Rising supply and investment: what next for seniors housing?

Seniors housing investment is on the rise, underpinning a pick-up in development volumes.

3 minutes to read

The UK has an ageing population and people are living longer; within the next five years, the number of people aged over-65 is projected to total over 14 million, a 10% increase on current totals. By 2037, it is forecast that one in four of us will be over-65.

At the same time, increasing wealth and income among this age cohort is resulting in more informed housing and lifestyle choices. The seniors cohort is the wealthiest in the UK in terms of property assets, with an estimated £1.5 trillion of equity.

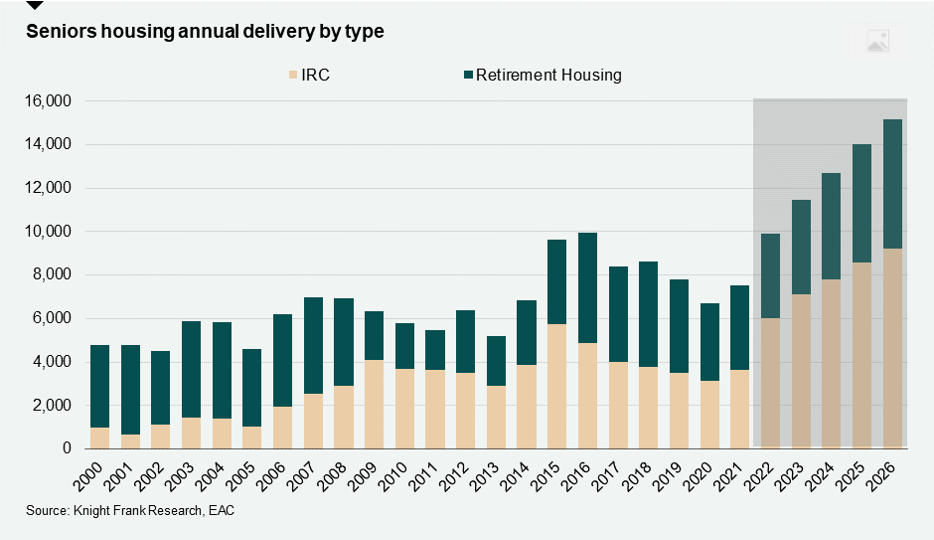

Yet delivery of age-appropriate housing for seniors continues to lag potential need. More than 7,500 new seniors housing units were built in 2021, a 12% increase on the previous year’s delivery. Rising delivery comes despite a more challenging development environment, with inflationary pressures putting pressure on construction costs and operating costs.

Longer term, over the last ten years, nearly 80,000 new seniors housing units have been delivered, at an average of nearly 7,700 per annum. It takes the total number of complete and operational seniors housing units across the UK to 756,529.

