New Knight Frank forecasts for UK house prices and rents

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Forecasts

We've long held the view that 2022 is when double-digit house price growth begins to unwind and growth returns to something resembling more long-term norms.

We published our updated forecasts outlining exactly how we expect that to play out this morning. We expect UK house prices to climb 5% this year as mortgage rates rise, inflation bites and the most distortive effects of the pandemic fade. Growth will slow to 1% in 2023 before picking up again in subsequent years, according to the forecasts (see table below). In the five years to 2026, that amounts to 13.6% cumulative growth.

In prime central London (PCL), we forecast 3.5% growth this year as the property market inside zone 1 continues its overdue recovery after six years of political uncertainty and the emergence of a more adverse tax landscape.

We forecast growth of 6% in 2023 as the return of international buyers gathers pace. This return is later than we previously anticipated and reflects how there is unlikely to be a single moment when overseas demand normalises. Instead, the process will be more erratic as countries deal with Covid-19 in different ways. We forecast 22% growth in PCL over the period.

For more detail, plus our rental forecasts, see this piece.

The jobs market

The UK's jobless rate averaged 3.8% during the three months to February, the lowest level since the onset of the pandemic, according to official figures.

That's largely where the good news stops. The number of people in work is more than 500,000 lower than it was at the onset of the pandemic, primarily due to people over 50 no longer working. Employers are clearly struggling with the dearth of workers and vacancies hit 1.288 million in the first quarter.

Pay is rising as a result and annual growth in average earnings excluding bonuses picked up to 4.0% during the period. That's still well below the rate of inflation, which accelerated to hit 7% in March, according to ONS figures published this morning. Workers on the lowest pay are being squeezed the most, according to a Reuters analysis of tax data.

