Souring consumer confidence and the outlook for UK interest rates

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Consumer confidence

Spiralling inflation and projections of a likely five-quarter-long recession from the Bank of England pushed consumer sentiment to a new low this month, according to data from GfK out this morning. All measures fell, whether that's plans to make future purchases or the outlook for personal finances. The -44 reading is the lowest since records began in 1974.

Souring sentiment will feed into consumer spending, which has been pretty resilient so far. ONS figures show that spending on credit and debit cards fell sharply over the past week, though it's a single metric.

Markets have now priced in a 50-basis-point rate hike from the Bank of England next month, following news earlier this week that inflation is now into double digits on an annual basis. Traders are now betting that the base rate could hit 3.5% early next year.

The inflation reading led economists at Citi to raise their forecast for peak inflation to 15% in Q1 2023. The bank expects the base rate to hit 3% by the end of this year.

Student rents

Rents are rising and energy costs are expected to spike again over the coming months. Students returning to university or starting their studies this September are going to feel the pinch.

Historically, there has been a perception that purpose-built student accommodation (PBSA) is the more expensive option relative to renting on the private market, but rising energy costs are tipping the balance due to the all-inclusive nature of PBSA rents, which include utilities and Wi-Fi.

Ollie Knight and the team have compared the difference in cost between an all-inclusive ensuite PBSA room and a room in a shared house within the wider private rented sector (PRS) marketed for students. The findings shows that, when additional costs including energy bills, insurance and Wi-Fi are included, PBSA offers a more cost-effective option in 80% of the 16 university towns and cities analysed compared to the wider rental market.

London offered the greatest difference in price. In the capital, students living in PBSA pay 33% less than the wider rental market once bills are included - offering a saving of approximately £108 per week, or £5,527 over a 51-week tenancy. Other university cities including Liverpool, Sheffield, Glasgow and Leicester offered students savings of 25%, 15%, 14% and 11% respectively. The cost of PBSA in Bristol and Nottingham is 10% lower than the wider rental market, while Edinburgh, Exeter and Coventry all offer savings of around 8% on average.

New homes

Limited supply of stock across the capital’s housing market, a flight to quality among buyers, and a push to complete sales using Help to Buy before the scheme ends, has encouraged more purchasers to look at the new homes market.

The number of prospective buyers registering their interest in buying a new home in the capital over the first six months of 2022 was 46% higher versus H1 2021, and 83% higher than the five-year pre-pandemic average for the first six months of the year (2015-2019). The spike in buyer enquiries also reflects the fact that several launches which were put on hold through 2020 and 2021 have since been brought to market.

International demand is also returning, albeit gradually. The number of international arrivals at Heathrow in June was only 17% down on the same month in 2019. That's compared to an equivalent drop of 87% last June. Regional differences remain due to varying Covid restrictions, with travel from Asia still half the level it was three years ago.

The new homes market is now facing the same pressures as the wider housing market where high inflation and rising mortgage costs are expected to lead to a moderation in price growth and demand later this year (as we set out in our latest forecasts). A reduction in development starts and completions could weigh on volumes for new homes specifically.

