UK residential property market: removal of stamp duty breaks from April 2025 to stimulate economy

Autumn Statement calms financial markets as residential property buyers take a breath.

3 minutes to read

You wait for a major fiscal event and then two come along at once.

The mini-Budget at the end of September triggered market volatility and a spike in borrowing rates.

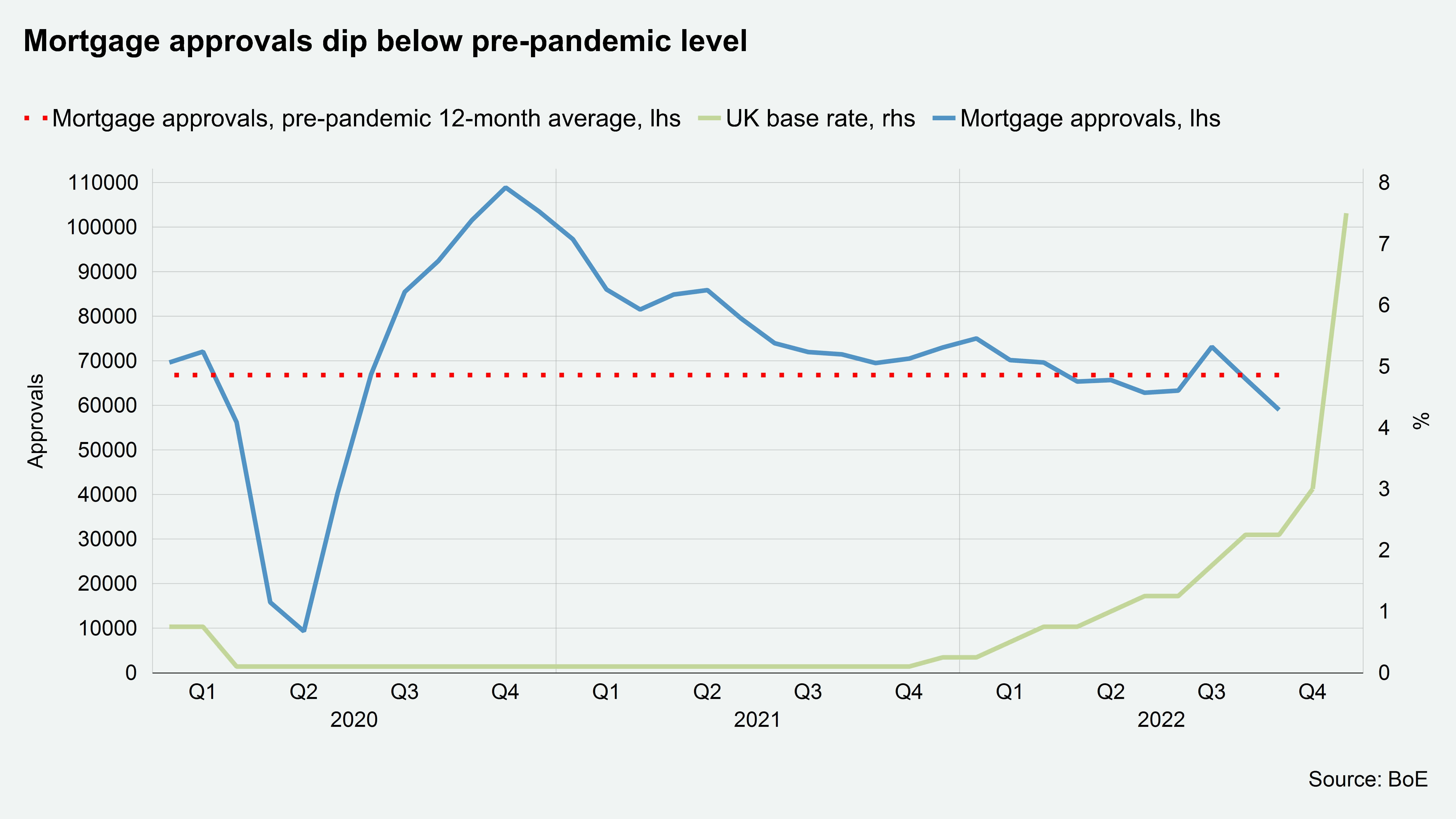

Its impact on the residential property market was laid bare with the release of mortgage approval data for October, which at 59,000, was the lowest monthly total since the early days of the pandemic (see chart).

Against this backdrop, the first job for newly-installed Prime Minister Rishi Sunak and his Chancellor Jeremy Hunt was to calm financial markets with their Autumn Statement a month later.

They appear to have succeeded, but with the City placated for now what does a programme of higher taxation mean for the UK residential property?

In short, the Autumn Statement could have been worse for the UK housing market.

However, the reversal of previous chancellor Kwasi Kwarteng’s stamp duty cut highlighted a paradox.

The nil rate band will revert to £125,000 from £250,000 (which represented a maximum £2,500 saving) and benefits that could save first-time buyers upwards of £10,000 will also be reversed.

None of this will happen until April 2025, which the government hopes will stimulate sales ahead of the deadline. In effect, it has announced a 28-month stamp duty holiday and more housing market activity around the time of the next general election (no later than January 2025) will presumably be a welcome by-product.

The inconsistency is that during the pandemic, the government introduced a stamp duty holiday to support the wider economy, not just the housing market. If that’s the case, why put rates back up in 2025?

London’s resilience

Prime London postcodes were not immune from the uncertainty that followed the mini-budget.

Average prices fell 0.3% in October in prime central London, which was the biggest monthly decline since May 2020. A fall of 0.1% in prime outer London was the first decline in 30 months.

But that does not signal a cliff-edge moment for prices. Instead, the data points to a resilient market in prime London and a relatively soft landing in 2023 compared to the wider UK.

The number of offers made in London was down by just over a fifth versus the five-year average (excluding 2020) in October while viewings slipped by 12%, Knight Frank data shows. However, the number of new buyers registering was up by 26% and the number of instructions to sell was 28% higher, which suggests transactions will remain healthy for now.

Country market momentum

Outside of London, the “escape to the country” trend is calming down but hasn’t ended. Offers accepted were up 24% in October versus the five-year average (excluding 2020), in part as buyers try to lock in deals at previously agreed, lower mortgage rates.

The return to the office for many workers and the lifting of restrictions has also led to a renaissance in urban living.

While we expect UK house prices to fall 5% next year and activity too, some parts of the UK will be more insulated from higher interest rates due to lower levels of mortgage debt.

Read more or get in contact: Tom Bill, head of UK residential research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up to our newsletters below.

Subscribe here