Platinum prices, Carbon crunch, Rural Report 2022

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

4 minutes to read

Long-term owners of farmland might be excited to know that the value of their land has increased by around 14,000% over the past 70 years. Inflation, however, is an unforgiving beast and, as I discuss below, the increase in real terms is somewhat less exciting, but it’s still a decent rise. Judged on the same criteria, wheat should now be worth £850/t. The rise in yields since then (just over 1.2t/acre was the average in the 1950s) goes someway to balancing the equation when farmers can sell their grain for over £300/t, but even then increasing fertiliser and energy prices wipe out most of the gain. Food for thought when planning cropping strategies for the next 70 years.

Please get in touch if we can help

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Oil prices back up

• Farmland values – Platinum-plated prices

• The Rural Report 2022 – Sign up for webinar

• Game birds – Defra releases release licence

• Yorkshire Wolds – AONB consultation open

• Overseas news – Lessons from Carbon markets

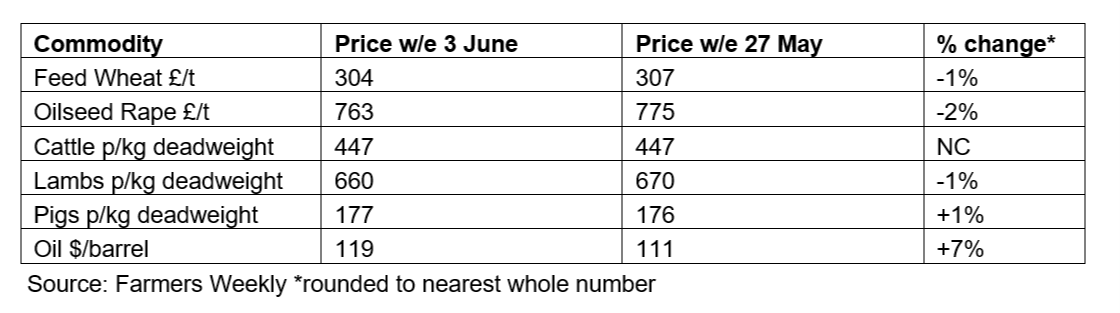

Commodity markets – Oil prices back up

Fuel prices are on the rise again despite Opec promising to pump more crude. The proposed increase, however, is not predicted to be enough to offset the drop in Russian supplies. It made me wince paying over 170p/litre to fill up my little A3 over the bank holiday, but I’d hate to guess what the huge Claas Jaguar forage harvester I got stuck behind for 10 miles or so on the way home was burning through. Meanwhile, some good news for egg-producers following Tesco’s decision to boost payments to offset the surging cost of feed, which accounts for around 70% of their costs.

Farmland values – Platinum-plated prices

The Rural Update isn’t immune to Jubilee fever so I thought it would be interesting to see how average land values have evolved since Queen Elizabeth II took the reins of the UK. Well, according to our Farmland Index, prices 70 years ago were just £55/acre. Since then they’ve jumped around 14,000% to almost £8,000/acre.

It’s worth bearing in mind though that back then the majority of land being sold was tenanted, so we’re not really comparing like with like.

Also, when we factor in inflation the jump in real terms is more like 320%, which sounds a bit less impressive. Even more soberingly, if wheat prices, which were just under £30/t 70 years ago, had kept up with inflation they should now be over £800/t. Again, the jump in yields makes the comparison a bit unfair, but it does highlight the tenuous link between farmland and output prices.

The Rural Report 2022 – Sign up for webinar

The latest edition of The Rural Report will be launched this week and some of its contributors will be sharing some of their insights via a live webinar later this month. If you’d like to ask our panellists any questions about regenerative agriculture, UK vineyard values or any other rural landownership issues please register now.

Game birds – Defra releases release licence

Defra has just released details of the GL43 licence that allows authorised persons to release common pheasants or red-legged partridges on “European sites”, such as special conservation areas (SPAs), and within 500 metres of their boundary.

Yorkshire Wolds – AONB consultation open

The government is proposing that the Yorkshire Wolds be designated an Area of Outstanding Natural Beauty. The consultation opens this week (6 June). If you have an interest in the area you can find out more or share you views here.

Overseas news – Lessons from Carbon markets

I spotted an interesting article in last week’s edition of The Economist looking at global carbon markets. Not the voluntary ones that are attracting the interests of landowners here, but the 64 government-level emissions–trading systems (ETSS) that force certain polluting industries to buy credits for every tonne of carbon they emit. The idea being that they will switch to more environmentally friendly sources of energy to reduce the amount of tax they have to pay.

However, many of the schemes levy such a low tax the deterrent is minimal or artificially manipulate the rate in the face of industry lobbying.

A good example was the EU’s decision earlier this month to issue an extra 200 million permits in the face of rising energy costs. Prices promptly fell by €10 to €80 a tonne.

This is a warning that such schemes, if extended to industries such as agriculture, can be volatile. But the article also suggests that even the most punitive schemes, such as the EU’s, are still considerably undervaluing the cost of carbon on society. Some economists put this as high as US$200, suggesting landowners should be careful when committing to join any long-term carbon offset schemes.