European office occupier market Q3 2022

Robust take-up underpins European office occupier market in Q3 2022.

6 minutes to read

Local experts across the Knight Frank network have analysed the latest occupier activity in their region, revealing a healthy demand for prime office space across Europe.

Updated quarterly, the dashboards provide a concise synopsis of occupier activity in Europe's markets.

Discover vacancy rates, take-up and prime rents from cities across Europe in more detail by exploring the dashboard for Q3 2022 at the bottom of each section.

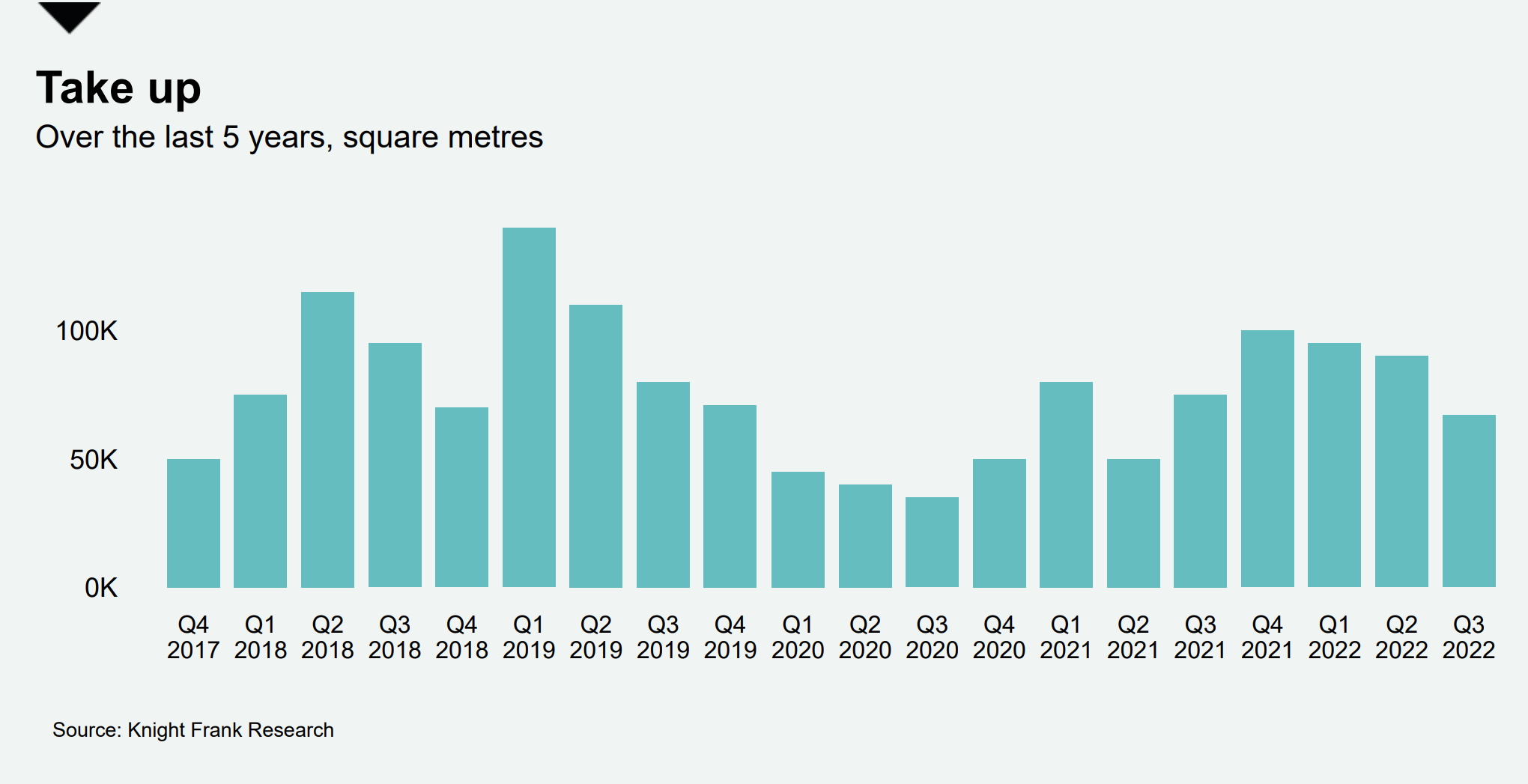

Barcelona office market

Take-up in the Barcelona office market stood at around 67,000 sqm. While this is 11% lower than the take-up in Q3 2021, it is in line with the five year Q3 average.

Office take-up in the first nine months of 2022 totalled around 252,000 sqm, which is 23% above the same period in the previous year.

