Madrid emerges as top logistics location

High absorption, investment activity as well as new developments in Madrid consolidate the city as key area for logistics development in Spain.

5 minutes to read

According to our European Logistics Report 2022, Spain will be one of the countries with the highest economic growth in the next five years. This will lead to a higher level of consumer spending, which is likely to drive increased demand for urban logistics.

Growth hub

The city is expected to record the highest growth of all southern European markets in 2026 compared to 2022 based on its population and retail sales growth prospects, both online and offline. Madrid market ranks eighth out of more than 800 markets in seven countries.

The Spanish capital is located less than 700-kilometer from any point of Iberian peninsula and is leader in terms of infrastructure concentration of this typology, as well as transportation.

The Madrid logistics market, mainly groups together areas belonging to the provinces of Madrid, Guadalajara and Toledo, is established as the core of e-commerce from where merchandise can be shipped to any area of the peninsula in less than 24 hours.

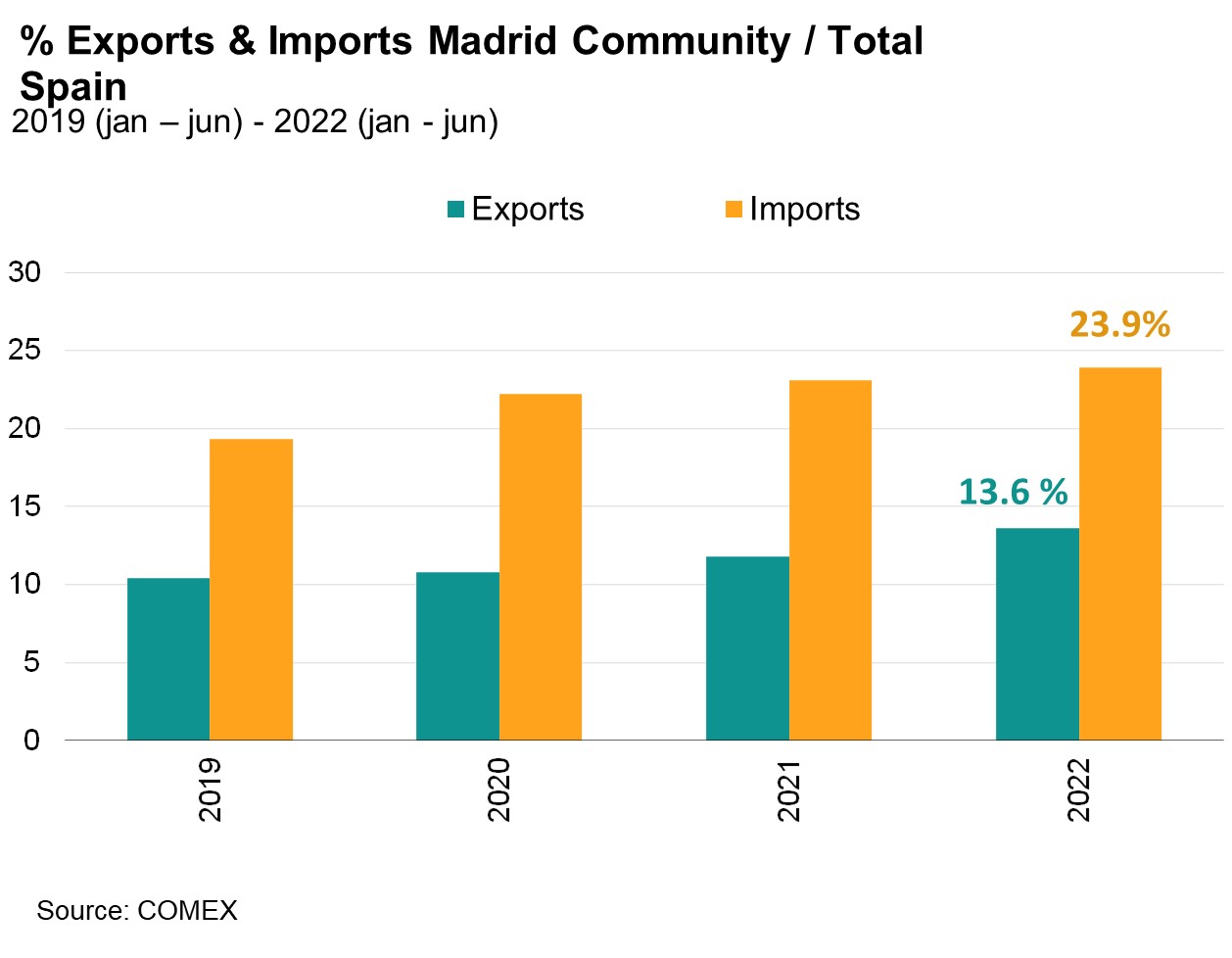

According to the last figures published in the report of the Comercio Exterior del Gobierno de España, the capital city accounted for 13.6% of the total export, with 44.5% year-on-year growth, during the first six month of the year. While the import registered around 24% of the total and an annual variation of 41.4%.

