October house prices retreat as mini-Budget causes homebuyer hesitance

Despite tougher economic picture demand remains resilient and transaction activity high.

3 minutes to read

House prices retreated in October as September’s mini-Budget spread uncertainty through the cooling housing market.

Mortgage rates spiked as financial markets took fright at the inflationary potential of Prime Minister Liz Truss’s tax-cutting programme announced on 23 September.

While the arrival of Rishi Sunak as her replacement has calmed nerves, sentiment amongst homebuyers took a hit in October as borrowing costs spiked.

Read our autumn statement preview for more on what may be announced this week.

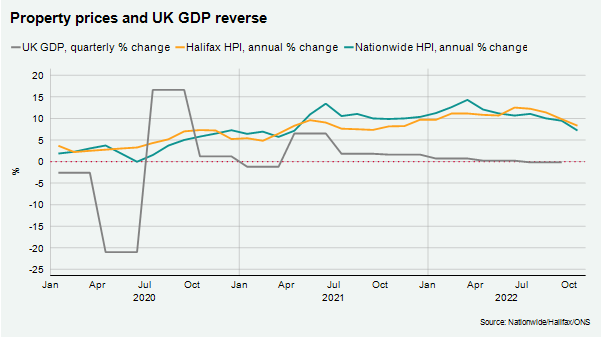

The volume housebuilders warned of falling demand in October and UK GDP contracted by 0.2% in the third quarter, with the decline accelerating to 0.6% in September.

House price growth goes into reverse

Halifax recorded the sharpest decline in house prices since February 2021 with a fall of 0.4% in October. This saw the rate of annual growth ease, from +9.8% in September to +8.3% last month.

Nationwide reported an even larger monthly contraction, with average house prices down 0.9% in October compared with a flat reading in September. It sent annual growth to 7.2% from 9.5% in September.

While house prices are under pressure, something we expect will lead to a decline of 5% next year, there has been no cliff edge moment for the UK residential market.

Transactions were inevitably down by 37% in September compared with a year ago and the end of the stamp duty holiday, however at 103,930 they remained 3% higher than the pre-pandemic average between 2015 and 2019.

The latest RICS sentiment survey found the national net balance for house prices was -2% in October, down from a figure of +30% in September. It ended a sequence of 28 positive monthly readings. New buyer enquiries fell for a sixth successive month, with a net balance of -55% in October (September -36%).

However, the lettings market continues to perform strongly. A net balance of +46 of respondents to RICS reported an increase in new tenant demand, suggesting that with supply tight upwards pressure on rental values will continue.

Despite the flurry of bad news last month, we don’t think the UK housing market is on a steeper downwards trajectory, as explored here.

Prime London sales

Prime London postcodes were not immune from the uncertainty that followed from the mini-Budget.

Average prices fell 0.3% in October in prime central London, which was the biggest monthly decline since May 2020. A fall of 0.1% in prime outer London was the first decline in 30 months.

However, the number of new buyers registering was up by 26% and the number of instructions to sell was 28% higher, which suggests transactions will remain healthy for now.

Prime London sales report November

Prime London lettings

Rental value growth remains firmly in double-digits in prime London postcodes as demand continues to outstrip supply.

The number of new prospective tenants was 60% above the five-year average (excluding 2020) in October while new listings were down by about a third. As a result of this imbalance, average rents rose by 17.8% in prime central London (PCL) and 15.4% in prime outer London (POL) in the year to October.

However, as the outlook for the sales market becomes more uncertain, there are early signs that the supply of lettings stock is increasing, particularly among more discretionary sellers in higher-value markets.

Prime London lettings report November

The country market

There is strong momentum in the country market despite the economic backdrop.

Offers accepted were up 24% in October versus the five-year average (excluding 2020) and exchanges climbed by 23%. As of the second week of November, the number of exchanges this year has exceeded the whole of 2019.

Sales instructions were 3% ahead of the five-year average and this gradual increase in supply is still matched by resilient demand. While the number of new prospective buyers registering in the same period was down 8%, the number of active applicants looking to buy was 1% higher in October compared with a year ago.

Sign up for more

For more property forecasts and market-leading insight into the UK property market, subscribe to the newsletter.