The Bank of England thinks markets are wrong on interest rates

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

PM markets

We'll have a new PM by October 28th at the latest. A likely field of three will be whittled down to two by Monday. Any serious gap in support could cause the other to withdraw, thereby ending the contest.

Rishi Sunak is the bookies' favourite by some distance, but the potential return of Boris Johnson commands the most column inches this morning. Penny Mordaunt is claimed in some Conservative circles to be the unity candidate.

The news of Liz Truss's resignation looks to have been largely priced in. Gilts barely moved. Sterling crept up to $1.126.

Broadbent speech

A speech given by Bank of England deputy governor Ben Broadbent yesterday arguably held greater immediate consequences - speech here, FT write up here. Mr Broadbent shared internal BOE modelling suggesting that the base rate would peak at a lower level than the 5.25% currently priced in financial markets

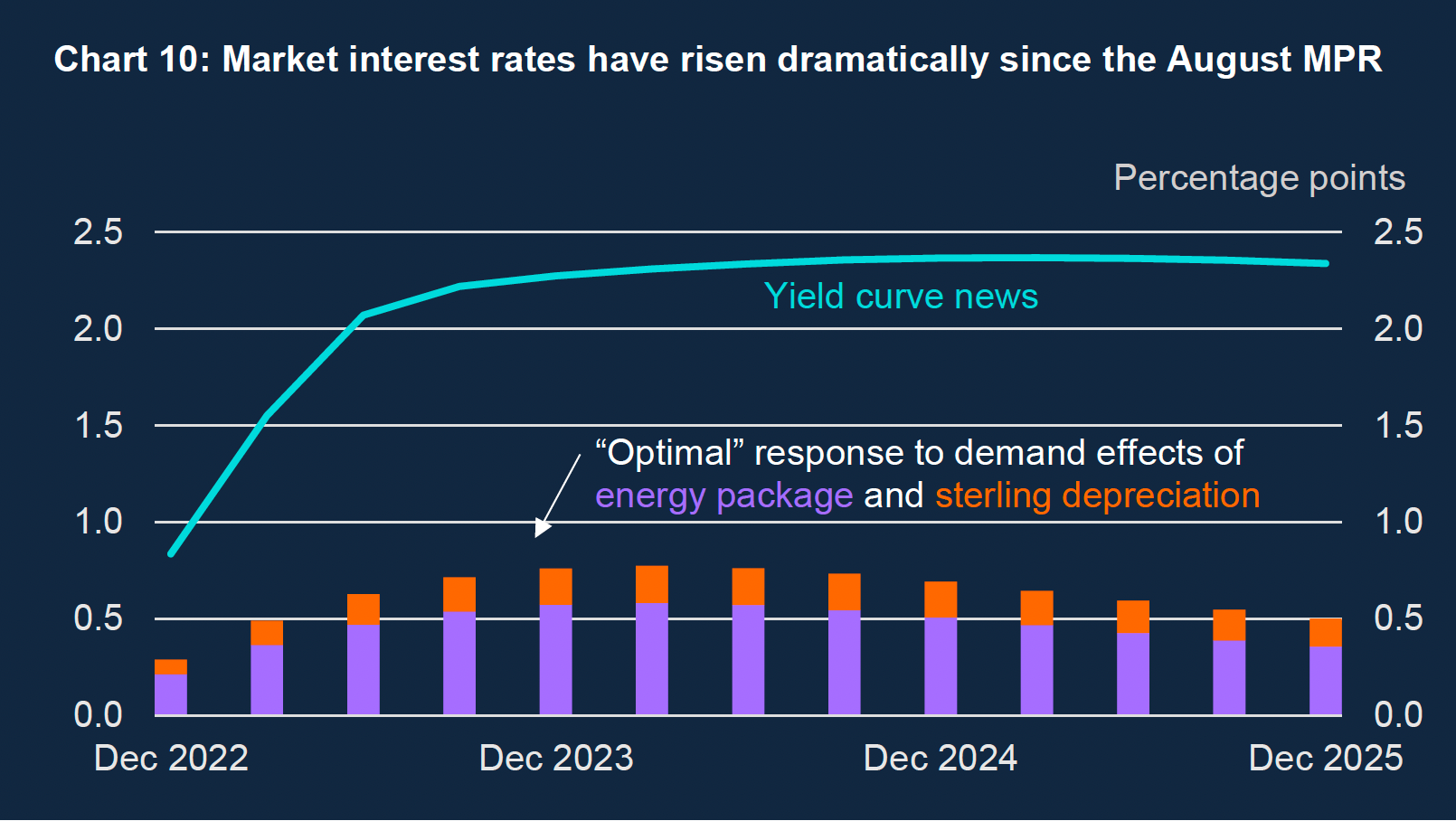

The modelling sought to weigh how much further interest rates would need to rise to offset the inflationary aspects of sterling's depreciation and the energy package (so not the tax cuts that remain from the mini-budget). The calculations suggest that additional increases of just 0.75% could be required on top of previous forecasts, rather than the 2.25% suggested by the yield curve (see chart).

The modelling should be taken with "a healthy dose of salt", Mr Broadbent said. Nevertheless, investors pared back their rate rise expectations by 0.25% following the speech, with financial markets now pricing in a base rate at 5% next June.

Interest rates

Expectations have been moving in the other direction in both the US and Europe. September's hotter-than-expected US inflation reading has all but guaranteed that the Fed will push on with a fourth consecutive 0.75% hike at its November meeting.