Soft landings

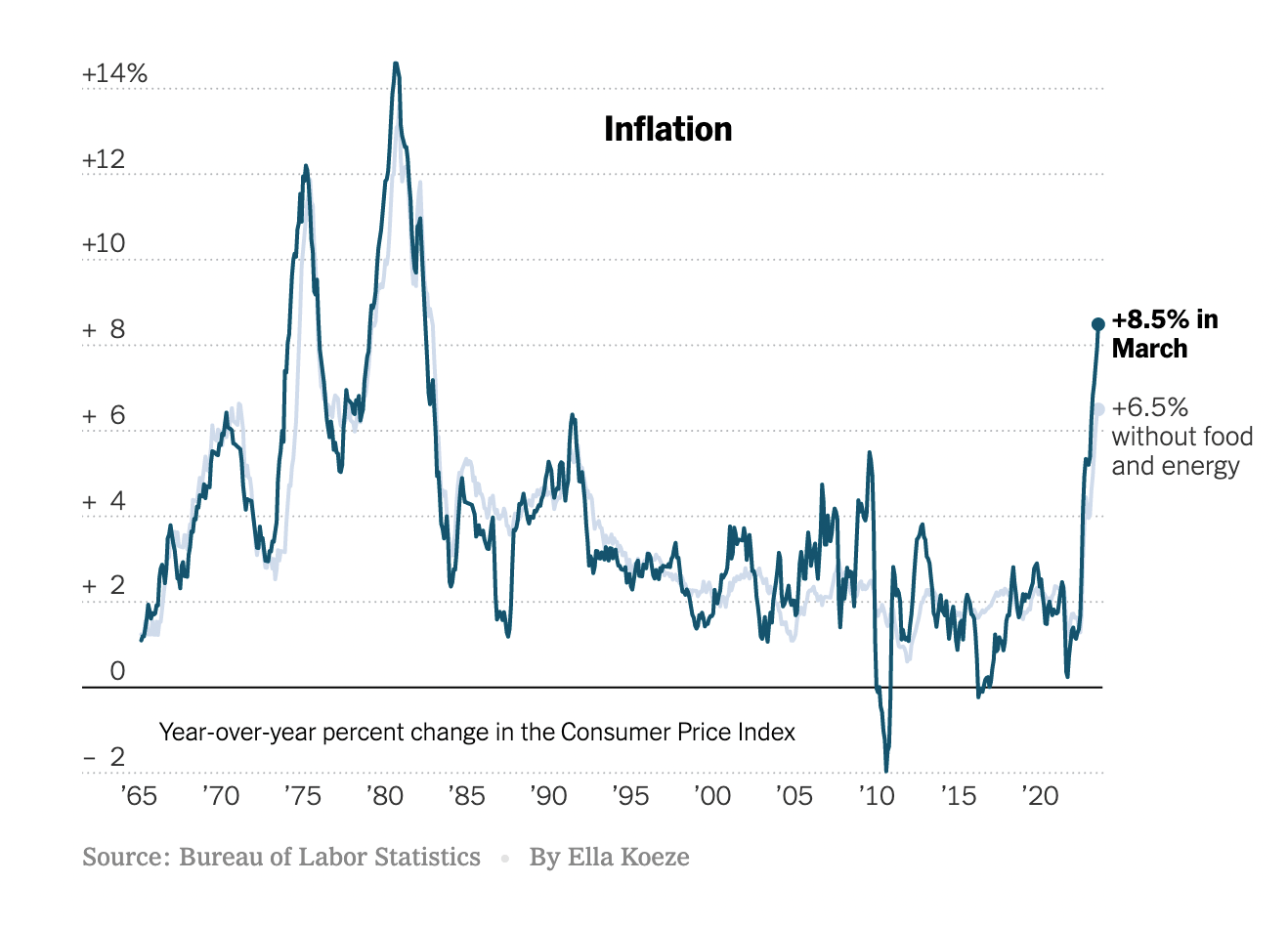

The latest inflation figures from the US look bad at first glance - the headline annual rate hit 8.5%, the most since 1981. However, strip out energy and food and the rate of price rises slowed slightly in March, largely due to easing in the used car market (see chart below courtesy of the NYT).

Several economists told the NYT that March may be the high-water mark for inflation, which will be crucial for the US economy and by extension the housing market. The Fed has been playing catch up for months and its aggressive plans for interest rate hikes threaten to tip the economy into recession next year. US mortgage rates are already at a 3-year high.

Deutsche Bank earlier this month became the first major bank to pin its colours to the mast. It forecasts a US recession next year due to the "major hit from the extra Fed tightening by late next year and early 2024.” If we are reaching peak inflation earlier than anticipated then we may see that soft landing that has been looking so doubtful.

Zero Covid

Approximately 373 million people in 45 Chinese cities are now under full or partial lockdown, making up 40% of the country’s gross domestic product, according to estimates from Japanese bank Nomura.

The outlook for global supply chains is truly dire. Imagery from Bloomberg shows huge and growing queues of 477 cargo ships waiting outside various ports to deliver everything from raw materials to grains.

China accounted for about a fifth of the UK's imported building and construction materials before the onset of the pandemic. Rises in UK construction materials prices had shown some signs of easing recently, with the rate of growth falling back to 20% in February, though those figures are yet to reflect Russia's invasion of Ukraine, or the scale of lockdowns across China.

New Zealand

New Zealand's central bank hiked its key interest rate by half a percentage point yesterday, the largest hike in 22 years. Canada's central bank may opt for the same aggressive approach later today.

New Zealand's rate now stands at 1.5% and the housing market is in the midst of a marked slowdown. Valuation company QV found the average home decreased in value by -0.6% nationally in the first quarter of the year and economists at ANZ are forecasting a drop of 10% over the course of the year.

Average house prices climbed 22% in the most recent 12 months, according to our Global House Price Index.

In other news...

WTO cuts growth forecast to 3% (FT), losses multiply for wealthy investors in first quarter (FT), and finally, tech companies try to lure employees back to the office (NYT)