As demand for office space continued to be robust, rents remained stable at €336 per sqm per year. They are expected to remain at this level in the next quarter.

View latest dashboard

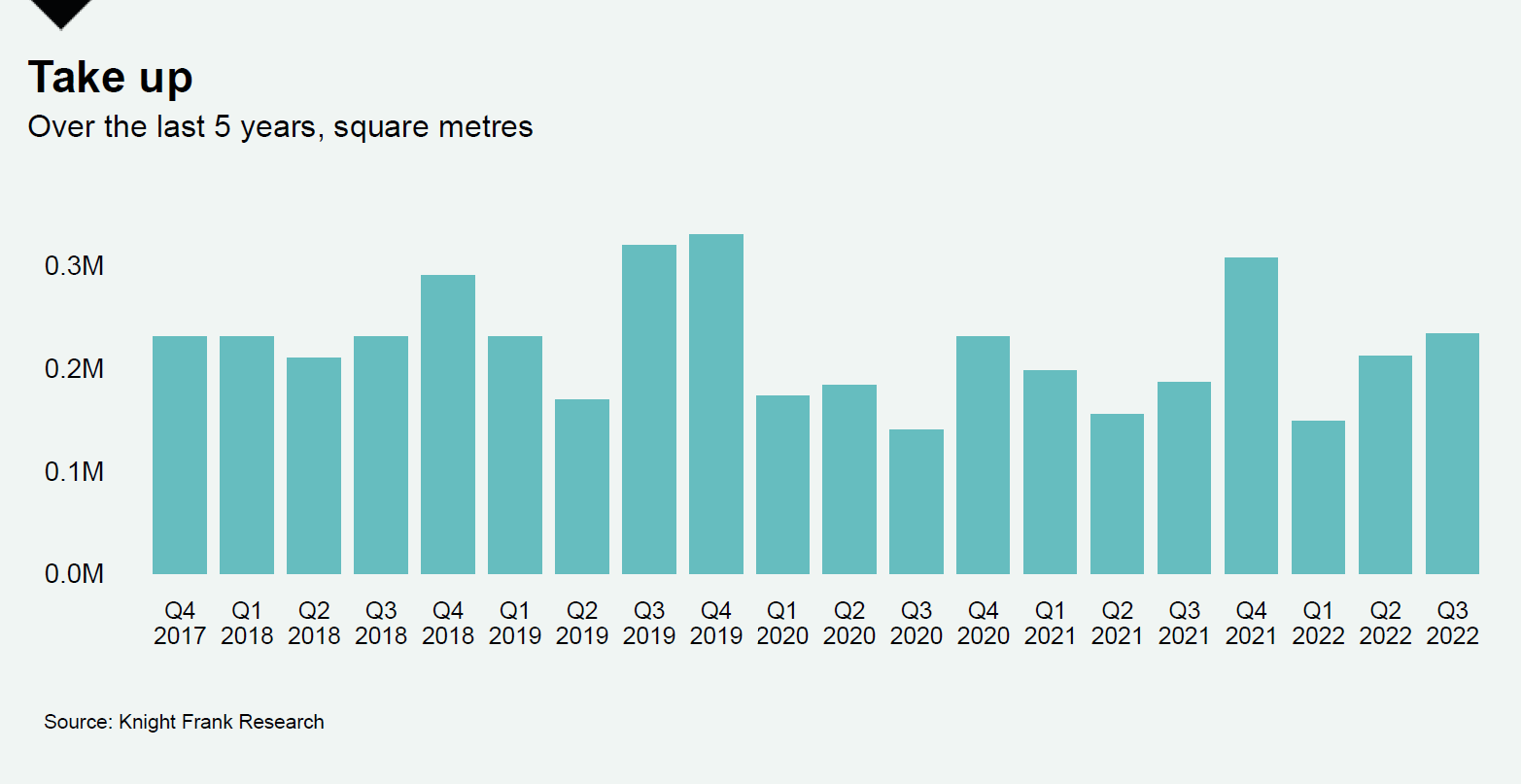

Berlin office market

Take-up in the Berlin office market in Q3 2022 remained robust at 233,500 sqm. This is a 10.3% increase over Q2 2022 and a 25.5% rise over the same quarter the previous year, driven by four deals above 10,000 sqm.

Total office take-up in the first nine months of the year amounted to 593,700 sqm, 10.3% higher compared to the same period last year. For 2022 as a whole, we could expect a total take-up of 850,000 sqm.

