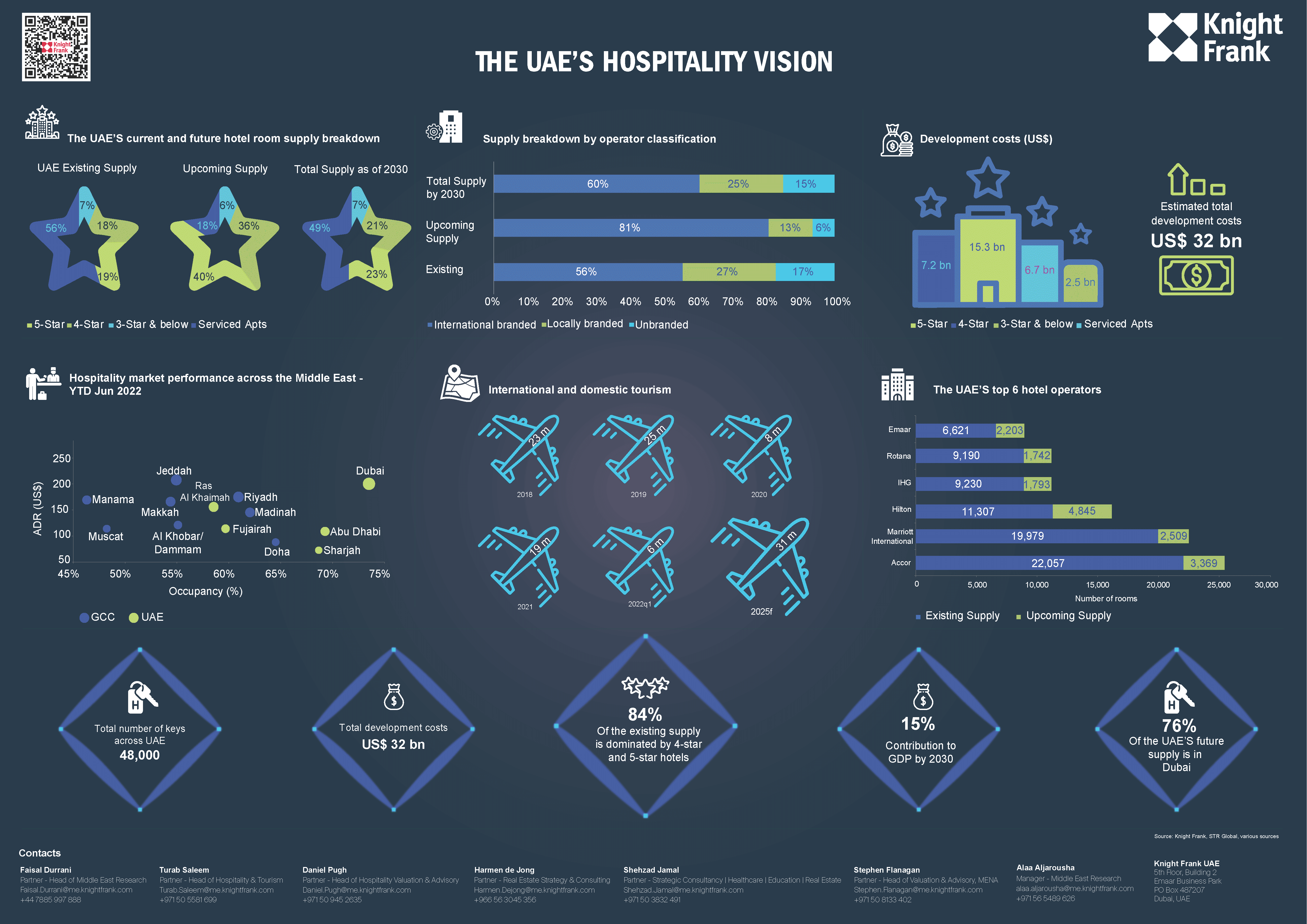

UAE hotel pipeline expands to 48,000 rooms

The delivery of the planned hotel room supply is forecast to cost approximately US$ 32bn.

2 minutes to read

The UAE’s hospitality market continues to expand, with a clear focus on the luxury end of the price spectrum. Our analysis shows that 70% of all the rooms planned will fall in the 4* and 5* category.

This comes at a time when Saudi Arabia is pushing ahead with what is set to be one of the world’s most ambitious hospitality development programmes that will see more than 275,000 hotel rooms built across the Kingdom over the course of the 2020’s at a total cost of US$ 110 billion. The region’s transforming hospitality sector is set to create a very attractive proposition for global travellers.

Faisal Durrani, head of Middle East Research, said: “The UAE’s world-leading hospitality market is set to expand by 25% by 2030, with a further 48,000 rooms adding to the nation’s extensive 200,000 key portfolio.

"Dubai is set to account for the lion’s share of this total, with 76% of all new rooms coming to the emirate, which already has over 130,000 rooms. This stockpile of hotel rooms is already higher than cities like London or New York.

“The emirate has some of the world’s most visited and incredible attractions. Dubai has the world’s busiest international airport and the highest hotel occupancy in the world, all of which strongly pointing to room for further growth and expansion of this all-important pillar in the economy”.

International operators continue to flock to the Emirates

The research has also revealed a growing proportion of international operators who are rushing to be part of one of the world’s most successful hospitality markets.

Durrani added: “The success of the UAE’s hospitality market means international operators are keen to continue cementing their presence. Indeed, the proportion of international operators to local ones is set to rise to 60%, from 56% today.

“Interestingly, Hilton Hotels will add the most rooms overall, with close to 5,000 new keys expected by the end of the decade, a 43% increase on today. This mirrors the group’s plans in Saudi, where Hilton hotels will emerge as the second biggest operator by 2030 with 19,000 rooms under management, around 3,000 rooms more than the group will have in the UAE by that stage.”

By 2030, the Accor Group will cement its place as UAE’s largest hotel room operator, with close to 25,000 rooms under management, a position the group also enjoys in Saudi Arabia.

The UAE’s three biggest cities – Dubai, Abu Dhabi and Sharjah, continue to lead the region in terms of hotel performance, but Saudi Arabia’s existing cities are poised to experience a sea change in demand as Vision 2030 unfolds.

Business and leisure travel will begin to overwhelm the existing supply, which will inevitably translate into heighted room rates and ADRs, at least while the existing number of keys remains inadequate for the demand yet to come.

For more information, please contact Turab Saleem.