Regulating ESG, property's climate reckoning and inflation soars to a 30-year high

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Climate disclosures

The US financial regulator on Monday published a 510-page proposal outlining how listed companies should disclose their greenhouse gas emissions alongside how much and how often they rely on offsets.

The proposals bring the US in line with other global markets. The UK's biggest companies will start reporting their climate risks for the first time next month, for example. Here are the key takeaways from Bloomberg.

It's a significant moment in the long journey to standardise, regulate and ultimately build some transparency into the world of ESG. Back in December 2020 we marvelled at the rate at which capital was flowing into self-labelled "green" funds with very little oversight. During the intervening months an increasingly complex web of regulations and systems have been implemented - effectively a parallel set of financial rules for the climate.

Those in favour of light touch regulation argue that investors or consumers will exert the necessary pressure for companies to do the right thing on climate and social issues. Governments are taking the opposite view - that they increasingly need to dictate how things are done in this arena.

Dictating the pace of change

Office developers have been on a similar journey to build transparency into how they disclose the impact their buildings have on the climate - see Matt Hayes this morning on the various ratings systems in play. The push to certify comes in response to pressure from occupiers - our 2021 (Y)OUR SPACE survey of global occupiers found that 58% of 400 executive respondents believe their Net Zero commitments will influence future real estate choices.

The residential world has not come under the same pressure to decarbonise. Affordability tends to trump most other concerns in the wider housing market, and for wealthy buyers, location, design and detailing are the focus. That means change has been slow in coming, leaving the sector as a potential target for further regulation.

I have tried to take a long view on what this means for residential markets in a new piece for The Wealth Report 2022. Dictating the kind of homes people buy is linked closely with taxing and regulating personal consumption, something governments have been wary of to date.

Yet a reckoning may be coming. A 2021 report from the Hot or Cool Institute confirmed that high-income countries must reduce lifestyle carbon footprints by 93% by 2050, with even middle-income countries needing cuts of up to 80% to meet targets. It’s impossible to square this with the current rate of change, and the implications extend well beyond property to every industry that commands a slice of luxury spending. See the piece for more.

Inflation

The annual rate of consumer price inflation hit 6.2% in February, the highest rate for 30 years, according to official figures published this morning. Energy and fuel prices were among the largest drivers, a global trend that shows few signs of abating (see chart).

There is undoubtedly more to come. Russia's invasion of Ukraine will continue to impact various commodity markets, particularly energy and food (see Andrew Shirley's Rural Update for more). The proportion of manufacturers expecting to increase prices has jumped to its highest level since records began in 1975, according to the latest monthly industrial trends survey from the CBI.

Yesterday Crest Nicholson said it was already seeing input cost inflation as a result of the conflict, both via rising energy costs and disruptions to the supply of raw materials.

Property market activity

Crest Nicholson also reported strong demand in the housing market, with its key measure of sales rates accelerating.

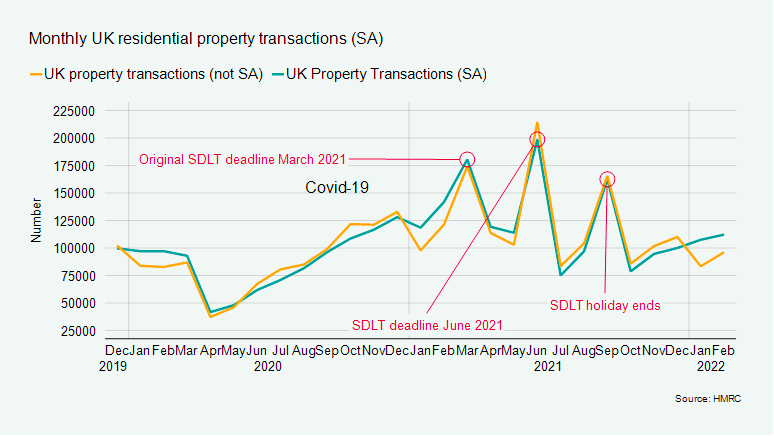

Officials figures from HMRC published yesterday revealed there were 96,250 property transactions in the UK in February, 20.6% lower than February 2021 and 15.3% higher than January 2022. The data is volatile due to the stamp duty holiday but transactions remain above pre-pandemic norms (see chart).

For an outlook as to how activity is likely to progress over the coming weeks, I recommend Tom Bill's weekly note.

In other news...

China-backed Malaysia megacity project struggles to gain momentum (FT), Frank Gehry on 'humane' design (FT), UK bankers are staying put, for now (Reuters), housebuilders hit back at Michael Gove ‘cartel’ slur (Times), and finally, the WHO on Europe's new wave of Covid-19 (Bloomberg).