Barbados’s welcome visa attracts over 3,700 applicants

The island successfully pitched itself as a work-from-home base during the pandemic and its innovative 12-month welcome visa has sparked significant interest.

2 minutes to read

The island’s success in pitching itself as a work-from-home base during the pandemic and its innovative 12-month welcome visa has sparked the interest of 3,784 applicants with some 2,417 being approved according to government figures.

The move by Prime Minister Mia Motley not only boosted the economy and profile of the island at a time when tourism was hit hard by the Covid-19 crisis, but the scheme has been copied by numerous global policymakers keen to attract their own cohort of digital nomads.

The scheme allows non-residents to live and work in Barbados for up to 12 months provided they earn at least US$50,000 a year or have the same amount in savings.

Property update

Barbados’s property market is struggling from a lack of stock, ten words I never thought I’d write given the decade long glut of inventory that we witnessed post the financial crisis and prior to the pandemic.

While available properties and new build completions fall across the country, the demand from tourists and permanent residents remains robust. This provides an opportunity for investors as the country continues to recover from the pandemic.

Prices

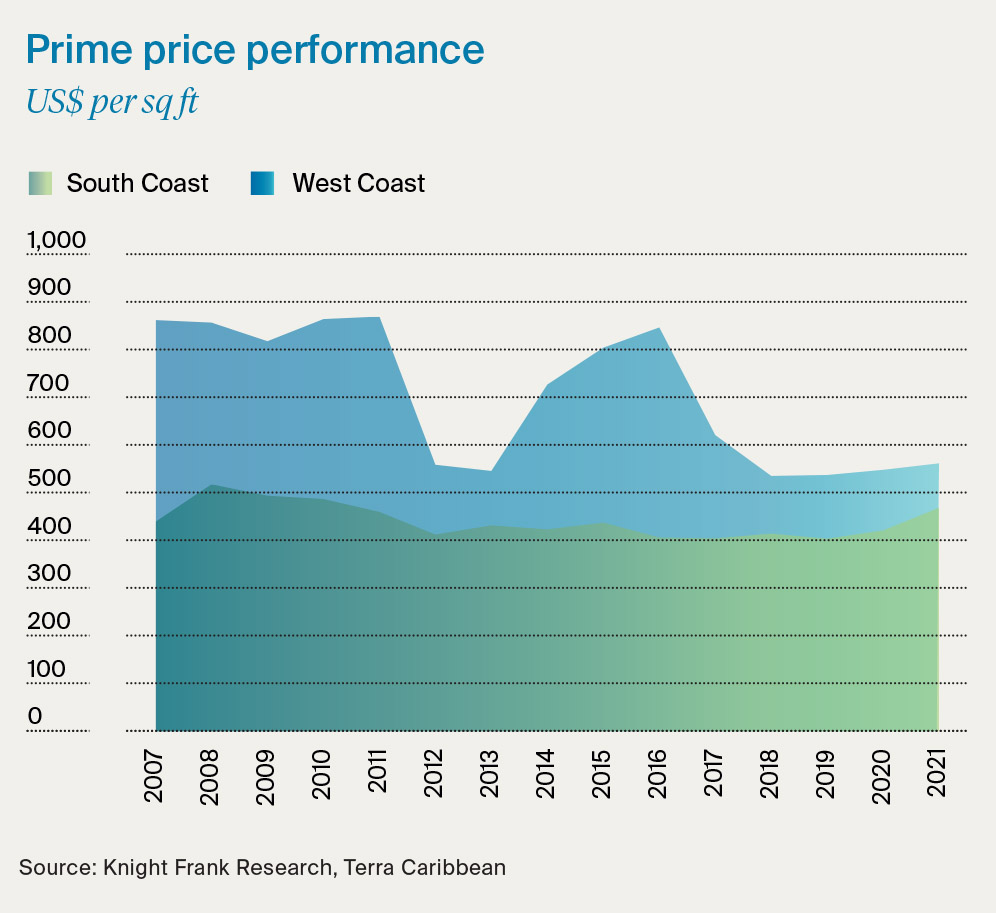

The West Coast continues to command a premium over the South Coast of the island with average prices around 19% higher. But in terms of price performance, the south registered stronger annual price growth of 11.2% in 2021 compared to 2.5% on the West Coast.

