Spain rental market boom as supply increases

Rental supply in Spain over the total available housing stock stands at 14% at the end of the second quarter of 2022.

4 minutes to read

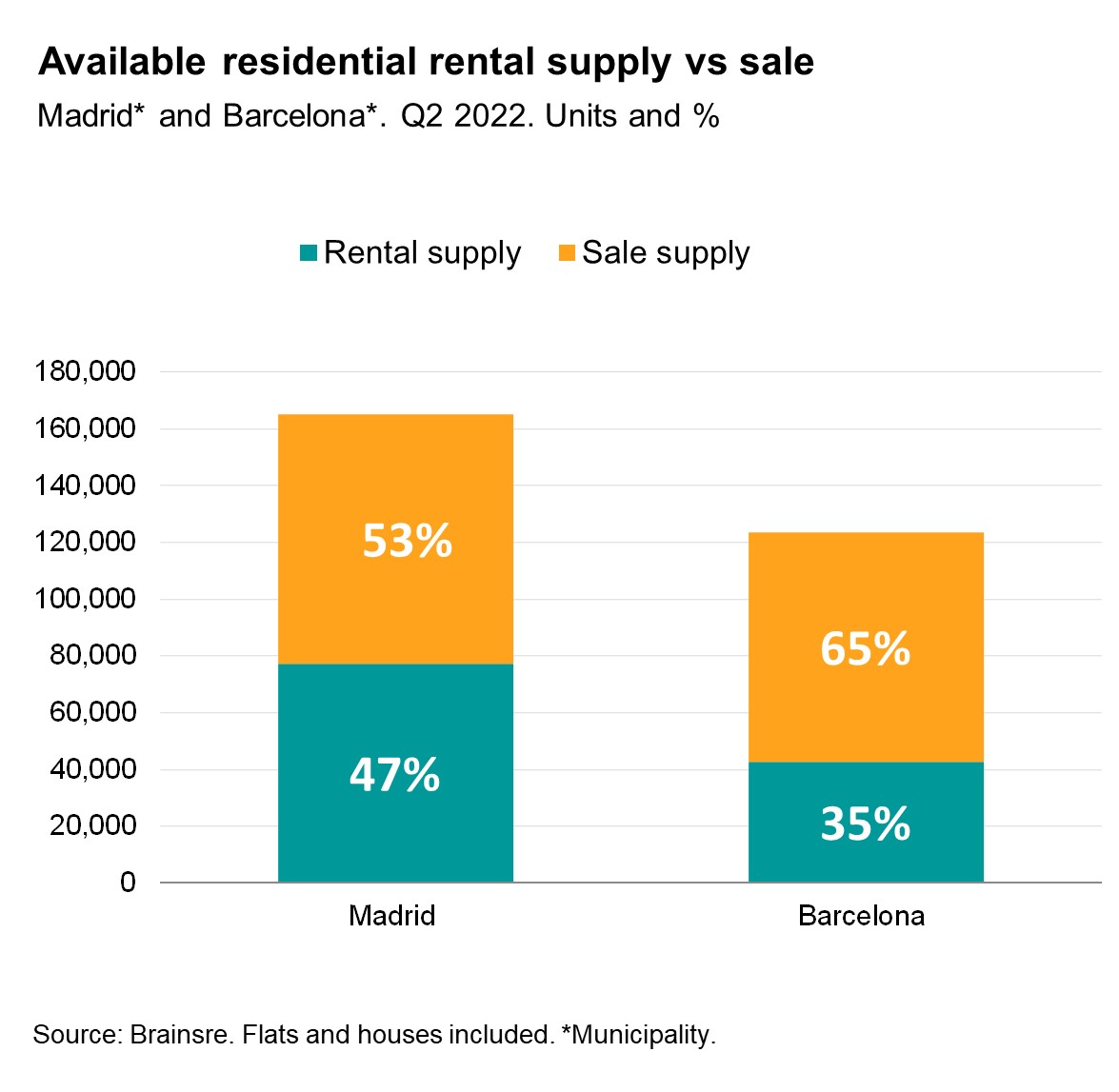

New rental trends, especially in the main cities, mean that this figure will increase considerably: in Madrid, almost 50% of the available supply is for rent and in Barcelona the figure stands at 35%.

Total available housing stock in Spain is currently around 3.4 million.

Rental market vs sale

According to The INE, a Spanish statistics agency, at the end of 2021 more than 24% of Spanish households were renting, one of the highest figures recorded in the last decade.

The Spanish population that rent the most are young people, one of the groups with the least economic resources to meet the initial expenses of buying a home.

