Edinburgh property market remains hot as demand continues to outstrip supply

Edinburgh Index 126.1 / House 126.2 / Flat 134.3

2 minutes to read

Edinburgh’s residential property market continued to see fierce competition for family homes in the first three months of 2022, as flats found renewed popularity after a pandemic-inspired hiatus.

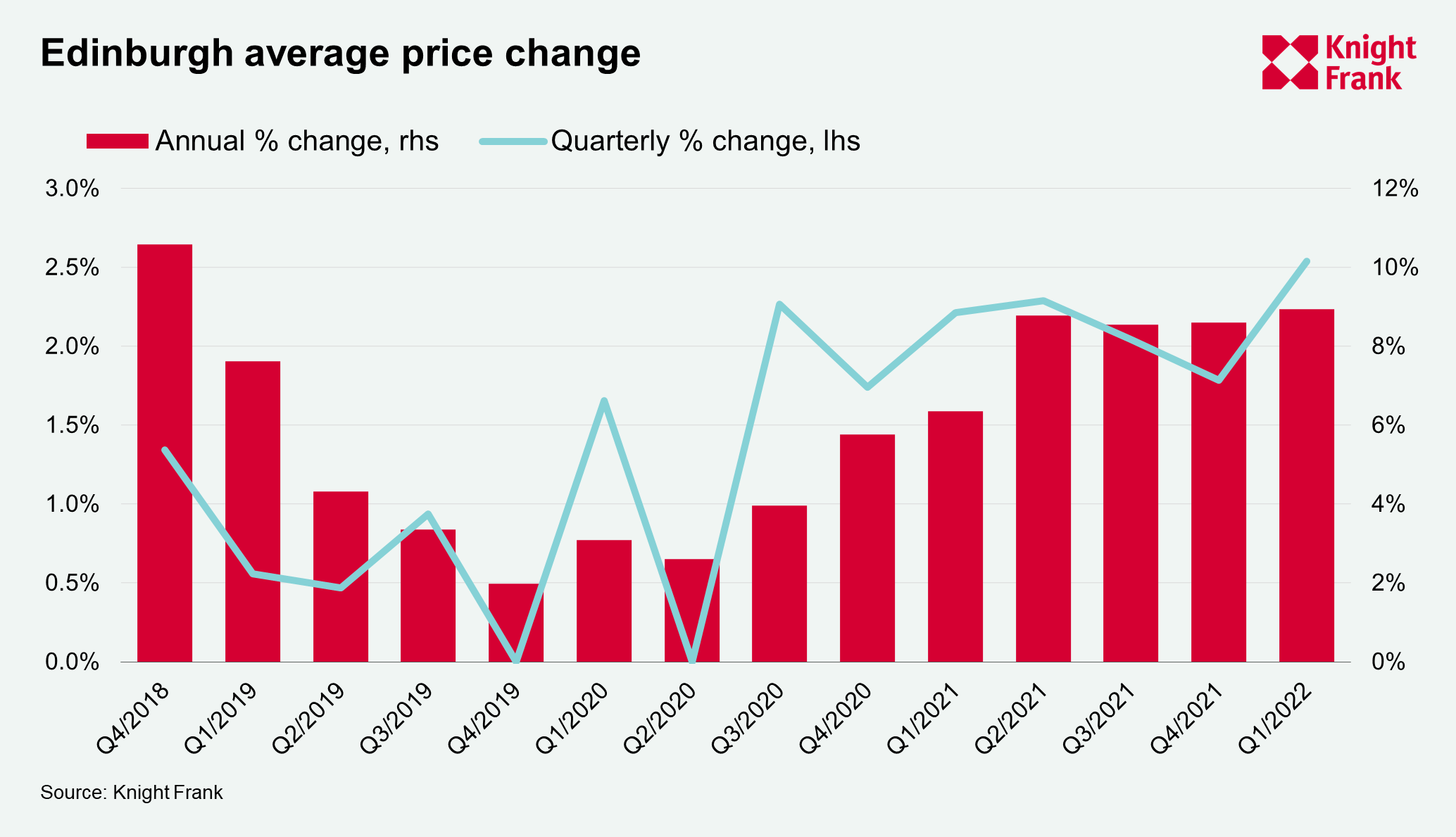

In line with the global resurgence of city markets, Edinburgh continued its strong performance. Annual price growth reached 8.9% in March, the strongest rate since the end of 2018.

On a quarterly basis, prices increased by 2.5% compared with 1.8% in December. This was the strongest performance since the start of the pandemic.

Agents report that the strongest competition among buyers is for larger family homes, particularly those with outside space, with evidence of large premiums being paid.

New prospective buyers, in the city and area around Edinburgh, were up 33% in the first quarter versus the five-year average. New instructions increased by 4% in the same period, underlining the supply/demand imbalance that has kept upwards pressure on prices.

Consistent with other city markets, flats are back in fashion as part of a trend that has seen the reopening of economies and return to offices rebalance demand between rural and urban markets.

While average house values increased 2.8% over the first quarter in the Scottish capital, flats saw 2% growth. It meant the quarterly price change between houses and flats was the smallest since the start of the pandemic, and the quarterly increase for flats was the largest since June 2018.

Since the market reopened in Scotland in June 2020, average house prices have increased by 21.1% compared with 7.8% for flats, boosting the relative value of the latter.

Exchanges in Edinburgh were up 22% in the first quarter of 2022 versus the five-year average and offers accepted increased by 16% as buyers continued to be attracted by the city’s broad appeal, which has attracted buyers from around the UK.

Against this backdrop, being a proceedable buyer is important. “Getting yourself in position to make a purchase is key. If you are subject to sale then you’re likely to struggle as you’ll be competing against people that are ready to go,” said Edward Douglas-Home, head of Scotland residential at Knight Frank.

However, with headwinds such as higher mortgage rates and inflation set to bite in the second half of the year, price growth is expected to slow and finish 2022 in single digit territory as our newly published forecast set out.

For further insight into the UK residential property market, subscribe below.

Subscribe