Cost increases put downward pressure on land prices

In spite of land shortages across all land types, build costs and general inflation have contributed to subdued development land values in Q3.

2 minutes to read

Written by David Chapman, Senior Research Analyst.

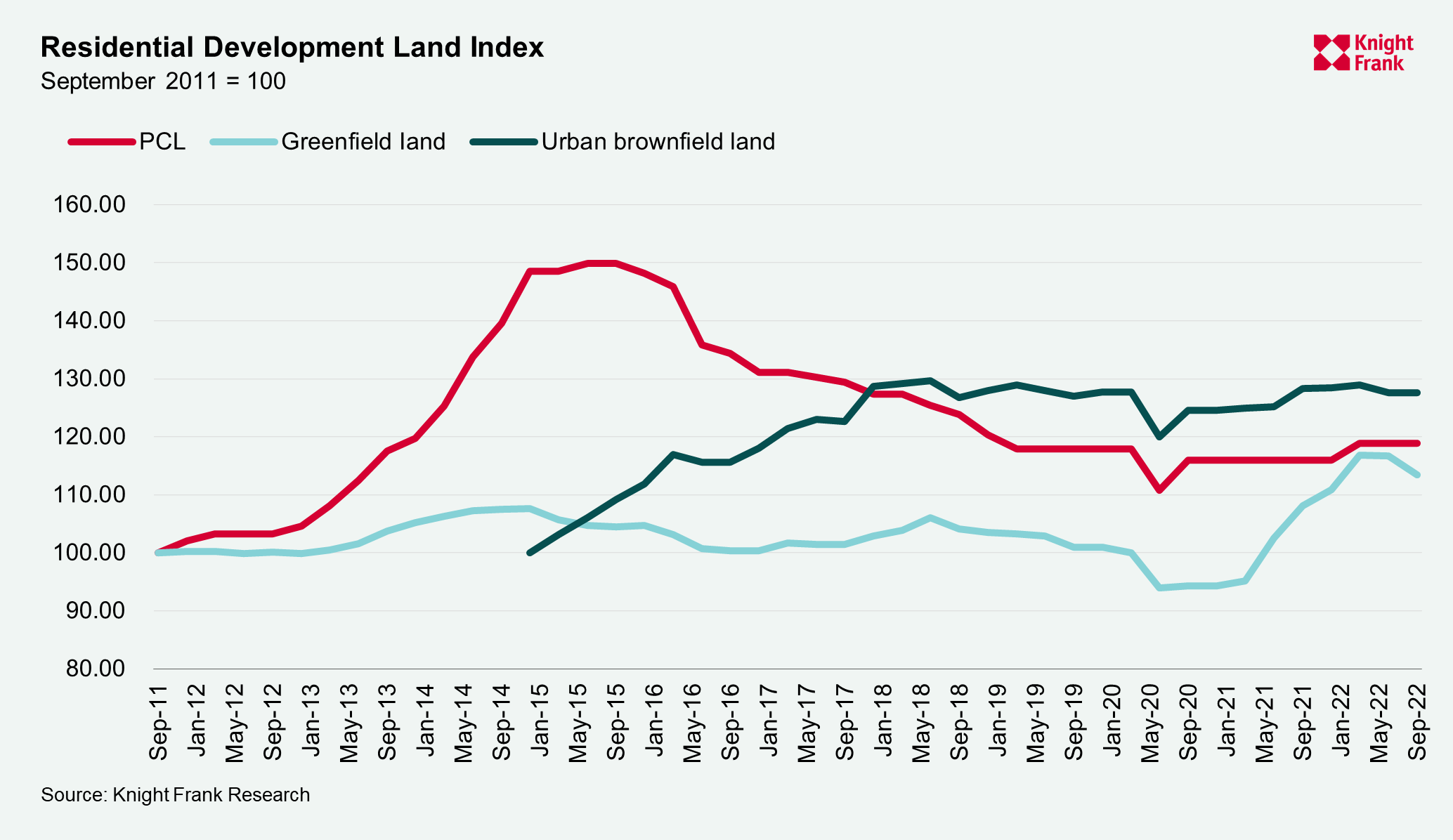

Development land price growth in Q3 2022 was mixed. While prime central London (PCL) values were unchanged from Q2 2022, values increased by 2.5% year-on-year. Urban brownfield sites were also unchanged from Q2, values fell -0.5% year-on-year. Values of greenfield development sites fell 2.9% from Q2, but grew 4.9% year-on-year.

There are several reasons for the mixed growth. Generally, across the market there remains a shortage of development opportunities relative to demand with both major housebuilders and Housing Associations looking to build pipelines. Prime central London’s land prices continue to be bolstered by competition from a variety of uses.

Inflation and the wider economic backdrop, in particular the increased costs of living, building and borrowing are, however, putting downward pressure on prices. Responses to our survey of SME homebuilders and developers suggested that the increased cost of living was having a moderate to significant impact on buyer sentiment, and the subdued pricing in both greenfield and urban brownfield sites reflects concerns over future customer demand.

Some 34% of survey respondents identified material and labour costs as a significant challenge to development. This response is borne out by the BCIS Build Cost Index which grew on average by 12.4% in Q3 2022, down from 14.7% in Q2 2022. Build costs are forecast to remain elevated for the remainder of 2022, before levelling out at 3.9% from Q2 2023.

As in earlier surveys, responses from developers and homebuilders reflect concerns at the each stage of the new homes development pipeline. Some 77% of responses stated land supply was limited or very limited, encouraging homebuilders to consider development opportunities with any planning status, including strategic land. Almost half of respondents suggested start volumes would decrease in Q4 as inflation reduces the pool of potential buyers and Help to Buy comes to an end.

While the increased cost of borrowing may contribute to short term uncertainty in the market, it may also lead to more land being released in the longer term as lower prices and higher borrowing costs act as a spur for landowners to sell.