South Africa

2022 looks set to usher in a period of stability and growth for South Africa’s property sector, following Covid-induced challenges during 2020 and 2021.

3 minutes to read

Logistics and industrial sector leading the way

Industrial property, including logistics, is enjoying its lowest vacancy rate since mid-2020 (4.4%).

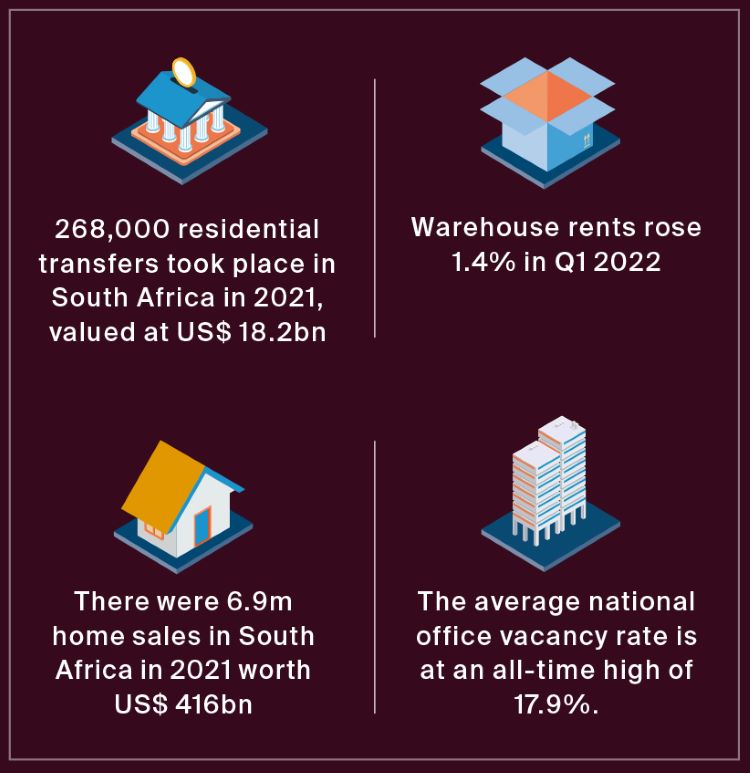

Rents rose by 1.4% during Q1, fuelled by the growing prominence of e-commerce and the recovery in the manufacturing and retail sectors. In addition, spiking global inflation and Covid-linked supply chain disruptions are prompting some importers to manufacture goods locally, contributing to the rising level of requirements we are recording.

Unsurprisingly, we expect logistics to continue outperforming other sectors in South Africa.

Retail bounces back as footfall recovers

The retail market made a strong comeback in 2021 and this has persisted into 2022. Larger regional centres in the more densely populated cities are experiencing trading levels that are almost back to pre-pandemic levels. As a result, improving demand is driving down vacancy rates and major retailers continue to report improved headline earnings as footfall recovers.

Elsewhere and like other rural markets on the continent, a preference for smaller, open-air convenience shopping, as well as neighborhood and community retail centres, persists.

Subdued conditions in the office market

With many companies still reworking existing space, or in some cases downsizing, due to the adoption of flexible work hours, the office market remains subdued. As these new post-Covid occupational strategies continue to be formulated, vacancy rates are rising and indeed reached an all-time high of 17.9% in Q1 2022.

Our expectation is for this to stabilise and gradually edge down in the short to medium term as business confidence returns and more companies return to offices on a full-time basis. There is already evidence of this in some submarkets where landlords have begun to retract generous incentives offered last year.

Separately, with the focus remaining centred on best-in-class space, there is also a growing trend for the conversion of Grade B and Grade C office buildings to alternate uses such as apartments, student accommodation, or indeed, storage space and educational, or medical facilities.

Residential market set for slowdown

Throughout the pandemic, the residential market experienced “normal” sales transaction levels across all price brackets, despite rising inflation and three recent consecutive increases in mortgage rates. In 2020, first time buyers were notably active, buoyed by all-time low lending rates. This year however, we expect this trend will moderate as the interest rate starts to creep up, which we expect will be sustained for the next three years.

"Reactionary market drivers from the pandemic have begun to abate and we look forward to the return of market stability, albeit off a ‘new normal’ base."

- Steve Rennie, Managing Director, Rennie Knight Frank

An Area to Watch

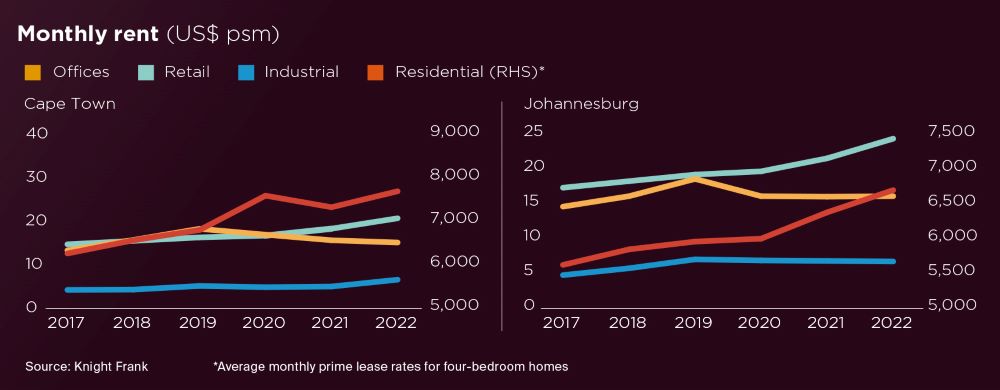

Cape Town is expected to be an outperformer in the property market due to the overall perception of the province as having a well-functioning local government and an attractive lifestyle. The province remains a magnet for skilled and affluent immigrants, often with high purchasing power and disposable incomes. Unsurprisingly, residential rents in the region are 1.7% higher than this time last year. In contrast, Johannesburg has experienced a 2% fall in average rental rates over the same period.