The pandemic has brought about cultural changes in the Spanish mentality, as the home became a refuge for the population during these times.

During this time Spanish families decided to renovate or even change their homes for more comfortable spaces, something that for many was only possible by renting.

Quality housing supply

In this new scenario, the evolution of the available supply plays a fundamental role, since up to now it has been limited and its prices have not always been in line with its quality.

The creation of a quality housing stock in line with the different population groups will be one of the main challenges on which private companies and public bodies are already working.

Madrid and Barcelona, the cities with the largest populations in Spain have the highest proportions of rental supply, reaching almost 50% in the Spanish capital at the end of the second quarter of the year.

Barcelona registers 35%, although it should be noted that in 2020, price limitations on rents were introduced in Catalonia which, although they were repealed by the Constitutional Court in the first quarter of 2022, their effect could still be felt to a certain extent in the available supply.

Housing supply by typology

When analysing the current available supply in the country, it shows that both Madrid and Barcelona, the greatest supply is found in the form of two-bedroom homes.

These percentages are in line with the latest data from the INE regarding the number of people in a household, mostly composed of two inhabitants both in the Community of Madrid and Catalonia.

It is also necessary to take into account the potential that Madrid has when it comes to establishing a suitable supply, as its population is practically double that of Barcelona, 3.3 million people by the end of 2021, compared to 1.6 million in the Catalan capital.

At the autonomous Community level, Madrid and Catalonia are, for the moment, the ones with the highest population growth prospects in Spain over the coming years (+9.1% in the Community of Madrid in 2035 and +5.4% in Catalonia).

Rental price evolution

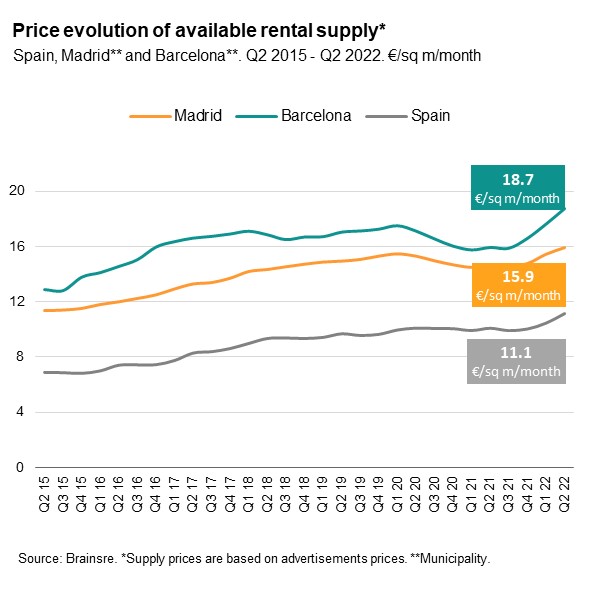

For years, there had been a general increase in residential rental prices which slowed down during the first months of the pandemic, when everything came to a standstill, only to return to its upward trend once the new situation had stabilised.

In Madrid and Barcelona, which are more exposed to economic movements, there was a notable decrease, while the national average remained more stable. In the second half of 2021 prices began to rebound strongly, registering historic values.

According to the latest data, the price of the available supply in Barcelona reaches 18.7 €/sq m, while in Madrid it is close to 16 €/sq m. The national average is just over 11 €/sq m.

The current limited supply to respond to latent demand, further reinforced by mortgage interest rate rises, has a direct impact on prices.

Rental property going quickly

Madrid records an average of 2.8 months for a rented property to be on offer until it is unpublished, with its advertisements having generally a faster rotation rate than in Barcelona and the national average.

This has changed at the end of the second quarter, where demand in the Catalan city has been more active, reducing its publication times to the same level as Madrid.

Affordable rent supply

The Community of Madrid has launched the "Plan Vive Madrid", one of the largest residential rental projects that seeks to promote accessibility to this type of housing.

The aim of the project is to put up to 25,000 homes on the rental market over the next eight years with a planned investment volume of around €700 million.

The plan also aims to facilitate access to affordable rental housing for certain vulnerable groups, such as young people under the age of 35, the over 65s, the disabled persons and women who are victims of gender violence, thus changing the rental scenario in the Spanish capital.

According to the Community of Madrid, this could mean annual savings for tenants of up to €3,000 a 40% difference compared to prices on the free market.

The first phase of the plan was awarded last September to the US fund Ares and the developer Culmia. Specifically, Ares will develop some 3,600 homes, while Culmia was awarded more than 1,700 units, for which negotiations are underway for the purchase by German developer DWS.

The second phase began the bidding process at the end of July.

Subscribe for more

For more international research, comment and analysis subscribe here.