The port of Puerto Seco de Coslada contributes to these figures, connecting by rail with the main ports (Algeciras, Valencia, Barcelona y Bilbao) and it is located about ten minutes from Adolfo Suárez Madrid - Barajas.

Infrastructure importance

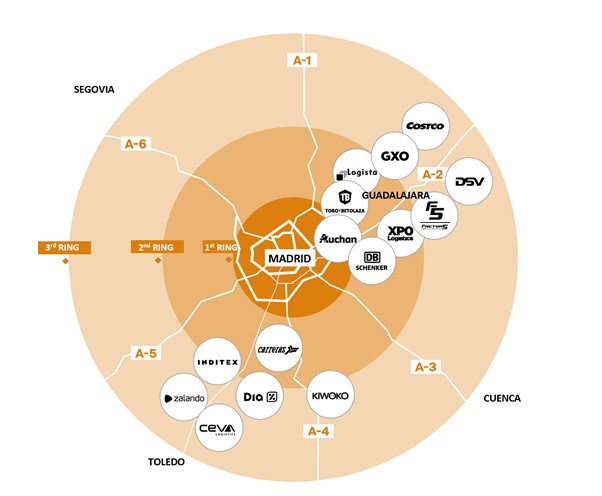

Madrid is the hub at the crossroads of axes that run through the territory by means of highways.

The A1 or North highways, connect Madrid to Vitoria and San Sebastian, highlighting its connection with Burgos. This locality has launched the Integrated Logistics Sector Development Strategy for the years 2022-2026, which aims to promote and improve infrastructure and thus attract new companies.

The axis of the A2 is one of the most important since it has with the Henares Corridor, the biggest logistic market in the capital city, which includes privileged locations that connect with Zaragoza, Barcelona and France.

In the case of the A3, infrastructure improvements are being considered, as well as the implementation of a new rail service, since the pandemic showed that only road transport was able to continue its activity as normal. This axe connects directly with the port of Valencia.

The southern area is formed by axis A4, the area has a high level of logistics and industrial activity and connects to the port of Seville.

The axis of the A5, that connect with Extremadura, although less important at the logistic level, also connects with another port, the Lisbon. In addition to the axes formed by the main highways, the most central area of the capital stands out with a high demand due to the last mile effect and of lack of space, with other other more peripheral areas growing at a very fast pace.

