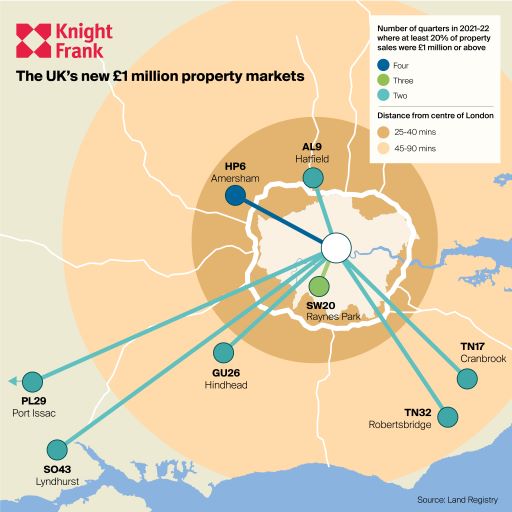

Where are the UK’s new £1 million property markets?

Several areas outside the M25 have crossed the £1 million property threshold, with price growth likely to remain stronger than the capital over the next five years.

2 minutes to read

We have previously explored how the pandemic is helping to redraw the house price map of the UK.

The combination of a ‘race for space’ and an affordability squeeze means demand has spread further from urban centres and house price growth has become more evenly distributed around the country.

For example, the top ten best-performing areas for growth during the stamp duty holiday, which ran from July 2020 to September 2021, included Hartlepool, Middlesbrough, and Bolton.

As the pandemic winds down and new work/life patterns establish themselves, we have updated our analysis of new £1 million property markets in England and Wales to better understand these trends.

How are £1 million property markets calculated?

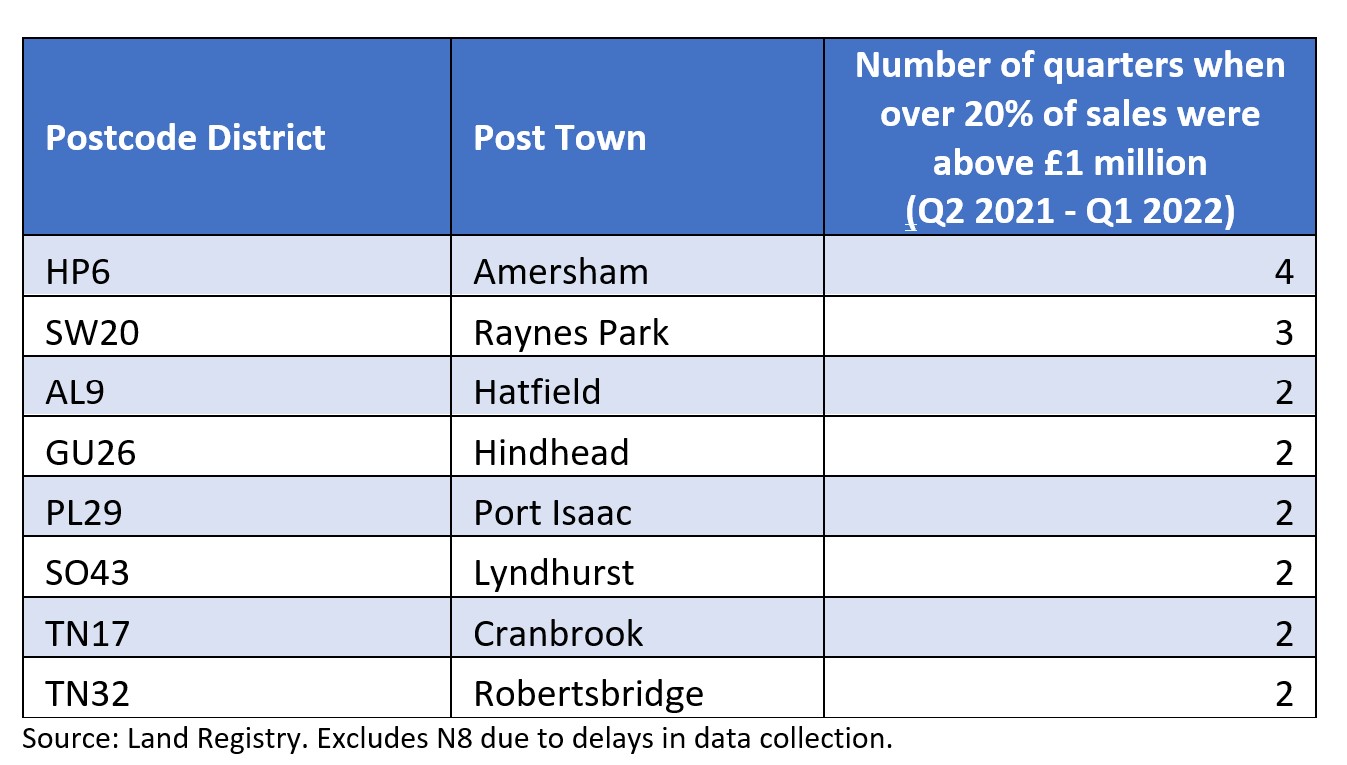

To qualify as a new £1 million market, at least 20% of sales had to be above that threshold in two or more quarters in the year to March 2022. This cannot have happened in a single quarter over the previous 12 months.

South-east England property markets

South-east England dominates the eight-strong list of new £1 million markets, as the table below shows. More than half the areas are located outside the M25, underlining how demand has strengthened in leafier parts of the commuter belt as buyers balance the desire for more space and proximity to the capital.

Last year’s list, which was longer, contained more areas inside London. However, areas such as N19 (Archway), EC1M (Farringdon) and NW10 (Harlesden) would have qualified but had a single quarter of sales where the £1 million criteria were met in the previous 12 months.

M25 property markets popular

“A heat map of house price growth would show a gradual retreat towards the capital over the course of the pandemic,” said Tom Bill, head of UK residential research at Knight Frank.

“After the early days of strong demand in remote picture-postcard locations, property markets encircling the M25 have thrived as offices re-open and new working patterns are established. London’s commuter belt has widened and prices there should continue to outperform the capital over the next five years.”

“Now that more people are not having to come into London five days a week, demand has increased in the outer ring of the M25 commuter corridor,” said James Cleland, head of Knight Frank’s Country business. “While new working-from-home patterns establish themselves, it’s great that so many people are seeing the benefits of living in some lovely areas that might have been previously overlooked.”

Property markets outside London

Knight Frank also undertook an analysis of property markets outside the capital where prices have crossed the £1,000 per square foot threshold earlier this year.

Wards where the top 10% of values exceeded this figure were also dominated by commuter belt areas around the M25 as well as parts of Oxford.

Discover more

Get more expert analysis, comment and opinion on the residential property market.