In the first three quarters of 2022, some 334,000 sqm of office space came to the market. A further 322,000 sqm are expected in the final quarter of the year, with a pre-letting rate of 63%. A total of 1.5m sqm are currently under construction.

Rents continue their upward trend as occupiers are looking for high-quality space in sought-after locations to remain attractive to employees.

View latest dashboard

Bucharest office market

Take-up in the Bucharest office market totalled 67,000 sqm in Q3 2022, of which 44% were renewals and 35% relocations. This brings the total take-up in the first nine months of the year to nearly 218,000 sqm, a 15% increase compared to the same period in the previous year.

The IT & Communications sector still makes up the largest share of office space demand, accounting for nearly 35% of total take-up. Q3 2022 also saw the largest transaction of the year so far, increasing the average transaction size to 1,200 sqm.

Amid the lack of approvals of new building permits we estimate a smaller number of projects will be delivered in the next few years. This means the Bucharest office leasing market will likely change to a landlord market, which will put further upward pressure on rents.

View latest dashboard

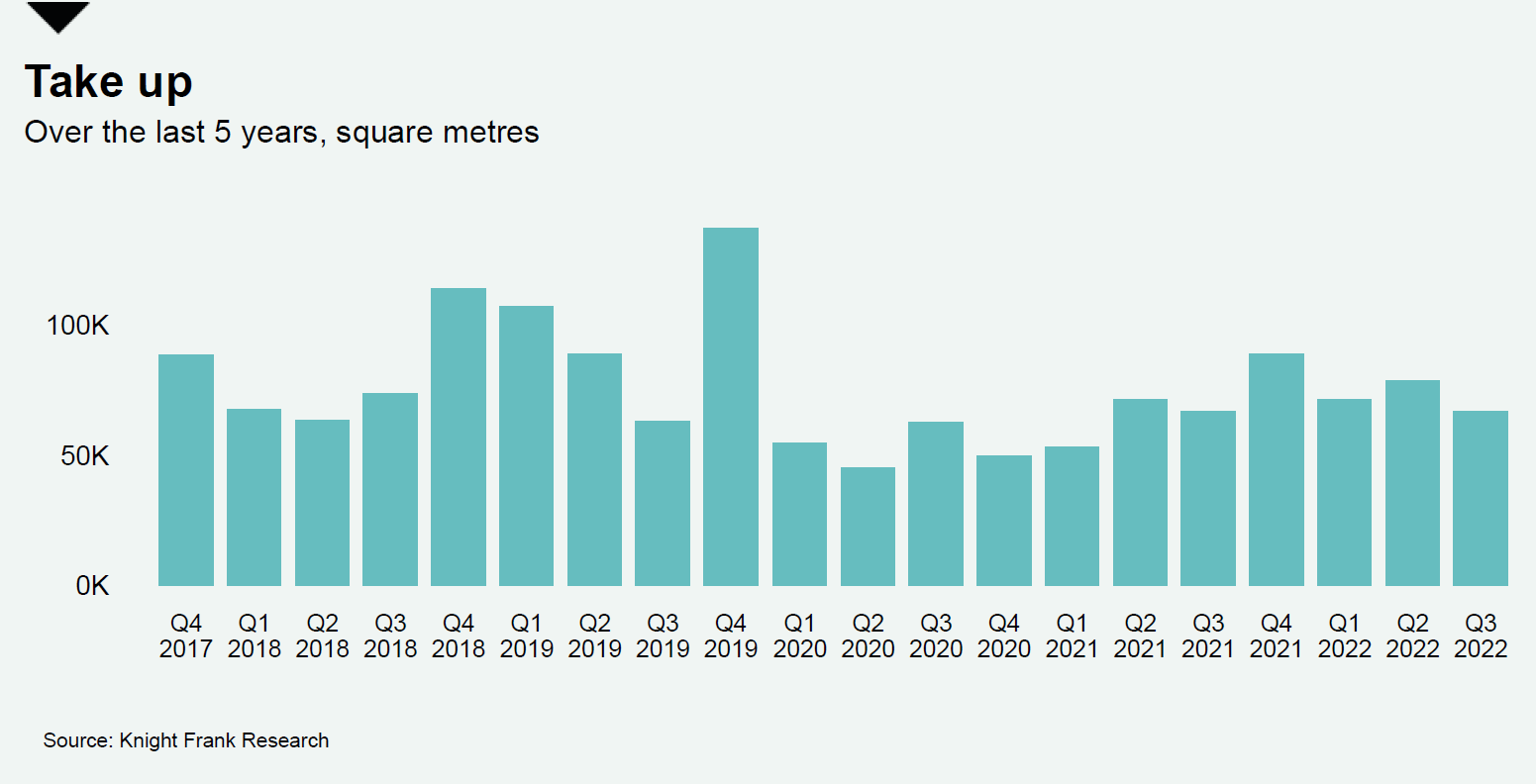

Madrid office market

The Madrid office market performed well in Q3 2022, with take-up accounting for 130,000 sqm. This represents a 53% increase over Q3 2021 and is 7% above the five year Q3 average.