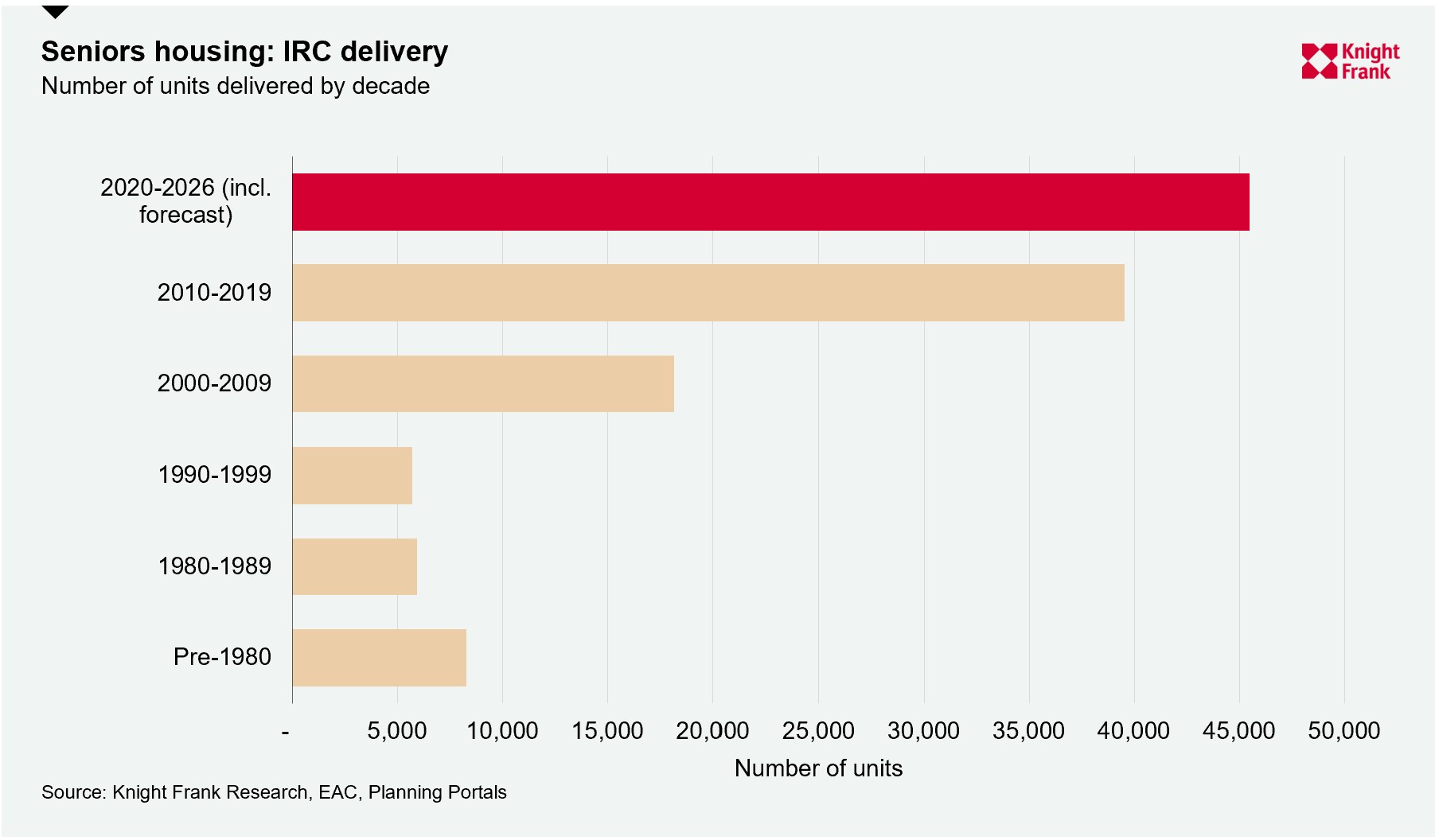

New delivery over this time has been underpinned by an increase in the number of units located within Integrated Retirement Community (IRC) schemes (also known as Housing with Care), which provide higher levels of services and support as an integral part of their proposition. IRC completions accounted for 51% of new seniors housing units built between 2011 and 2021, up from 36% over the previous ten-year period, with the remainder age-restricted retirement housing.

With a significant and growing volume of private capital entering the market, largely targeting the IRC sector, we expect the next five years will see delivery accelerate further. Analysis of the planning pipeline has identified nearly 120 seniors housing schemes which received planning permission last year.

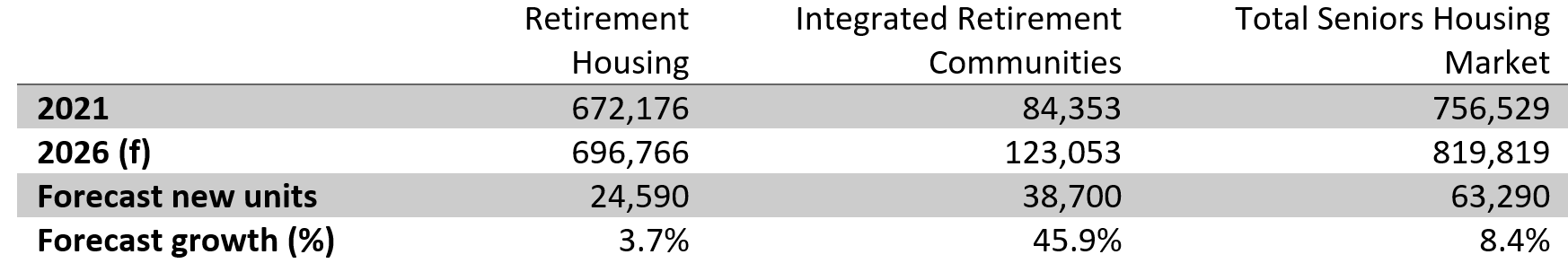

Consequently, we forecast that the total number of specialist seniors housing units in the UK will grow by 8% over the next five years, taking the total size of the sector to just short of 820,000 units.

Seniors Housing Development Forecasts

The composition of the market will also shift over this time, reflecting a need to provide more choice for residents including through mixed-tenure and rental-only options, affordable housing provision and more schemes with varying levels of facilities and services.

As a result, we anticipate that the IRC segment of the market will continue to be the dominant form of delivery, driven by even greater institutional backing. IRC supply is forecast to increase by 46% (or 38,700 units) over the next five years. This compares with 4% (or 24,590 units) growth in age-restricted retirement housing stock.

Even with this forecast expansion, the rate of delivery will still be overshadowed by the UK’s ageing population, deepening the existing mismatch between supply and demand. In real terms, the number of seniors housing units per 1,000 individuals aged 75+ is expected to drop to 120 by 2025, down from 137 in 2010 and 128 currently, underscoring the headroom in the market today, which will only grow with population growth.

Rising institutional investment key seniors housing delivery

Last year, a record £1.4 billion was invested in the UK seniors housing market, with a particular focus on the IRC sector. Momentum has continued into 2021, with more than £662 million invested in the first half of the year, up 47% on H1 2021 levels.

Rising investment volumes come amid a wider pivot from institutional investors towards residential assets across all age groups, with investors recognising the quality of income streams on offer and strong demographic fundamentals.

Sustainability will dictate investment strategies going forward. There has been commitment from some operators to net zero carbon platforms and we expect others will follow to future proof assets and reduce the risk of future obsolescence.

The social benefits of seniors housing are also recognised by investors. Housing people in age-appropriate homes can hugely reduce instances of trips and falls and other injuries within the home, while housing people in safe communities where residents can interact and live active and social lives is better for people’s mental health and wellbeing, and again reduces the reliance on social services to deal with issues of loneliness and isolation.