Your Leading Indicators | Political Upheaval | Softening Outlook | Tight Labour Markets

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Political upheaval hits sterling

Boris Johnson’s resignation last week has caused some market uncertainty. For instance, we have seen some volatility in sterling, which has hit its lowest level since 1985 this morning, at $1.18. At the margins, this might impact overseas investment. However, with the winner of the Conservative party leadership election not announced until September 5, we do not expect to see any policy movement until then. For now, we do not think there are too many direct implications of Johnson's resignation on real estate.

UK outlook softens

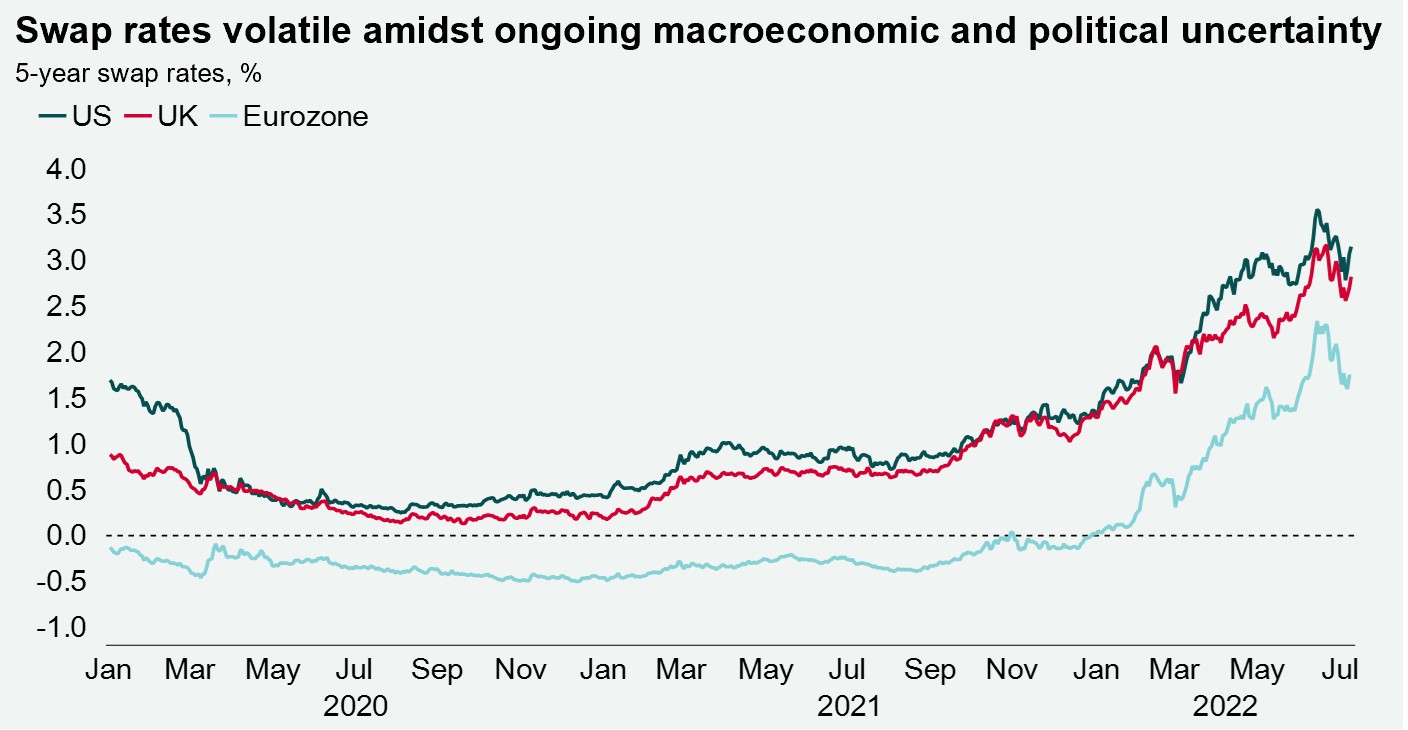

The potentially bigger story has been the warnings from the Bank of England, which downgraded its growth outlook last week, and the OBR, which said that government debt is on an unsustainable path. In the immediate aftermath of these announcements, swap rates fell, however, they have since increased back to 2.52%. The UK gilt yield has also settled at 2.09%, after it contracted below 2.0% on the news.

Tight labour markets counteract wider economic narrative

One of the big contradictions of the current global slowdown is what is happening with labour markets. Last week, the US added almost 400,000 jobs in June, which was much more than expected. In the UK we have to wait until next week for our big labour market update, but the weekly indicators are showing, for example, that redundancies are running at significantly lower levels than pre-pandemic. Therefore, whatever happens over the rest of the year, and despite what we may see in the headlines, we begin with a labour market in pretty good health.

Download the latest dashboard