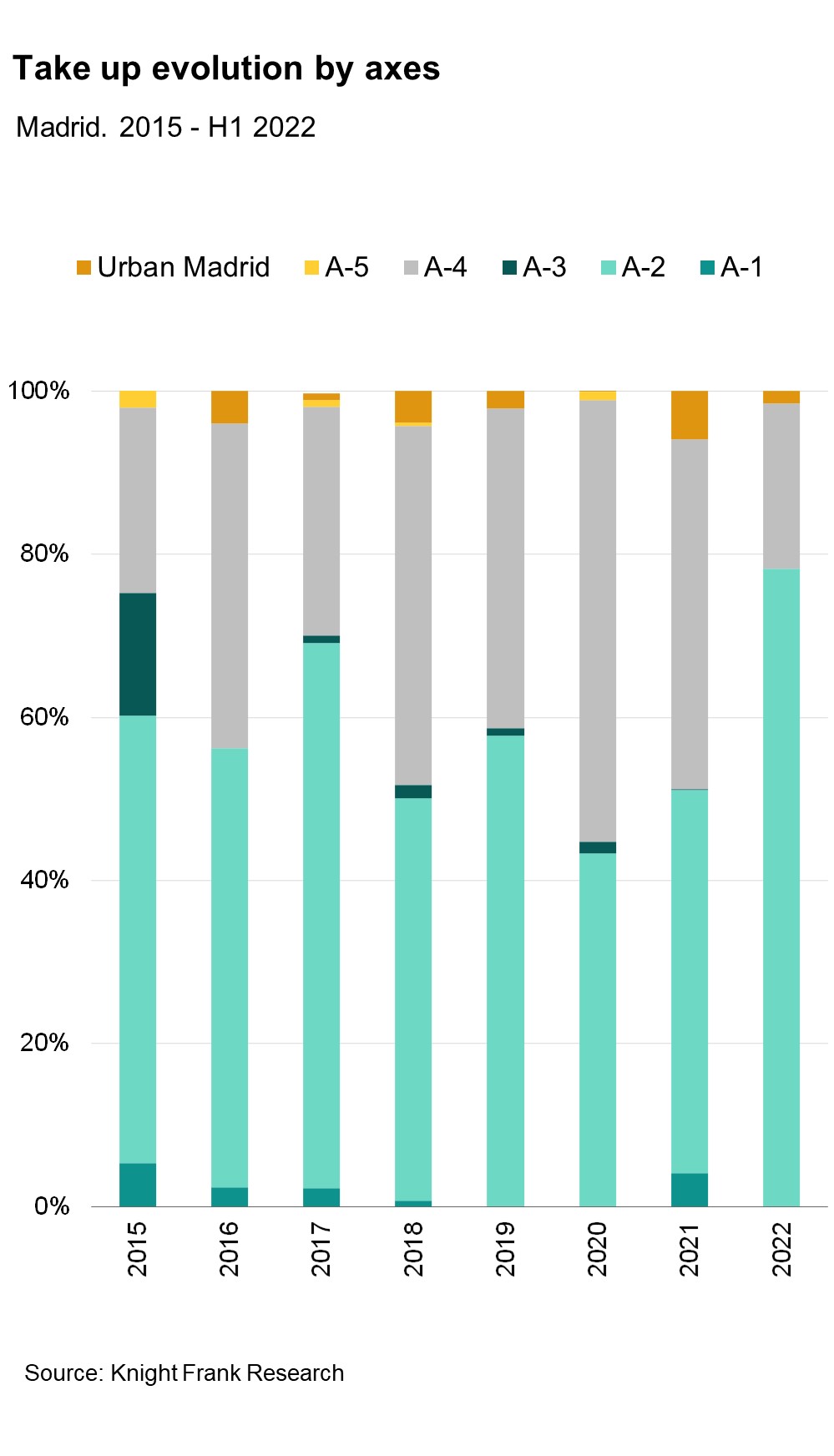

Take up evolution

Among the most important logistics hubs in the Community are those located in the Henares Corridor, located on the axis of the A2 highway, with municipalities such as Coslada, Torrejón de Ardoz, or San Fernando de Henares, among others and extends to Guadalajara.

During the last years, in general, this axis has represented the major proportion of the take up registered in Madrid, among other factors, thanks to the offer of more spacious warehouses as well as its advantageous location and connections.

Among the most important operations and deal of this axis during the last three years, there is:

- Costco for 80.500 sq m in Torija

- GXO for more than 58.000 sq m in Marchamalo

These are both in the same province, Guadalajara.

The axes of A3, A4 and A5 form the southern area with municipalities such as Rivas, Getafe o Alcorcon. The take up level in the A4 zone also has a high demand, similar to the A2 zone.

A4 axis development

Among the most important factors for tenants is that most of its municipalities are known for their historical logistic and industrial activity. Among the latest tenants that have chosen the A4 axis to locate their warehouses are

- Inditex, with a 120,000 sq m warehouse

- Carreras, with 86,000 sq m

These are both in Illescas, Toledo.

Although the level of hiring in recent years in the most central urban area of the capital is lower, new tenants have put the focus on the area and have settled, such as Dia Retail España, with a logistics warehouse of almost 10,000 sq m in Villaverde.

Future logistics development

Logistics developers are playing a key role in carrying out new developments to meet the high demand for these assets. Although Madrid has a large number of new logistics developments in comparison with other parts of the country, these are more concentrated in the most demanded axes.

The A-2 highway stands out for its large number of new developments. A good example is the expansion of Madrid airport, a project that will make it the largest logistics hub in Spain, connecting the major markets of Asia with Europe, the United States and Latin America.

It will be built on a 323-hectare site near Terminal 4, with a buildable area of 2.1 million square meters for different uses (offices, hotels, warehouses, etc.).

In the south of the capital, on the A-4 axis, GLP will promote a mega-project in Villaverde of 273,000 square meters, of which 160,000 will be used for logistics. This project, called Oaxis GLP Park Madrid Villaverde, will be inaugurated during 2025 and is intended to provide an answer to last-mile urban logistics, since it will be located only 9 km from Puerta del Sol.

GLP has also recently acquired a 32,000 square meter plot in the Getafe area where it will build a 21,500 square meter logistics warehouse, which will be its seventh development in the south of Madrid.

Madrid remains logistics hub

While the logistics sector in Madrid has seen its axes strengthened thanks to the rise of digitalization and the transformation of purchasing habits, the current situation of uncertainty will lead to changes in consumer behaviour to which they will have to respond.

Logistics operators will probably have to adapt their asset location strategies to provide quality service. However, Madrid, in constant development, will continue to be one of the main logistics points for transport and distribution, as well as the European location of choice for large logistics operators.