate hikes in March, after two successive quarter point rises. However, the ECB may be slightly further away from the end of its tightening cycle. Last week, a governing council member of the ECB stated that there will be at least two more 50bps rate hikes in February and March, and that the central bank will “continue to be in tightening mode until the summer”.

Soft landing ahead?

The US economy recorded better than expected growth in the last quarter of 2022, with GDP rising by an annualized +2.9%, beating market expectations of +2.6% growth. This robust economic performance, combined with US inflation slowing for six consecutive months in December, has caused economists to deliberate a potential ‘soft landing’ for the US economy. However, given historic trends, this may be unlikely. Since the 1950s the US economy has tipped into a recession within two years every time inflation exceeded 4.0% and unemployment fell below 5.0%. US Inflation is currently at 6.5%, while unemployment is at 3.5%. Meanwhile, in the UK, a mild recession seems unavoidable with the latest IMF forecasts indicating a -0.6% contraction in GDP this year, reflecting tighter fiscal and monetary policies and constrained household budgets.

Global shift towards renewables is accelerating

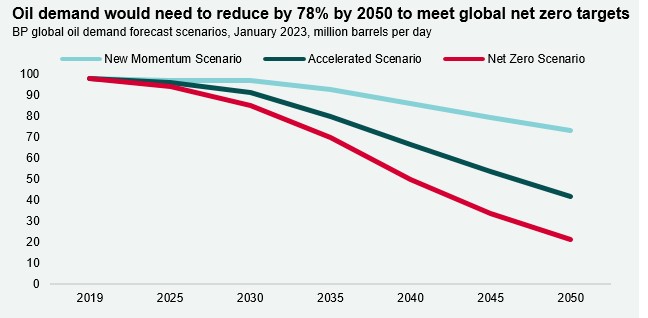

BP’s 2023 Energy Outlook forecasts a sharper decline in fossil fuel demands by 2035 than previously expected, due to countries prioritising domestic renewable energy sources in the wake of the Russia / Ukraine war. Indeed, countries are expected to be more focused on increasing security of supply and reducing emissions. BP’s latest 2035 demand forecast outlined a +5.3% rise in renewable demand compared to last years forecast. Meanwhile Natural Gas (-6.4%) and oil (-5.5%) is now anticipated to see lower demand compared to previous forecasts. Meanwhile, BP outlined three scenarios that differ in how quickly climate action would cut carbon emissions. In the most ambitious scenario that sees net zero carbon by 2050, oil demand would have to decline by 78% on 2019 levels. However, BP’s most moderate scenario still sees oil demand contract by 25%.

Download the latest dashboard