Sales & rentals

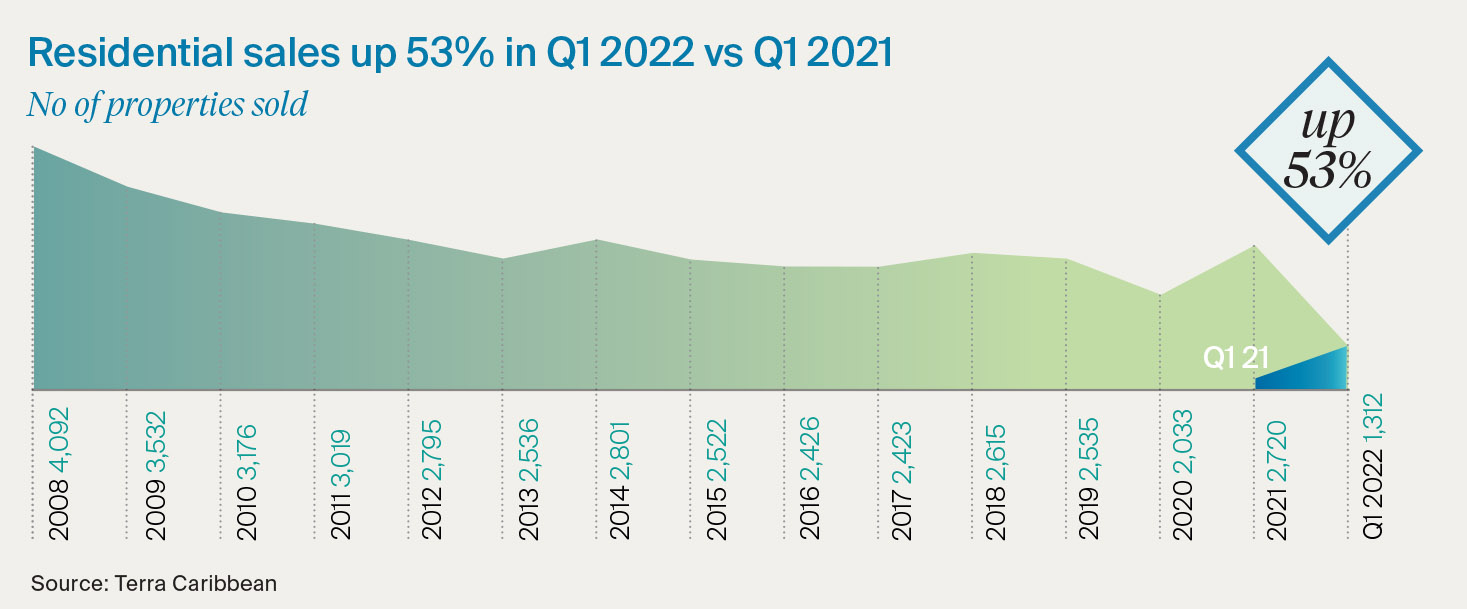

Residential sales increased 33% in 2021 year-on-year and transactions in Q1 2022 were up 53% on the same period a year earlier. The expected shift in sentiment due to global recessionary fears will likely temper activity into 2023.

Super-prime sales (US$ 10m+) have been strong in 2022 with modern, turn-key properties most in demand. The pandemic has seen the appetite for refurbishments wane as buyers seek to enjoy the location and lifestyle from day one.

With supply chain disruptions pushing up construction costs to around US$400-800 per sq ft there is little appetite to take on the extra cost.

Rental activity is down 23% in Q2 2022 but up 18% compared to pre-Covid levels in 2019. The slowdown over a 12-month period reflects the surge in demand at the height of the pandemic, rather than a marked slowdown.

Currency

One unexpected boon may be Barbados’ currency. Pegged to the dollar (2:1) investors wanting exposure to the strengthening greenback may look to combine currency play with a lifestyle gain and a potential inflation hedge.