Leading Indicators | 2023 Pockets of Positivity | Energy Demand | UK CRE Forecasts

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Pockets of positivity going into 2023

While the global economy is set to slow, it is not all bad news. China has started to ease Covid-19 testing requirements in certain major cities, which will likely be positive for global supply chains next year.

Meanwhile, unemployment within the G7 is on average 1.88ppts below the LTA, so any increases to unemployment next year would be from a low base. For the UK, there are signs that inflation peaked at 11.1% in October, with the latest PMI survey pointing to output price inflation cooling in November. The Confederation of British Industry (CBI) forecasts UK GDP to contract by -0.4% next year, which is more optimistic than the OBR’s -1.4% forecast. The CBI expects stronger business investment next year as fiscal stability concerns ease, combined with interest rates coming down at a quicker pace than the OBR anticipates.

European energy demand softens as prices rise

As the EU's import ban and G7 price cap on Russian oil come into force, European energy consumption has moderated. According to the ICIS, gas consumption in the EU was 24% below the five-year average in November. This reduced consumption has meant that gas storage facilities across the continent are currently at 93% of capacity.

This has been supported by record liquified natural gas (LNG) imports, with Europe and the UK importing 11.1 million tonnes of LNG in November. However, while consumption is moderating, prices are still rising and contributing to inflation. Dutch TTF gas futures are trading near €150 per megawatt hour, the highest in over a month. Oil prices are also elevated after OPEC+ agreed to stick to its October plan to cut output by 2 million barrels per day from November.

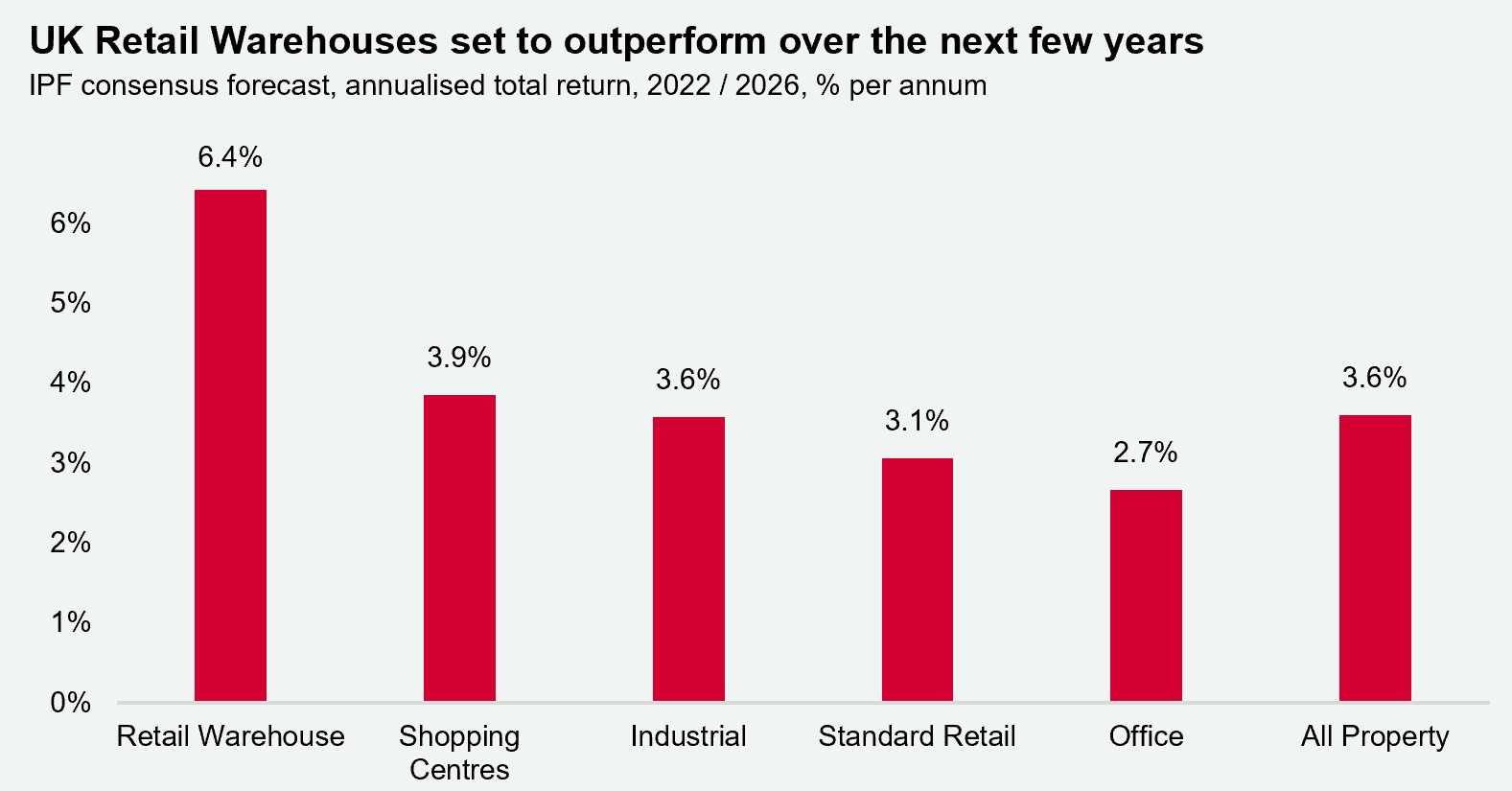

All UK property outlook downgraded, but retail Warehouses are the bright spot

In line with expectations for the wider economy, the outlook for UK CRE has also moderated. The latest UK All Property IPF consensus forecast has been downgraded for 2022 and 2023, with the exception of rental value growth in 2022.

All Property rental value growth projections for 2022 improved by 30bps to 3.7% in November, primarily driven by industrial rental growth. For 2023, the All Property total return forecast has moderated by 540bps to -2.4%. Returns will see a gradual recovery from 2024 onwards. Between 2022 – 2026, Retail Warehouses are expected to be the best performing sector with a total return of 6.4% per annum (p.a.). For comparison, Shopping Centre total return is forecast to be 3.9% p.a, Industrial 3.6% p.a, Standard Retail 3.1% p.a, and Offices at 2.7% p.a.

Download the latest dashboard