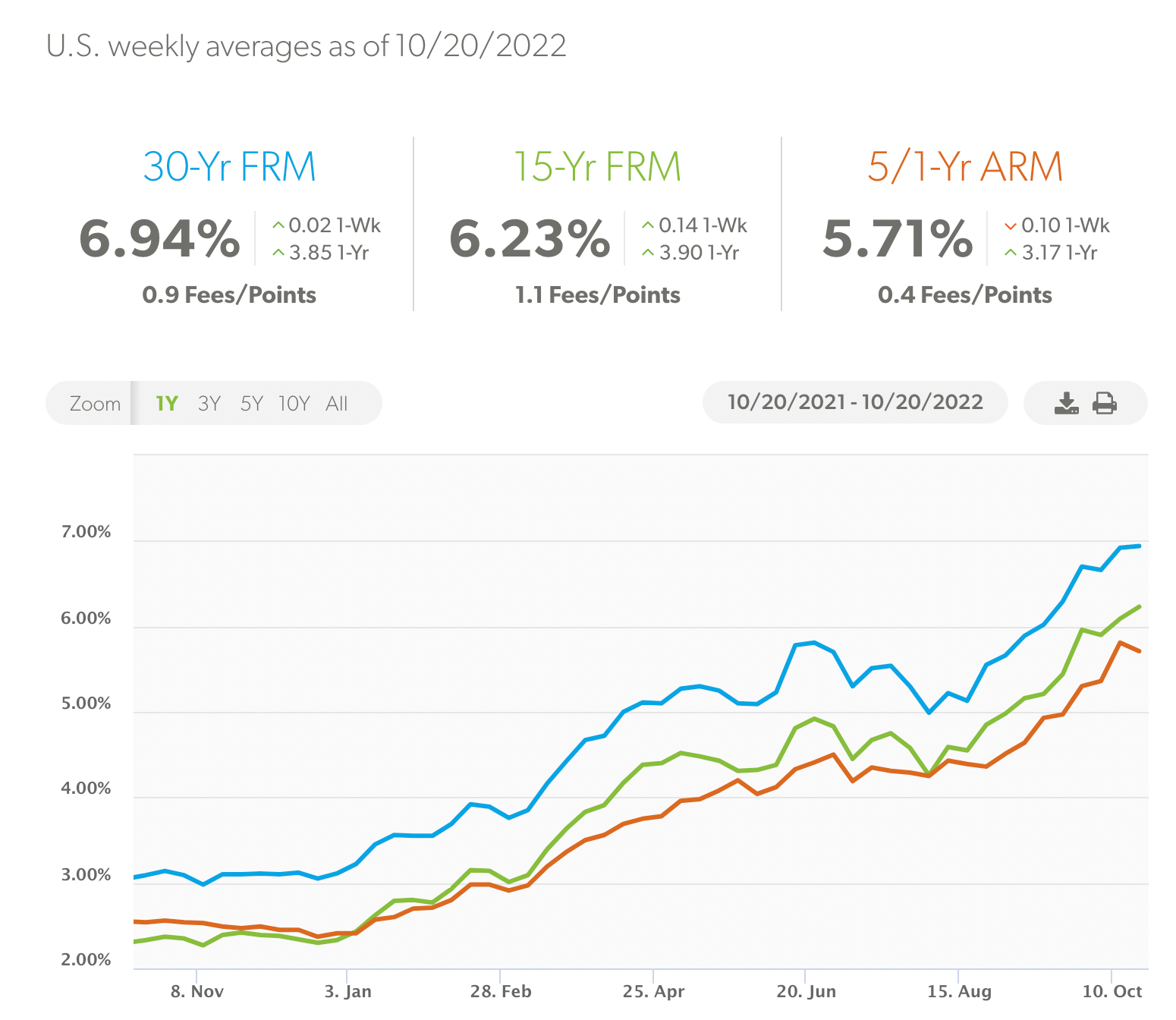

Investors have priced in the benchmark policy rate reaching 5% in May 2023. The pace at which mortgage rates are rising has slowed a little in recent weeks, with the 30-year rate now sitting just shy of 7%, according to Freddie Mac (see chart).

The European Central Bank, which started its policy tightening months after the Fed, is now expected to move its key deposit rate to 2.5% by March, according to a poll of economists by Bloomberg. That would include a 0.75% hike at its meeting next week. The first rate cut won't come until 2024, according to the median forecast.

Scotland

Housing market buyers and sellers in Scotland brought forward moves in the face of uncertainty in the mortgage market, pushing activity levels above long-run norms.

Offers accepted in the Scottish country market climbed 7% in the three months to September versus the five-year average, according to the latest from Chris Druce (see chart). Exchanges increased by 12% in the same period (see chart). The average price of a property was unchanged on a quarterly and annual basis in the three months to September.

Tight supply is helping support prices in Edinburgh, but buyers are becoming more cautious as the cost of borrowing rises. New prospective buyers registering in the Edinburgh region were up 28% versus the five-year average in the third quarter, while new instructions for sale were 1% below in the same period. Property available to buy was down by a third in the 12 months to September compared to the previous year.

In other news...

UK consumers remain close to gloomiest on record (Reuters), Ireland relaxes crisis-era mortgage rules (FT), and finally, rising rents and strong warehouse demand keeps Segro growing (Times).