Office take-up in the first nine months of the year totalled 385,000 sqm, 51% higher than in the same period the previous year.

The vacancy rate continued to decline to 11.1%, while prime office rents remained stable at €396 per sqm per year. In the last quarter of the year, rents are expected to rise.

View latest dashboard

Munich office market

Take-up in the Munich office market remained stable, totalling 600,900 sqm in the first nine months of the year. The quarterly result of 201,000 sqm was on par with the Q3 five year average.

The vacancy rate fell moderately to 5.0% in Q3 2022. The Munich CBD recorded a vacancy rate of 2% and the vacancy rate in the City Centre stood at 3.2%.

Prime office rents remained stable at €42.5 per sqm per month in Q3 2022 and are expected to remain at this level for the rest of the year.

We do not expect a year-end rally in the final quarter. Nevertheless, we expect the Munich office leasing market to remain stable, with take-up and rents holding up. The vacancy rate will likely settle at the 5% mark.

View latest dashboard

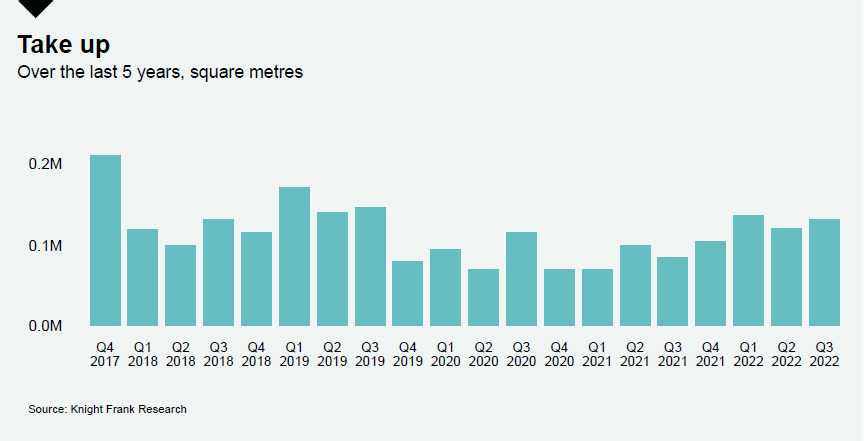

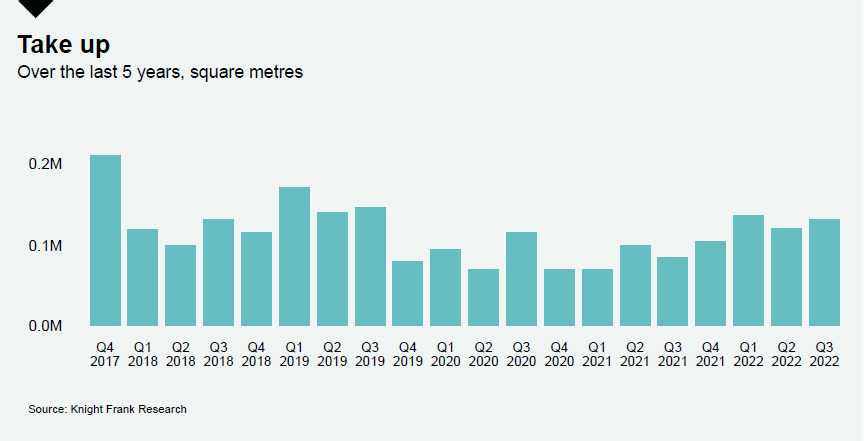

Paris CBD office market

The occupier market in the Paris Central Business District (CBD) was very active in Q3 2022. Take-up totalled nearly 206,200 sqm, the highest quarterly take-up since 2017 and the highest Q3 take-up on record.

The CBD could see a record year in terms of take-up, given the number of deals that are currently being finalised. The central location makes the CBD a favourable location for occupiers.

Given the strong demand for office space in Q3, the vacancy rate in the Paris CBD declined further to 3.3%, compared to 5.1% in Q3 2021. Grade A assets only represent 8% of available space which is putting upward pressure on rents.

Prime office rents in the Paris CBD reached a new record high of €955 per sqm per year. The rental gap between the CBD and other Paris submarkets is not likely to narrow in the short to medium-term.

