Australian residential update: Census shows changing ways of living

Michelle Ciesielski, head of residential research, Knight Frank Australia, outlines five trends shaping the Australian residential property market.

3 minutes to read

Australian official cash rate reverts to mid-2019 target

For the third consecutive month, the cash rate has been increased for Australia. On 5th July 2022, the Reserve Bank of Australia (RBA) lifted the cash rate target by 50 bps to 1.35%. This follows the increase of 25 bps in May, to 0.35%, and rise of 50 bps in June, to 0.85%. The last time the Australian cash rate was recorded higher than 1.25% was back in June 2019.

According to the RBA, this sharp rate increase came down to several factors including the high global inflation expected to remain elevated until it potentially peaks later this year, Covid-related disruptions to supply chains including in China, the war in Ukraine and strong demand placing pressure on productive capacity.

It was noted that Australia’s inflation is also high as result of global pressures, but lower than many other countries with additional local factors including a resilient economy, a tight labour market and capacity constraints placing upward pressure on prices, including the impact of recent floods.

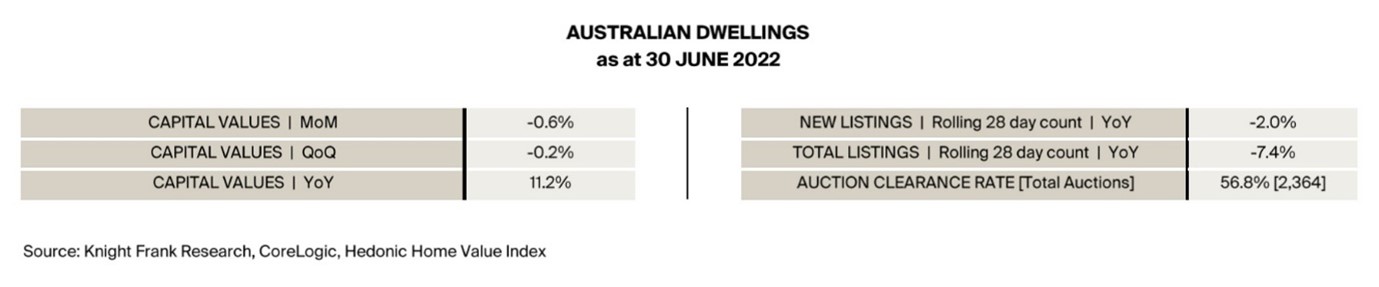

Housing prices have also declined in some markets over recent months after the large increases of recent years.

In saying that, the household saving rate remains higher than it was before the pandemic as it appears many households have built up large financial buffers and are benefiting from stronger income growth.

The RBA will be paying close attention to household spending but still expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.

This is having a flow on to mortgage lending rates. Over the June 2022 quarter, average lending rates to owner occupiers rose by 183 bps, to 5.66%, for a 3-year fixed term loan and increased 75 bps, to 5.27%, for a standard variable loan. For investors, a 3-year fixed term increased by 183 bps, to 5.84%, and a standard variable loan rose 75 bps, to 5.85%.

Australian residential market undergoing a significant generational shift

The first phase of the Australian Census has now been released by the Australian Bureau of Statistics following the survey being undertaken on Tuesday 10th August 2021.

The latest Census shared that 66.9% of people counted were living in Greater Capital Cities and 33.1% were in the rest of Australia. Almost 80% of Australian residents live in eastern Australia in New South Wales, Victoria, Queensland, and the Australian Capital Territory.

The median age of all Australians remains at 38 years in 2021. Baby Boomers and Millennials each have over 5.4 million people, with only 5,662 more Baby Boomers than Millennials counted on the day.

Number of people living in Australia born overseas increases

Australia continues to be a culturally and linguistically diverse country. The proportion of Australian residents that are born overseas (first generation) or have a parent born overseas (second generation) has moved above 50%.

The top five most reported ancestries in the 2021 Census followed previous trends and included English at 33.0%, Australian (29.9%), Irish (9.5%), Scottish (8.6%) and Chinese (5.5%).

It was also revealed the growth of communities born in Nepal (124%), India (48%), Pakistan (45%), Iraq (38%) and the Philippines (26%).

Mandarin continues to be the most common language other than English spoken at home, this is followed by Arabic, Vietnamese, and Cantonese. Overall, Punjabi saw the largest increase.

Australian households are shrinking

The 2021 Census counted more than 10.8 million private dwellings across Australia. Over the past five years, households decreased from an average 2.6, to 2.5 persons.

Across the three household types, family households made up 70.5%, lone households 25.6% and group households 3.9%. Of the 5.5 million couple families, of which 53% have children living with them and 47% do not have children living with them.

More Australians call apartments home

The distribution of Australian dwellings is changing according to the 2021 Census.

Separate houses made up 70% of occupied private dwellings, 13% were townhouses and 16% were apartments. Compared to the 2016 Census, this composition was closer to 73%, 13% and 13%, respectively.

Housing tenure remained similar to the past two Census surveys, two-thirds of households (66.0%) own their home outright or with a mortgage. One-third of households rent (30.6%).