Recession signals

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Recession indicators

Commodities prices took a beating yesterday in a clear signal that investors believe recessions in several major markets are now very likely. Global Brent crude prices, to take one example, fell 9%, the biggest daily fall since March.

Consensus is coalescing around expectations that recessions in markets including the US and UK are coming, though are likely to be relatively mild. Drop offs in consumer spending are likely to weigh on inflation, leaving the worst predictions of aggressive cycles of interest rate hikes unfulfilled.

Traders were betting only a month ago that the US Federal Reserve would take rates above 4% to levels not seen since before the Global Financial Crisis. Those bets have come down to a peak of 3.3% in Q1 2023 with rate cuts now pencilled in around the summer, according to Bloomberg.

Financial stability

The Bank of England's biannual view on the stability of the financial system, published yesterday, was pretty unequivocal. The economic outlook in the UK and globally has "deteriorated materially" and there are a number of downside risks, most notably from Russia's invasion of Ukraine and vulnerabilities in China's property sector.

Major banks, however, "have considerable capacity to support lending to households and businesses," and the Bank issued a warning against restricting lending to defend capital ratios or capital buffers: "Such excessive tightening would harm the broader economy and ultimately the banks themselves."

When answering questions from the media following publication of the report, deputy governor Sir Jon Cunliffe said he expected distress to rise next year, "but we don’t expect it to go back to levels before the financial crisis." Here is the Telegraph write up, with this key excerpt:

"Asked what level rates would need to hit to push many households into distress and default, [Cunliffe] said: “You’d be looking at 5% to 7%, or 8%, on the corporate side. The picture is not that dissimilar on the mortgage market side.”

That seems overly relaxed, a base rate much above 3% would we think begin to be felt sharply in the housing market.

Sentiment

This view is confirmed by the results of our latest residential property survey, with seven out of ten respondents being concerned about an increase in mortgage repayments

While close to a quarter (24%) were slightly concerned about an increase, approaching half (47%) were ‘concerned’ or ‘extremely concerned’. Among those not planning to move within the next year, close to a third (31%) cited either the rise in the cost of living or increases in borrowing costs as the reason.

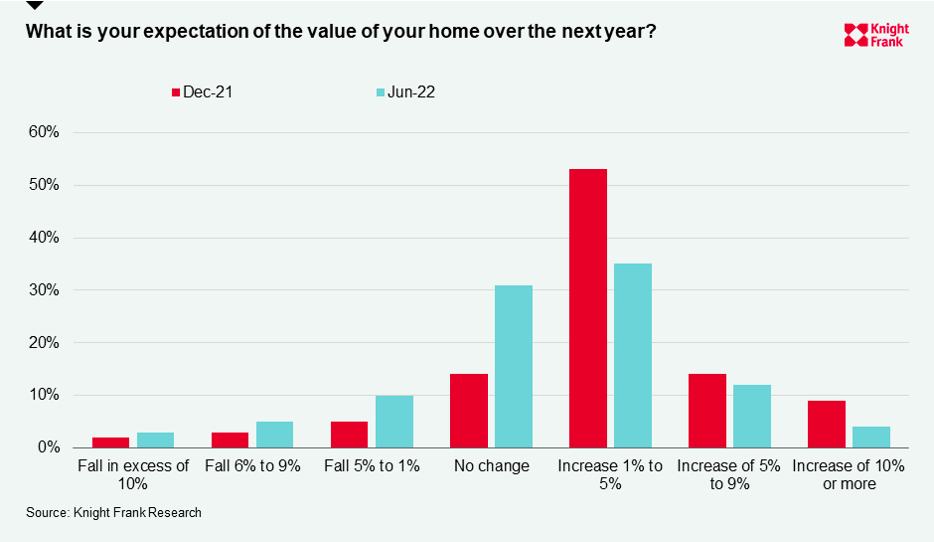

More than half of respondents (51%) said the value of their home would rise in the next 12-months. An increase in value of between 1% to 5% was the most popular option with 35% (see chart). In second place was ‘no change’ in value with 31%.

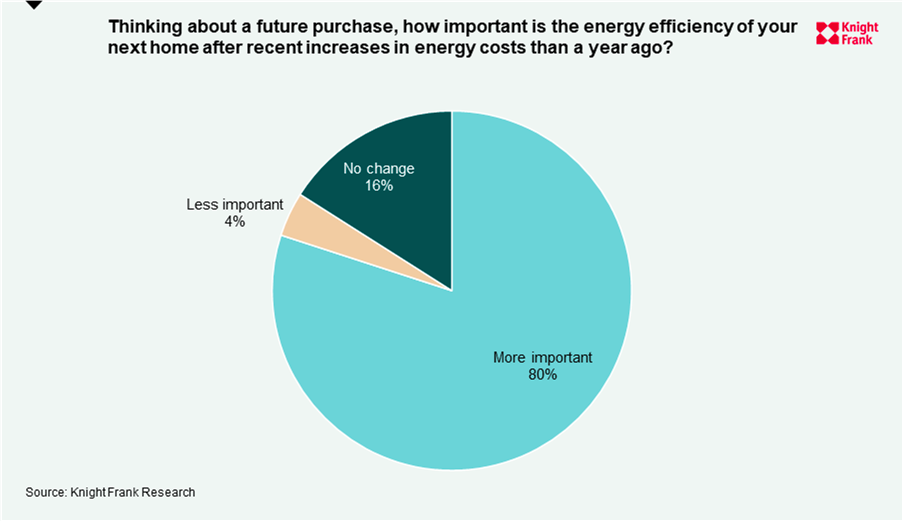

Meanwhile, eight out of ten people say the energy efficiency of their next home purchase is more important to them than it was a year ago due to rising energy prices and environmental concerns.

In other news...

Property set to cool as investors face ‘new paradigm’, Brookfield warns (FT), UBS sublets London office ‘grey space’ (FT), on Boris Johnson: Months of rising tension came to a head in ten destructive minutes (Times), and finally, Manhattan prices hit record (Bloomberg).