View latest dashboard

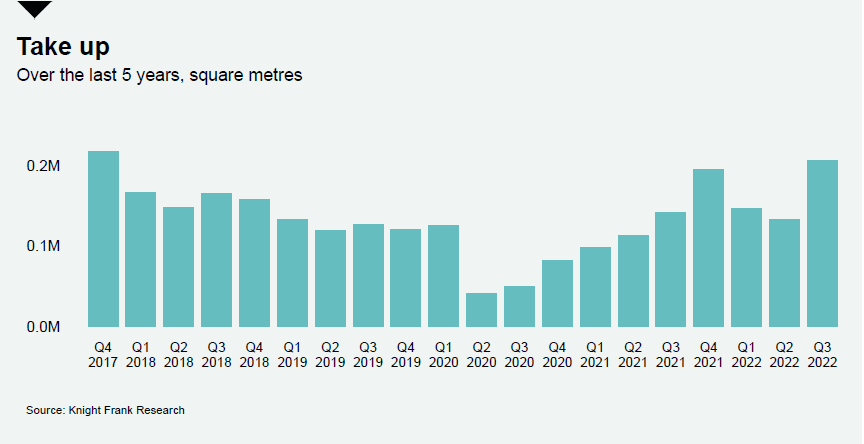

Greater Paris office market

The Ile-de-France or Greater Paris office market was dynamic and recorded a total take-up of around 491,000 sqm in Q3 2022.

In the first nine months of the year, take-up totalled around 1.58 million sqm, up 23% from the same period last year and 2% above the 10 year average.

Demand from coworking operators has seen a revival, with take-up amounting to 82,000 sqm in the Ile-de-France region since the beginning of 2022, or a 28% increase over one year.

Office occupier activity is likely to accelerate in the last quarter of the year and office take-up for 2022 as a whole could exceed 2.1 million sqm, compared to 1.9 million sqm of take-up in 2021 and the 10 year average of 2.2 million sqm.

View latest dashboard

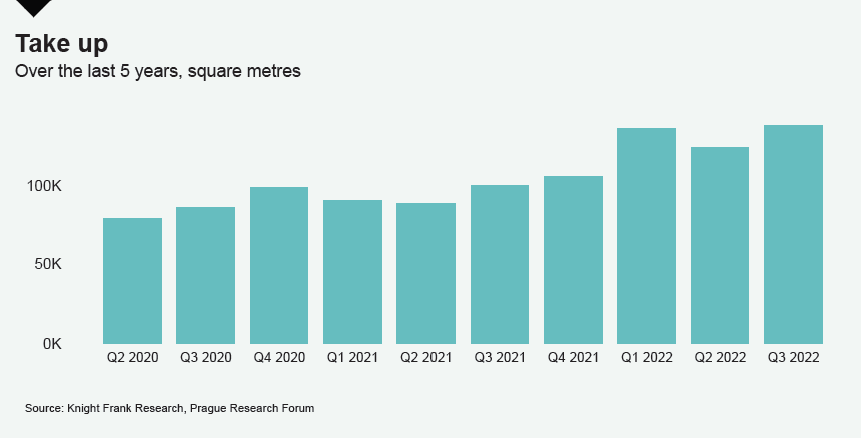

Prague office market

Despite the apparent slowdown in the office leasing market, the vacancy rate decreased by 20 bps quarter on quarter.

Growing construction costs put upward pressure on rental growth, which we are seeing particularly in newly built properties.

Three smaller properties were completed during Q3 2022 with GLA of 18,200 sqm in total, bringing total office stock in Prague to 3.8 million sqm. An additional 191,300 sqm of modern office space was under construction.

The economic uncertainty forces companies to reconsider their occupational strategies and they are trying to renegotiate their leases with shorter lease terms which was previously unseen in the market.

View latest dashboard

Warsaw office market

In Q3 2022, take-up in the Warsaw office market accounted for around 129,000 sqm. Take-up in the first nine months of the year totalled more than 608,000 sqm, an increase of 53% compared to the same period the previous year.

Tenant activity remains dynamic. It is possible that take-up will return to pre-pandemic levels by the end of 2022.

Demand, however, is changing, with more renegotiations and fewer new contracts being signed than pre-pandemic.

Developers are postponing commencements of new developments scheduled for 2022 due to rising construction costs and the cost of financing new projects.

If take-up remains at a high level until the end of the year and the supply expected for 2022 remains relatively low, the vacancy rate is expected to decrease significantly.

View latest dashboard

Subscribe for more

For more market-leading research, analysis and insights subscribe to our newsletters.