Divergent views on the UK's outlook

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Lower for longer?

Last week, three of the Bank of England's nine Monetary Policy Committee members voted to raise the base rate by a larger, 50 basis point margin, which would have put the rate at 1.25%. Michael Saunders was one of them, and he laid out his thinking in a speech on Monday.

Mr Saunders takes the view that the current path of interest rates is too benign and raises the risk of a dreaded spiral of rising wages feeding into rising prices and back again. He advocates quicker tightening, without suggesting the base rate will need to rise beyond the 2.5% set out in the Bank of England's latest forecasts.

I keep returning to this because a great deal hinges on the path and peak of the base rate. You can see how it underpins various forecasts for house prices, including our own, here. I can't recall a time with so many widespread, divergent views on what's likely to happen next, and I said last week that the Bank's market-implied projection that the rate will need to hit 2.5% next year appeared unduly pessimistic.

Some smart voices agree. Toscafund chief economist Savvas Savouri (note not online) says "there is no chance" rates will rise as sharply as the BoE's projections imply "as the MPC well knows. In particular, two members thought guidance that interest rates needed to rise further ‘was not appropriate’. These two therefore cannot possibly have confidence in the credibility of their own central forecast."

A conflicting view comes from the National Institute of Economic and Social Research (NIESR) this morning. The influential think tank suggests consumer price inflation will peak at 8.3% in Q3, lower than the Bank's forecasts, but says it will run above 3% until at least Q4 2023. The group suggests the rate will indeed hit 2.5% next year and will remain there until at least the middle of the decade.

The income squeeze

The NIESR suggests UK economic growth will slow to a snail's pace - 0.8% in 2023 and 0.9% in 2024. That's slow even by the standards of recent history and growth will return to just 1.5% by 2026.

"The combination of shocks – Brexit, Covid-19 and the recent shocks to energy prices – is set to leave the incomes of people in the UK permanently lower," the group notes.

It'll take some time before that takes hold. The NIESR expects private consumption to grow by a robust 4.7% this year as households unleash some of the £200 billion they saved during Covid-19, which will smooth spending patterns and ensure consumption falls by less than incomes.

Retail is particularly vulnerable to the squeeze in incomes and - though there are a number of bright spots that Stephen Springham touched on here - sales are beginning to slow. The latest figures from KPMG with the British Retail Consortium revealed that sales fell at an annual rate of 0.3% in April, the first decline in 15 months. That's down from a 3.1% expansion the previous month.

What are companies for?

Vivek Ramaswamy, pharma investor and author of the book “Woke, Inc.”, has raised $20 million from well known investors for a fund targeting companies that "focus on making money, not taking stands", according to the WSJ write up.

The money raised is tiny compared to the size and scope of the huge asset managers that Ramaswamy wants to take on, but the fact it's newsworthy when a fund targeting companies solely aiming to maximise shareholder value over say, environmental or social concerns, shows how far corporate discourse as moved in the past three years.

The growth of ESG has chipped away at Milton Friedman's doctrine that the sole responsibility of a company is to maximise shareholder value. Many large investors argue that ESG concerns and shareholder value are inextricably linked - do the right thing and profits will follow., with the theory widely adopted across the real estate industry. Ramaswamy‘s performance will be keenly watched.

The rotation

A five month equity sell off has erased more than $9 trillion from the value of stocks this year. The average S&P 500 stock is down 24% from its recent high as companies face rapidly rising interest rates, rising inflation and supply chain bottlenecks.

Knight Frank Head of Commercial Research Will Matthews notes that an environment of softer equity markets and worsening economics could see increased polarisation of performance, potentially even for real estate. However, real estate offers one or more of; inflation hedge properties, growth potential, diversification benefits, income and / or relative stability, and is expected to see strengthened interest from investors looking to achieve these aims.

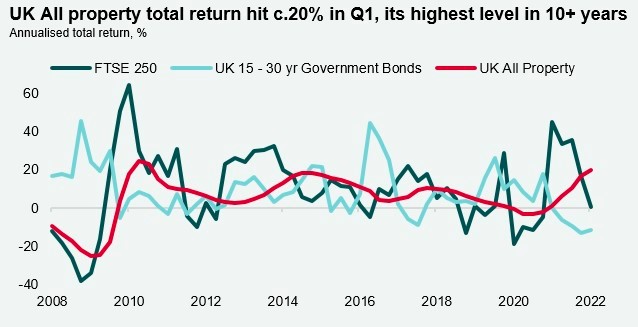

Total returns hit almost 20% in the first quarter, the highest level in more than ten years (see chart).

Selling up

The number of offers accepted in the country house market in April was the highest for the month in 15 years, surpassing the previous record set last year during the stamp duty holiday.

After a period of record-breaking growth that saw prices in the country market hit a new peak in March, sellers have been motivated to act during one of the property market’s busiest months to crystallise gains ahead of an expected slowdown later this year, writes Chris Druce.

“Having taken stock during the first three months of the year people are now coming to market and being decisive. Where property is realistically priced, it is selling quickly and attracting competition,” said Russell Grieve, office head at Knight Frank Haselmere.

The median time from instruction to an offer being accepted fell from 57 in March to 56.5 days in April. This is the shortest time since last June, when the figure was 54.5 days during the frenzied final month of the full stamp duty saving.

In other news...

A wide-ranging set of 38 pieces of legislation were announced in the Queen’s Speech yesterday as Boris Johnson sought to reboot his premiership. That's up from 30 last year.

Anna Ward runs through the key points for property.

Elsewhere - mortgages drive increase in US household debt to nearly $16tn (FT), and finally, the Bank is out on a limb with its doom-filled forecast (Times).