Côte d'Ivoire

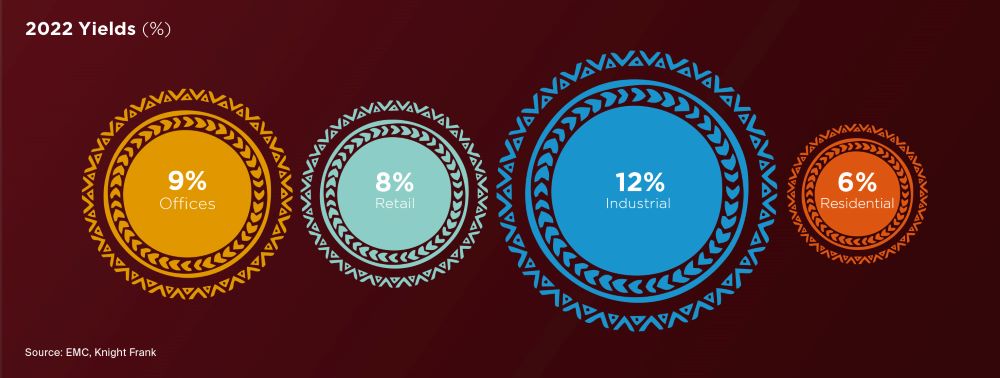

Following the injection of political stability in the wake of the presidential elections in 2020, Abidjan’s real estate market continues to experience growth in most sectors, with a clear focus on higher quality stock by investors and occupiers alike.

2 minutes to read

Steady and stable demand for office space

Over the past few years, the office market has expanded beyond the boundaries of the traditional Plateau CBD area and a number of new developments have completed in Cocody and Riviera.

Recent completions have raised the bar for quality with higher levels of finishing, in addition to better health, safety, and security features, as well as improved parking provisions. The largest and most recent development is the Ivoire Trade Center (ITC), a mixed-use development. ITC opened in 2020 and is now fully occupied.

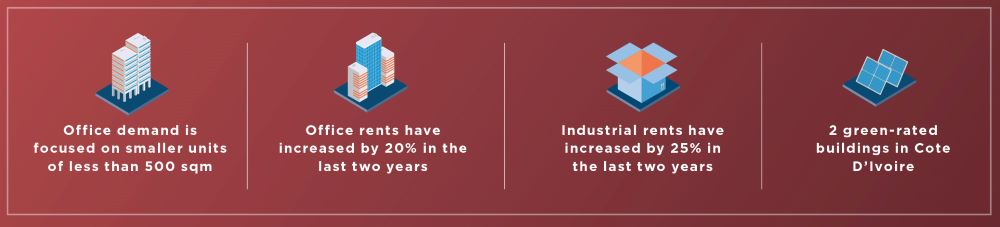

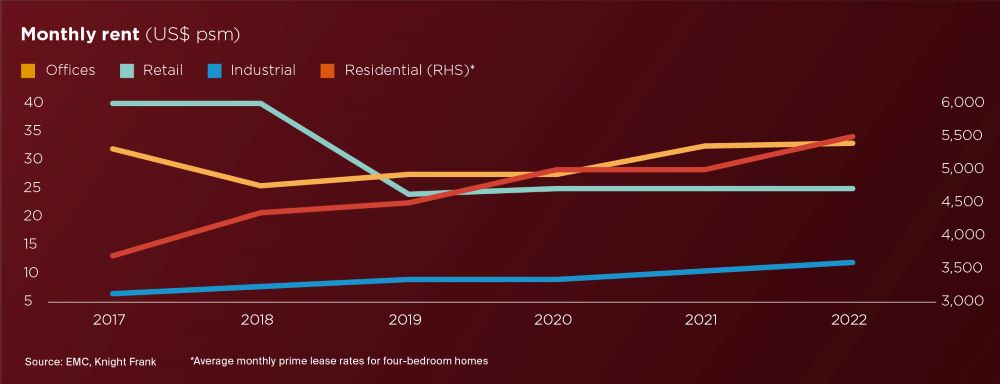

Steady demand for high-quality Grade A office space has helped to keep rents relatively steady over the last two years, especially for best-in-class space. Rising stock levels and a widespread review of occupational strategies have, to an extent, contained rental growth.

Increased retail variety

The retail market appears to be entering a period of recovery, as evidenced by the rapid uptake of vacant units. The market also is attracting new entrants, such as Carrefour and Auchan, who are competing directly with traditional malls due to their ‘super-store’ offering.

"The retail market appears to be entering a period of recovery, as evidenced by the rapid uptake of vacant units."

And more retail is on the way. New mixed-use developments, featuring retail, in Marcory-Zone 4 are expected to be delivered by 2024, adding c.6,000 sqm of retail (and 15,000 sqm of offices) to Abidjan’s stock.

Demand grows for warehousing

Traditionally sought-after areas like Vridi are losing ground to new industrial areas formed by public-private-partnerships (PPPs), as tenants gravitate to modern, higher quality warehousing.

Yamassoukro and Bassam, for instance, are seeing increased interest from both local and foreign companies and investors, with the food and beverage sector accounting for the bulk of demand.

Indeed, industrial rents have risen by c. 25% in the last two years, reflecting the growing depth of requirements.

The residential sector remains stable

Marcory, Cocody and Riviera remain the most sought-after residential neighbourhoods, but activity is also picking up further east, towards Rivera 5 and 6.

As expats start returning and the post-Covid recovery takes hold, housing demand is growing and we are recording a rising number of sales transactions. Developers are responding to the level of requirements with new schemes such as Residence Akwaba being brought to market.

Rents too are rising and are up 10% in the last 12-months, which has prevented yield compression.