Revised growth forecasts, money market predictions, and the impact of weaker sterling

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Please find attached the latest Leading Indicators Dashboard, our weekly roundup of the economic and financial metrics you need to track, and what to look out for in the week ahead.

Tug of war between growth and inflation

The IMF downgraded its growth forecasts for 2022 to 3.6% from 4.4% in January and 4.9% six months ago. The UK’s growth was also downgraded to 3.7% in 2022. To counteract potential stagflation, the IMF recommended that central banks react quickly by raising interest rates.

Rate hikes expected to accelerate

Money markets predict central banks in the US, UK and Europe will heed the IMF’s warning and begin to raise interest rates in a more aggressive manner. The US Federal Reserve is expected to increase rates by 50bps at each of its next three meetings, culminating in a 2.7% interest rate by year end. In the UK, the Bank of England is expected to raise rates to 2.25% over this time. Meanwhile, markets predict 85bps worth of interest rate hikes from the European Central Bank this year, bringing the rate into positive territory for the first time since 2014.

Cross border investors to capitalise on weaker sterling?

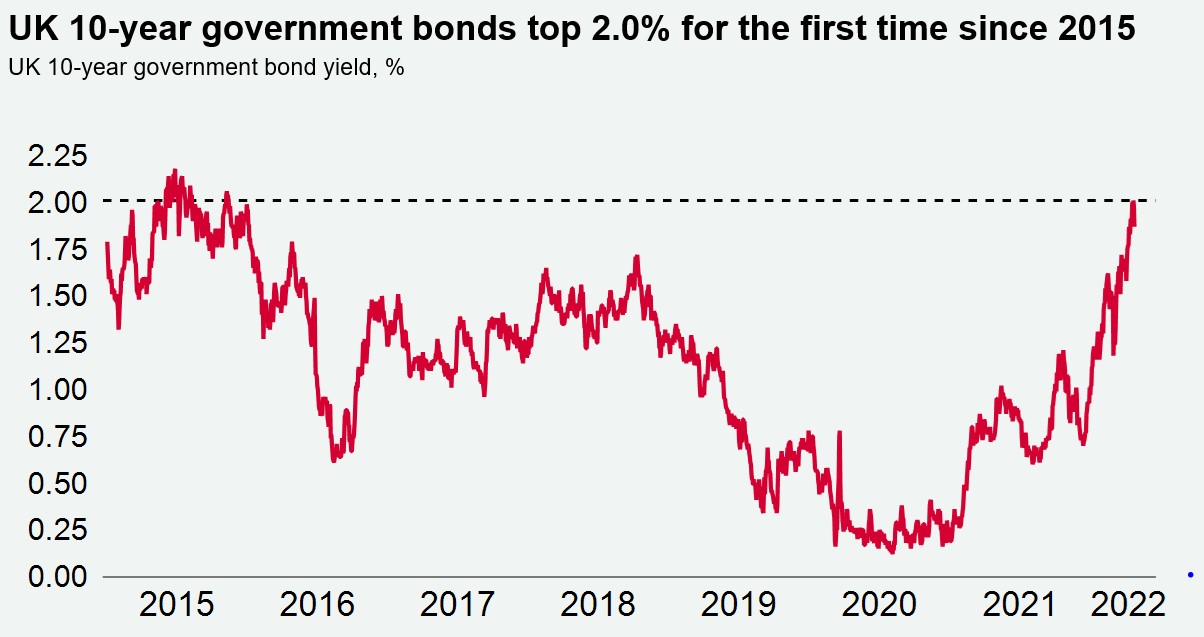

Hawkish central bank signalling has done little to settle markets, with UK 5-year interest rate swaps hitting their highest level since 2011 at 2.5%, while UK 10-year government bonds topped 2.0% for the first time since 2015. Sterling has depreciated to $1.27, down from $1.37 from the beginning of the year and its lowest level since June 2020. With sterling depreciating and hedging benefits on the rise, UK commercial real estate has become notably cheaper for some overseas capital.

Download the lastest Dashboard