What you need to know when financing your second home in France

British buyers looking for a mortgage for their second home in France face a shrinking pool of lenders since leaving the EU. Kate Everett-Allen talks to Felicity Sullivan of Knight Frank Finance to understand what’s changed.

4 minutes to read

Felicity, thanks for joining me. Can you explain how the mortgage market has changed since the UK left the European Union (EU) on 31 January 2020?

Since the UK left the EU the mortgage landscape has changed. Fewer lenders will loan to British buyers in the EU. At Knight Frank Finance we are making sure we are up to date with any regulatory changes in the market.

Speaking to a broker who is on top of criteria changes means buyers won’t waste time speaking to a local lender who are unable to assist.

But it is not just British buyers we can assist, in 2021 we worked with clients across the globe, from Singapore to the US.

Why is there a stronger argument for taking out finance in France compared with elsewhere?

A lot of my clients start out as cash buyers, with no plans to take out a mortgage for their new property in France. However, having sought independent qualified tax advice many want to discuss their finance options as it may allow them to benefit from certain tax advantages.

Plus, buyers at the top end of the market are reluctant to tie up significant funds in a prime property. A mortgage allows them to free up the funds to be invested elsewhere with the potential of a higher return. This trend has been particularly acute given the low interest rate environment in Europe.

Is France’s mortgage market very different to that of the UK?

France’s mortgage market is not as sophisticated as that of the UK, with less diversity of product. A fixed rate deal over 20 years is commonplace in France, in the UK such deals represent just a fraction of the mortgage market. The knock-on effect of such long mortgage periods is much less competition in the market.

Post-Brexit British buyers are considered a higher risk. At present, this means a French tax resident can achieve a lower rate than a non-resident borrower.

What do non-resident buyers need to know about France’s mortgage market?

There are two types of lenders, high street lenders and private banks. The strength of the Knight Frank brand means banks want to work with us, giving us access to over 50 lenders in Europe.

The different ways in which high street and private banks fund their mortgages means that they have been impacted by the changes in interest rate markets in distinct ways.

High street lenders’ rates have remained relatively stable, as opposed to private banks where we have seen much more volatility in interest rates. The high street banking model is transactional and the offering is simpler and less nuanced when compared to the private banks.

Private banks on the other hand, want a long-term relationship with the client and will usually look at innovative ways to split the loan against the property and other assets in order to maximise the overall loan to value up to as high as 100%. This blend of mortgage and so-called Lombard lending allows clients to diversify their investments, spread risk and maximise returns.

A recent client who purchased a chalet in Megève for €4.95 million for example, had the funds to purchase in cash but wanted to avoid taking funds out of his business, after consulting his tax adviser he also wanted to maximise the debt taken against the property for tax planning purposes.

We raised a total mortgage of €4.95 million which was split into two parts, a mortgage of €2,814,000, secured against the property, at a rate of 1.64% fixed for 10 years and a Lombard loan of €2,466,000, secured against financial assets brought by the client, at a rate of 1.49% fixed for 10 years fulfilling all the client’s requirements.

We’re entering a new phase of rising interest rates, what advice do buyers need to consider?

Firstly, the Eurozone is expected to be something of a laggard on the world stage, raising rates much more slowly than in the US, UK and other advanced economies. Capital Economics forecasts rates will reach a high of 2% in the Eurozone, that compares to 3% in the UK and 4% in the US.

