Dedicated seniors housing delivery accelerating

There remains a compelling investment case for assets that benefit from changing ways of living and long-term shifts in demography in the UK.

3 minutes to read

The majority of stock in the UK seniors housing market is affordable housing built pre-1980, accounting for almost 50% of total supply.

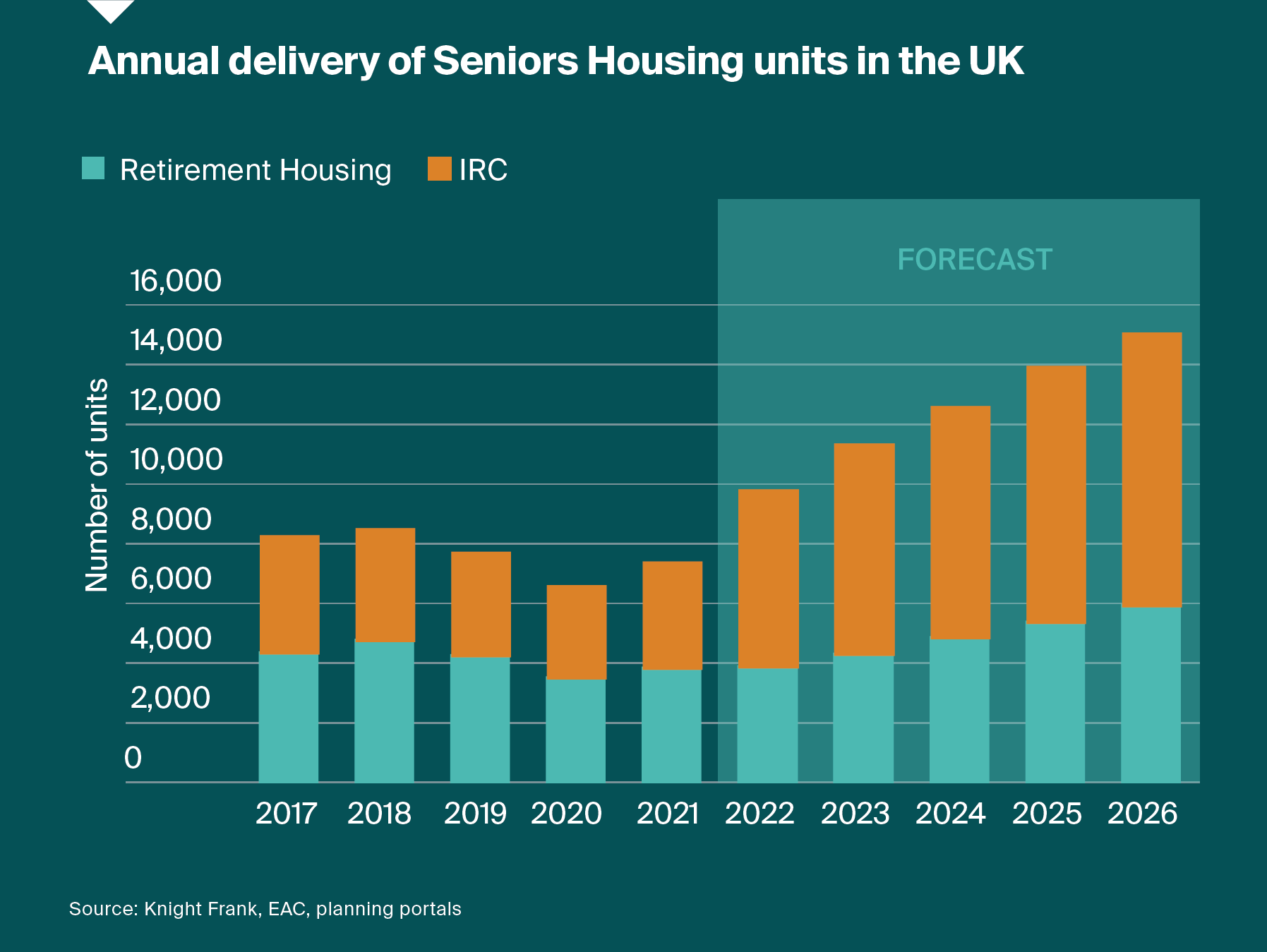

The private market comprises 190,000 units largely constructed in the 1980’s onwards. In recent years the rate of delivery of the private market has been accelerating due to increasing investment from institutions seeking long-term stable cashflows.

The IRC pipeline has recently overtaken the Retirement Housing pipeline for the first time.

Land and build costs rising

Build costs have risen by 16% over the last 12 months, according to data from the Build Cost Information Service, putting pressure on new delivery.

Land prices have also risen steeply. Knight Frank’s latest Land Index shows that the price of English greenfield sites has increased by almost 14% over the last 12 months, principally driven by a shortage of supply.

Despite this, the seniors housing development pipeline continues to grow. There are over 39,000 seniors housing units planned, up from 31,000 last year. The current inflationary environment may impact how quickly some of these sites are delivered.

However, over the medium term, we forecast a trend of accelerated year-on-year delivery. On the demand side, the baby boomer generation has reached retirement age.

