The diverging fortunes of the US and China

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

House prices

UK house prices fell 0.1% in December, the fourth consecutive monthly decline, according to Nationwide. That cuts annual house price growth to 2.8%, from 4.4% in November.

Volumes tend to be lower in December and a fall of 0.1% is narrower than the previous two months, adding to evidence that the ship has steadied in the wake of the mini-budget (more on that shortly). East Anglia capped the year as the strongest performing region, while Scotland was weakest, though the gap between the leader and laggard was the smallest since the index began in 1974.

The average price of a detached property has now increased 26% since Q1 2020, roughly double the price growth of flats over the same period.

Activity steadies

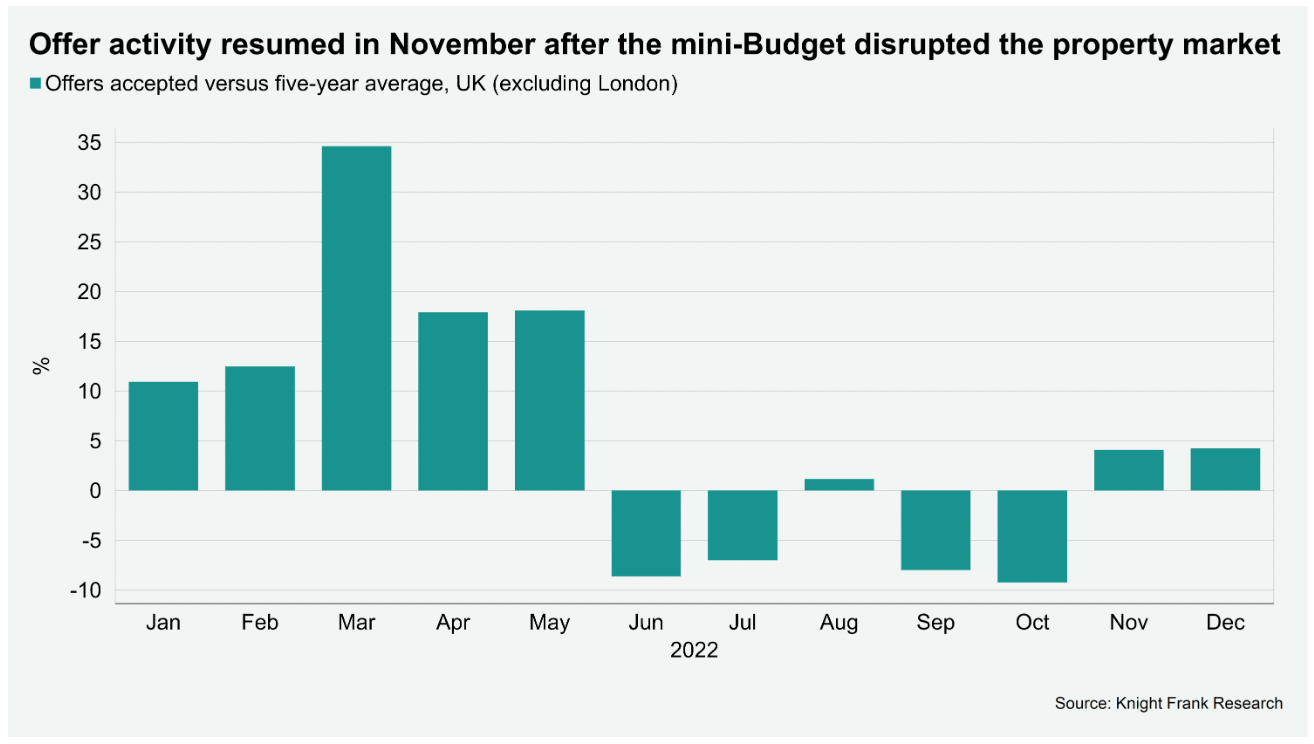

The number of offers accepted in prime residential markets outside of London rose more than 4% above the five year average in both November and December as sentiment improved in the wake of the September 23rd mini-budget. October's volumes were 9% below the long run average.

That data (see chart below) comes from our latest Prime Country House Index, published just before the turn of the year. For comparison, June's deal volumes, and to a lesser degree July and September, were negatively distorted by the comparison to 2021’s stamp duty deadlines.

Nevertheless, average price growth fell 0.9% in the fourth quarter, taking the annual rate of change in the prime regional market to 3.1%. That's the largest quarterly fall since the onset of the pandemic.

