Mozambique

With improving business conditions, pent-up demand across all real estate asset classes is underpinning a strong rebound.

3 minutes to read

Positive outlook for the office market

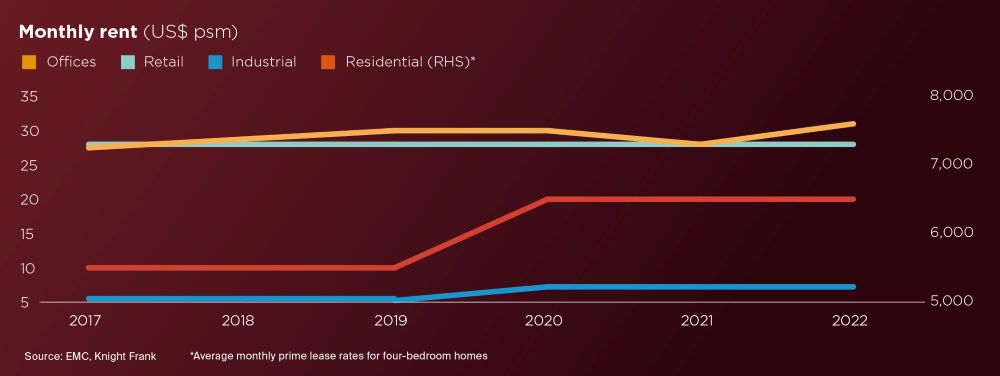

As life starts to normalise, businesses are taking advantage of the easing of pandemic restrictions, lifting demand for office space. Indeed, average prime rents have increased by 10.7% when compared to 2020 levels.

Vacancy rates across the CBD remain broadly in line with long term levels, although for the whole market, the vacancy rate is still stubbornly high at 25%; however, this is down from 33% at the end of 2021. Occupier activity, like elsewhere in the world, remains centred on Grade A space, where vacancy rates are substantially lower. And with limited supply pipeline, coupled with just 21,000 sqm of available space, including the recently completed Green Tower (7,300 sqm), we expect rents to continue rising, especially for best-in-class space.

In addition, demand is expected to grow further as the post-Covid economic recovery beds in and the new natural gas field projects result in an influx of energy companies, all of which will contribute to increased space requirements.

Sluggish return to growth for residential rental rates

"Following a sluggish period for the residential leasing market, demand is slowly returning."

In Maputo for instance, the arrival of businesses and professionals from other cities to take advantage of rising economic activity, along with an increase in Portuguese entrepreneurs, has led to an accelerating uptake of apartments, which is helping to drive up lease rates. Good quality 3-bedroom apartments in Downtown Maputo and further north in the upmarket area of Sommerschield are currently available for between US$ 2,500 to US$ 3,200 per month.

Retail market poised for recovery

The formal retail sector remains mainly restricted to the capital, Maputo. Constructed by RPP Developments, together with Actis in 2018, the 30,500 sqm Baía Mall is still the largest retail offering in Maputo. City Mall (24,700 sqm) follows in second place. Other retail offerings outside the capital include Matola Mall and Mall de Tete.

Monthly retail rents remain stable at US$ 28 psm. Although there has been an uptick in footfall following the easing of pandemic restrictions, high vacancy rates continue to depress rents. Our outlook however is positive. As travel restrictions ease, we expect an influx of tourists in the short to medium term from Johannesburg and further afield, boosting retailers’ turnover, while also catalysing demand.

Logistics expands, spurred by improved infrastructure

Mozambique’s logistics capabilities are fast growing, following the significant improvements in transport infrastructure. In fact, these improvements have prompted Bolloré Transport & Logistics to offer end-to-end supply chain solutions across road, air and ocean freight, while operating 21 international standard warehousing & distribution points across major urban centres in the country.

The most significant addition to the country’s industrial stock has been the opening of Agility Logistics Park in Maputo last year, offering 32,000 sqm of international-standard warehousing, with further expansions currently being planned. Monthly rents for international standard warehousing generally range between US$ 7-8.50 psm outside Maputo and other major urban centres. These levels remain below a peak of US$ 10 psm achieved before the pandemic, when lower supply, combined with higher absorption rates, particularly by the energy sector, helped to sustain elevated rents.

We expect that the industrial sector will continue to improve, underpinned by the economic recovery and fuelled by upcoming LNG and agricultural projects.