Ageing population

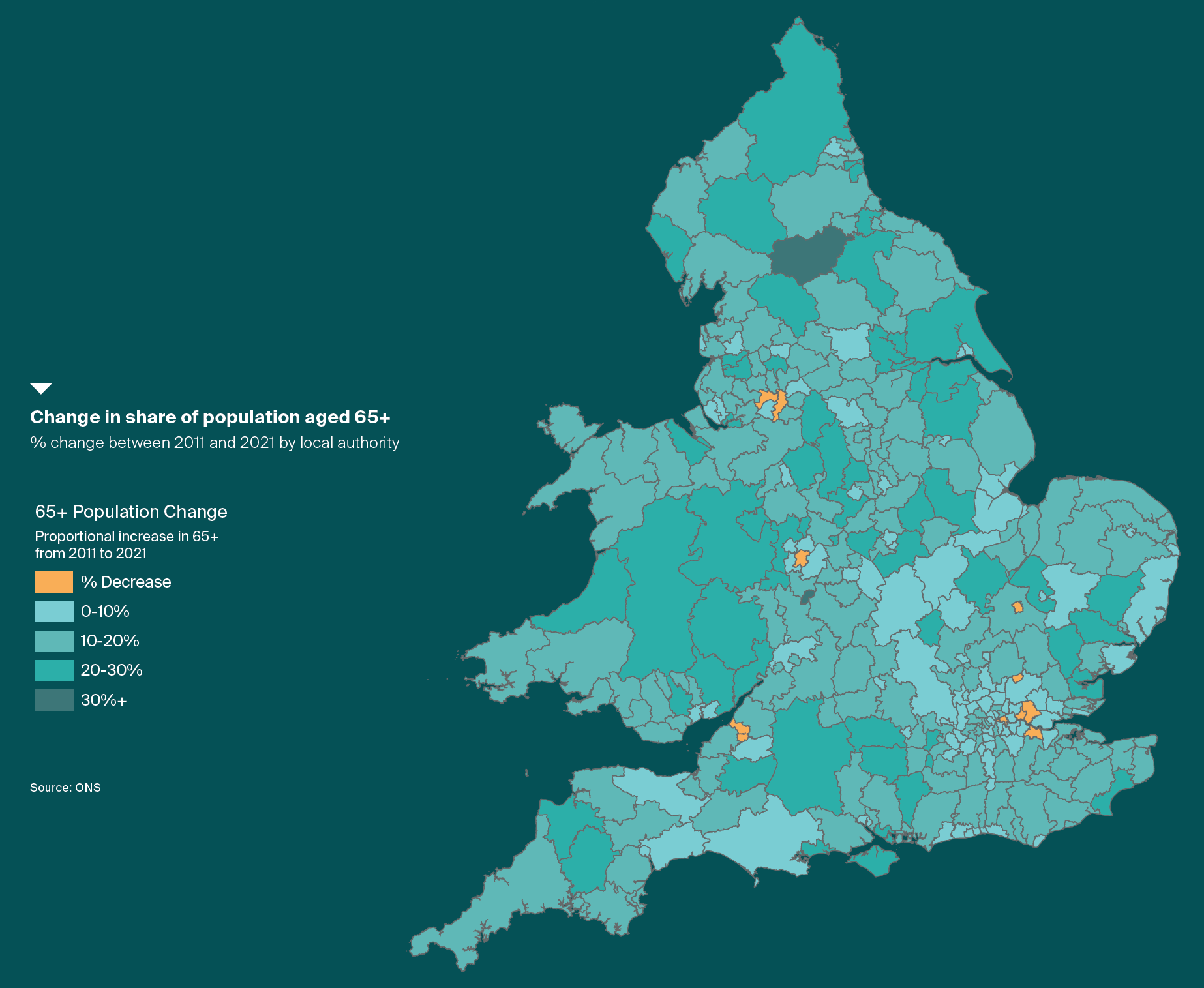

Data from the 2021 Census confirmed that nearly one in five people in England and Wales is now aged 65 or older, the highest proportion of older people ever recorded.

In total, there were 11.1 million individuals aged 65+, up 20% from 9.2 million in 2011. The number of people aged 75+ increased by 18% over the same period.

An ageing population is not new, but the official figures reinforce the need for more dedicated housing for seniors in nearly every location. Over 95% of local authorities saw an increase in their share of population aged 65+ over the last 10 years.

Our forecasting, based on the new Census figures, indicate these increases are only going to accelerate. We anticipate a 17% increase in the 65+ population between 2021 and 2031, equating to an additional 1.9 million people.

The number of people aged 75+ is expected to grow by 23%. In real terms – and considering our expectation that the total number of specialist seniors housing units in the UK will grow by 8%, or around 63,000 units over the next five years – this would mean there would be 119 seniors housing units per 1,000 individuals aged 75 by 2026.

This is down from 124 currently and from 137 back in 2012, underscoring the potential for significant growth in the sector to provide enough age-appropriate housing for the demographic shift taking place.

Advances in healthcare and medicine mean seniors are now living healthier lives for longer than previous generations.

In later life as people grow older it is not surprising they have a demand for high quality, new, purpose-built housing within a community with on-site services and access to care on offer.

Another sign that baby boomers are different to the previous generation lies in the increasing numbers of rental households 65+.

According to the English Housing Survey, there has been a 39% increase in the number of privately renting households in England where the household lead was aged over 65, while data from Knight Frank’s London lettings business shows 7.1% of tenancies agreed so far in 2022 have been to tenants aged 70 or above, up from a five-year average of 3.5%.

Subscribe for more

Subscribe to our newsletters for more or contact Oliver Knight for more research insights.