1 minute to read

A cornerstone of the Life Sciences Golden triangle and a market darling during the Covid-19 pandemic. Incubator, start up, and ‘grow on’ first and second stage life sciences companies have exploded in the city, which is already home to four ‘Unicorn’ companies.

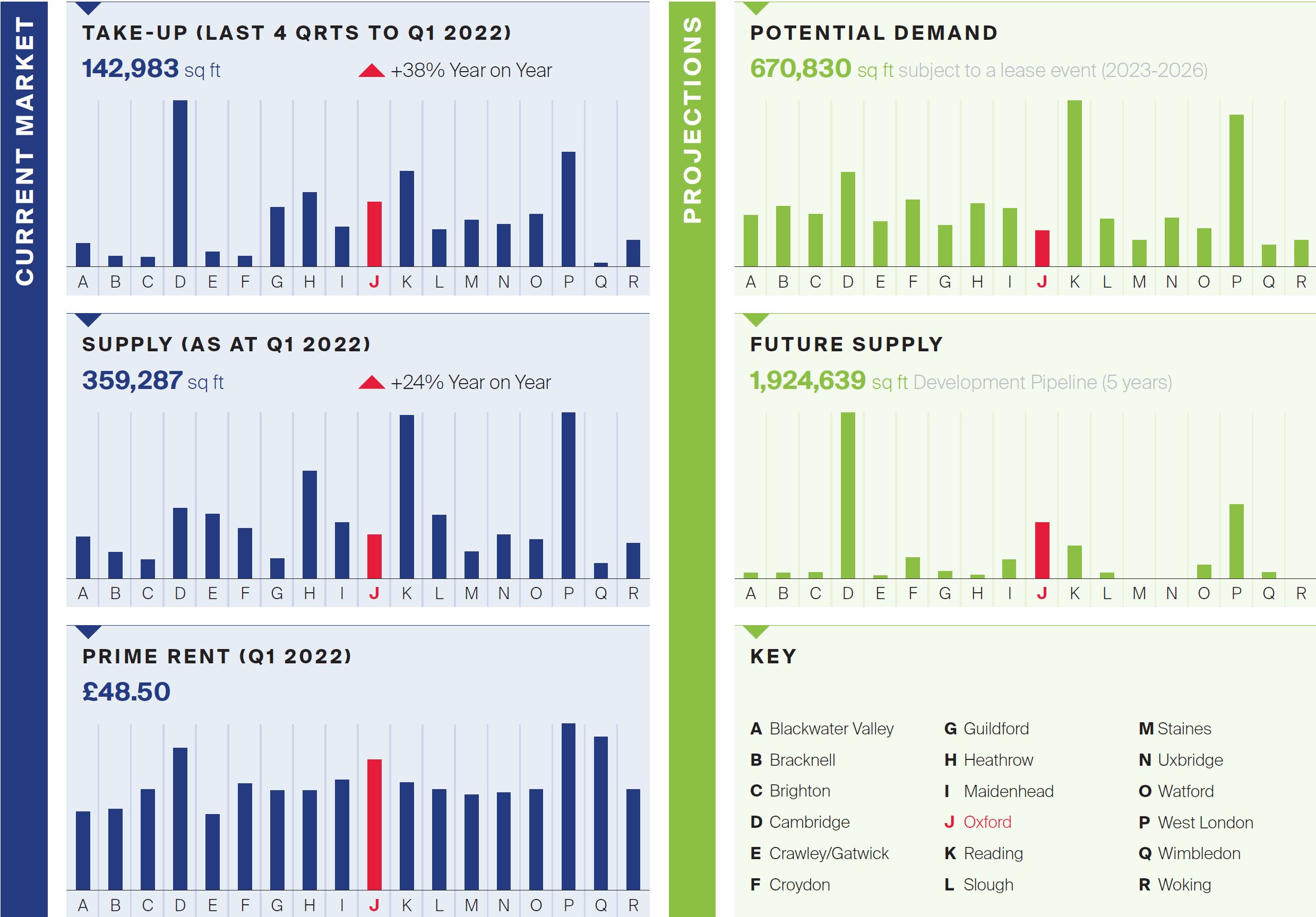

Take up in 2020 tracked +5% above 2019 levels. But 2021 saw take-up skyrocket +95% above 2020 levels: the focus on the edge of town science parks with office space being fashioned for laboratory use. In turn this has driven rents across the city to new levels. Edge of town schemes are now at £35-£40.00 psf with those in the core at mid £40.00’s. Both rental tones will rise but analysis of the market will be complicated by levels of Landlord fit out provided.

This is spurring new speculative development pipeline. Thomas White, now in conjunction with Stanhope and Cadillac Fairview, will bring forward Oxford North, a new global life science district with 1.1 m sq ft of commercial space. The next phase of Oxford Science Park also beckons, beautifully designed by Perkins&Will. Brookfield AM have also pledged £1.5bn - £2bn to quadruple the footprint of its Advanced Research Cluster (soon to be re-branded ARCo), the bulk of which is earmarked for Harwell Science and Innovation Campus. To the north, Begbroke Science Park will develop a new focus under a £4bn partnership between L&G Bruntwood SciTech and Oxford University.

Click to enlarge image

Download the Key Markets report 2022