Country living

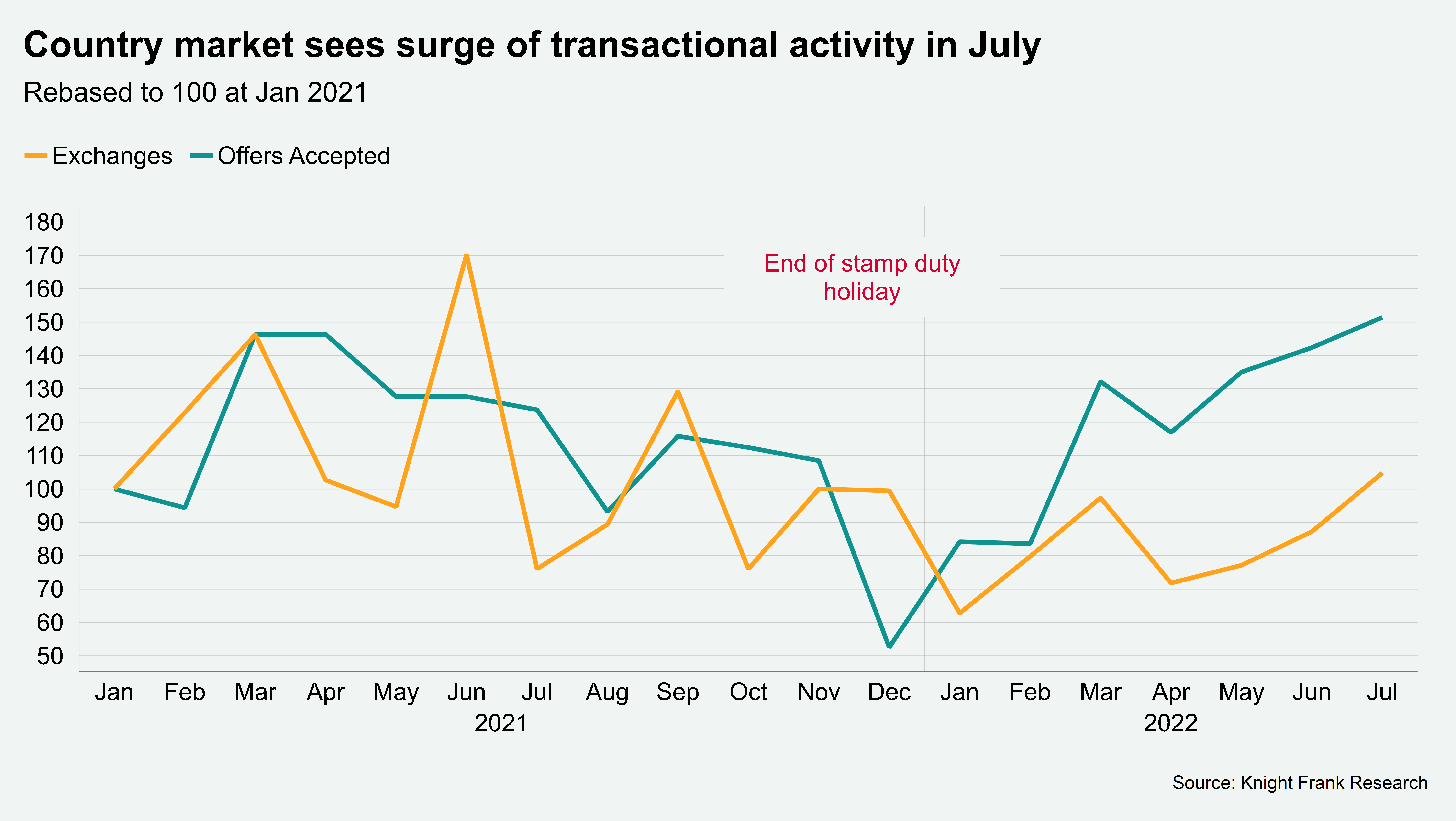

Frustrated demand helped drive July’s country market to its strongest period of transactional activity since the end of the stamp duty holiday last September.

Rising mortgage rates have sparked a clamour to act, and rising supply has prompted many prospective buyers to continue their search after failing to find a suitable property in previous months. The ratio of new prospective buyers (demand) to new instructions (supply) outside London is now close to the pre-pandemic five-year average of 7.6.

The number of exchanges in July was the highest since the end of the stamp duty holiday last year (see chart). See more analysis from Chris Druce here.

In other news...

Debt can offer relief to farmers and rural landowners suffering acute pressures on income, writes Bradley Smith.

Elsewhere - Fed officials signal restrictive rates may be needed ‘for some time’ (FT), one-fifth of property sellers miss CGT payment deadline (FT), and finally richest Silicon Valley suburb says build anywhere but here (Bloomberg).