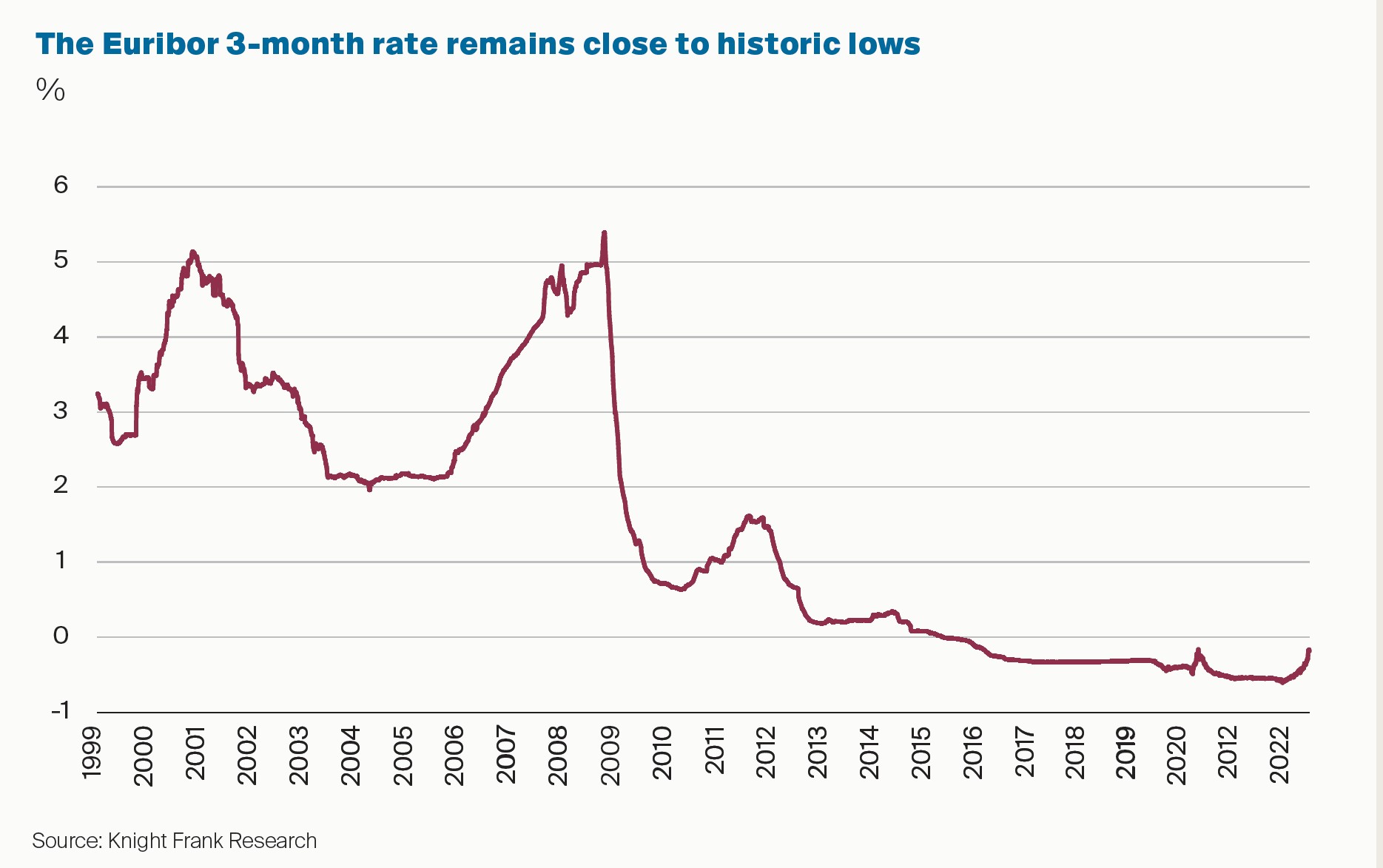

Secondly, lending rates are rising but in terms of the Euribor 3-month rate, the base rate that the majority of French banks track, we are still close to historical lows (see chart).

Often, buyers will be unfamiliar with purchasing overseas, presumably the skill sets and service provided by Knight Frank Finance is important to them?

Most buyers will need a lot of strategic help and careful explanation of the buying process and resulting costs in France. For most buyers, it’s a new and exciting experience but for some it can seem daunting and complex.

Knight Frank Finance’s team can guide them and explain the nuances of buying abroad. Plus, being bilingual I can address any concerns and liaise with all parties involved.

Contact Felicity Sullivan to learn more