Australia Underpinned by Low Real Interest Rates

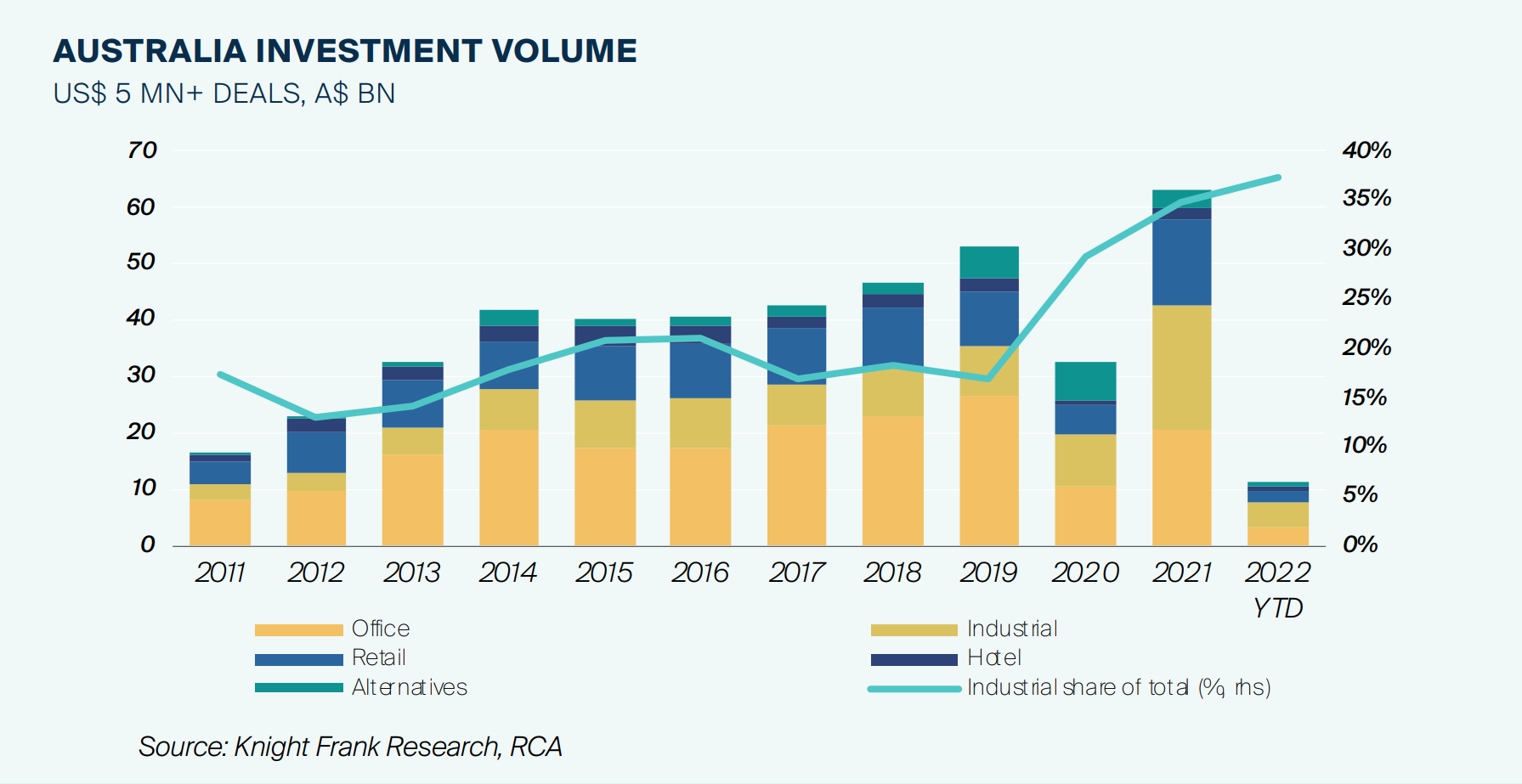

Reflecting investors’ sustained appetite for commercial property assets, investment volume in Australia reached a record high in 2021 following the pandemic impacted fall in 2020.

3 minutes to read

Reviewing investment activities from 2021

Investment volume totalled A$63 bn (for deals US$5 mn+), driven principally by record levels of activity in the industrial and logistics sector. Over A$20 bn in industrial assets were transacted nationally, accounting for a record 37% of total investment.

Office investment rebounded in 2021 from the large fall seen in 2020 but volume remains below the pre-pandemic high recorded in 2019. Sectors that had been heavily impacted by the pandemic such as retail and hotels have also seen renewed investor interest following the easing of COVID restrictions.

Cross-border investors continue to play a highly active role in Australian investment markets. APAC investors were particularly active last year, with capital from Singapore and Hong Kong SAR accounting for nearly half of total offshore investment in 2021, boosted by GIC’s and ESR’s joint acquisition of the Milestone logistics portfolio for A$3.8bn. US and European investors also made a significant contribution to cross-border investment activity.

Strong economic conditions to improve investment volume in 2022

Investment volume is expected to pick up further in 2022 reflecting strong economic conditions and growing confidence and momentum in key occupier markets. In the office sector, A$4.9 bn has traded over the year to date across the six major cities of Sydney, Melbourne, Brisbane, Perth, Adelaide, and Canberra, with a further A$6.9 bn currently on the market.

Melbourne in particular is expected to see a very strong year, with the most stock on market of any city, at A$3.4 bn, driven up by the on-market sale of the Southern Cross Towers complex and 1000 La Trobe.

The reopening of Australia’s border and easing travel restrictions are expected to facilitate higher foreign investment in 2022. Sustained demand from Singaporean and US investors as well as increasing appetite from German and Korean investors will ensure that offshore capital continues to drive the market.

Cross-border investor appetite reflects confidence in the near-term outlook for the occupier market recovery in Australia and the longer-term prospects for Australian cities supported by a robust labour market and a large pipeline of infrastructure investment to be rolled out over the next decade.

Commercial property asset performance is expected to remain favourable in 2022 after a strong year in 2021. Total returns for office assets will be supported by a nascent leasing market recovery, with the flight to quality from tenants now seeing a selective return to rental growth in parts of the Sydney and Melbourne markets.

After recording exceptional capital growth in 2021, industrial asset performance will moderate, although the market is significantly under supplied and will continue to benefit from strong rental growth.

Drivers

• Adapting strategy for a higher inflation and higher interest rate environment

• Demand for premium and office assets to mitigate against leasing risk

• Investors seeking energy efficient assets or partnering with managers who prioritise ESG principles

Sectors to watch

1. Industrial:

• Record occupancy and lack of fresh supply will continue to drive rental growth in the near term

• Tight supply in infill locations will drive developers to consider multi-level schemes

2. Alternatives:

• Investor demand for assets that are less correlated to the business cycle such as healthcare, data centres, and self-storage facilities will continue to strengthen

• Build-to-rent, which is in its infancy in Australia, will see large growth as an asset class

3. Office:

• Improving leasing markets will drive lower vacancy and stronger rental growth

___

This piece was originally published in 'Rising Capital in Uncertain Times' Active Capital Asia-Pacific Perspective (June/July 2022)'. The report aims to provide an insight into how the real estate market in Asia-Pacific performed historically and how it is predicted to play out in 2022, thereby acting as a guide for investors.

It also highlights an important theme – Environmental, Social and Governance (ESG) – for investors that are looking to expand their ESG foothold in their portfolios.