A tough year

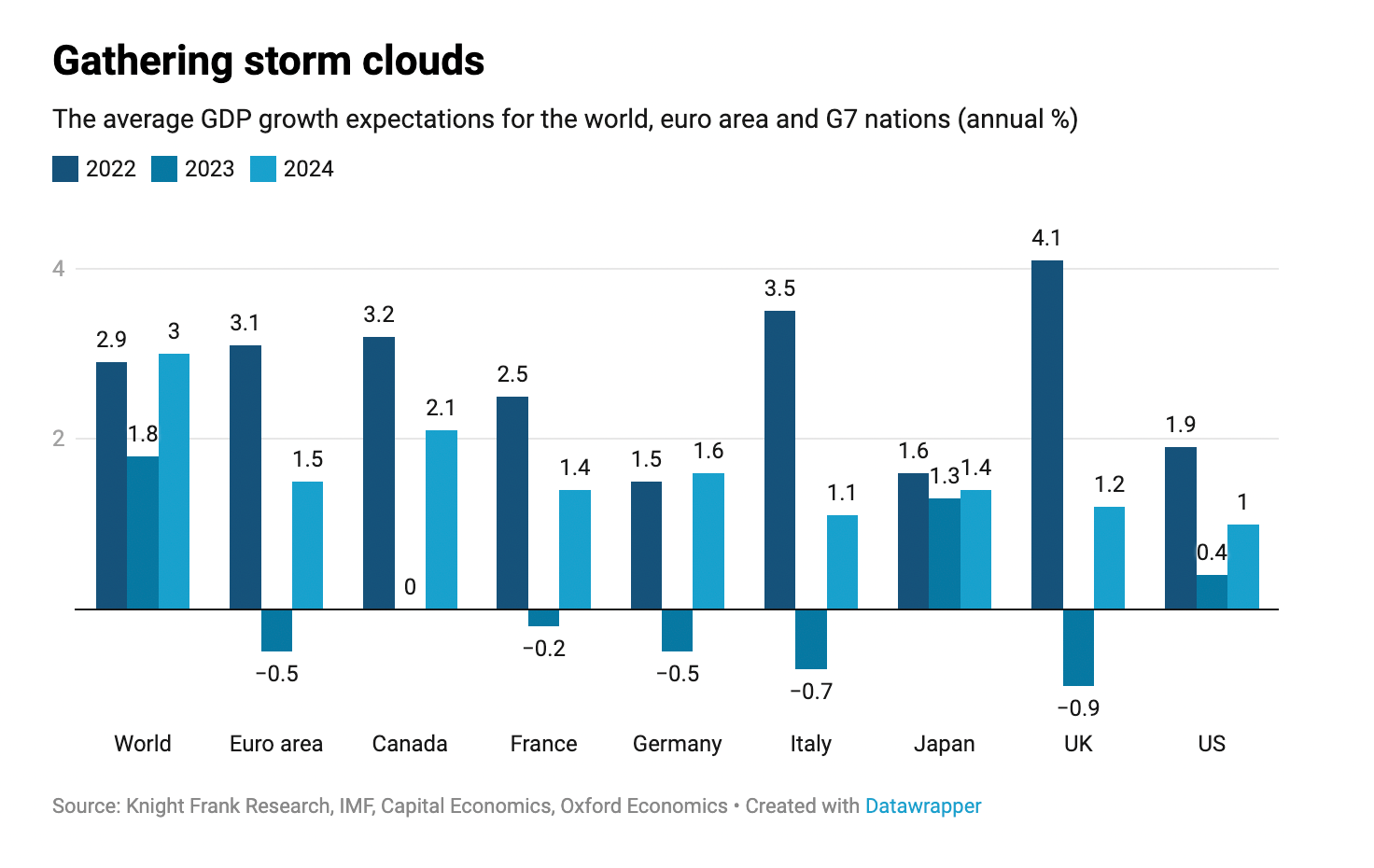

It's going to be a tough year as a third of the global economy falls into recession, IMF head Kristalina Georgieva told CBS News earlier this week.

The US is likely to outperform, owing to its strong labour market performance. China on the other hand is likely to equal or fall below average global growth for the first time in forty years, Georgieva said.

Many economies in Europe have almost certainly entered recession and others are sure to follow - see chart below courtesy of Flora Harley's economic outlook. The downturn is likely to be mild relative to historic standards, however.

When interest rates top out and how long they remain at peak will be the year's key questions. As Flora writes, we are entering a new phase as rate hikes shrink. Consensus suggests we'll see a peak in key interest rates of about 5% in the US, 4.5% in the UK and 3% across the euro area.

Inflation

Those peaks are subject to considerable uncertainty. The rate of inflation may be starting to ease, but it remains unclear how successful the prevailing round of monetary policy tightening will be in bringing rising prices back to the 2% target.

Data from the British Retail Consortium provided a reminder this morning. Annual growth of UK food prices hit 13.3% in December, up from 12.4% in November and the highest reading since records began in 2005.

Chief executive Helen Dickinson largely puts that down to the rising costs of animal feed, fertiliser and energy as a result of the war in Ukraine. Andrew Shirley covers the implications of volatile commodity prices for farmers and rural landowners in his latest note.

In other news...

Deloitte cuts temperatures in UK offices by 2C to save energy (FT), and finally, Blackstone’s BREIT gets $4 billion California injection (Bloomberg).