Clean, Healthy and Green

Sustainability will be a principal objective for organisations in 2022, with tighter regulations and reporting meaning more measurement, more management, and a shift in real estate focus. But, what will be the impact on office markets across the UK Cities?

4 minutes to read

Choices made in the urban landscape over the next decade will have a significant influence on the battle against climate change. Currently, four in five Britons reside within a city region, with cities estimated to account for 70% of global emissions. The ESG responsibilities bestowed on organisations continue to grow meaning that ESG is already ‘front and centre’ of business strategy. The built environment is a key component in supporting the realisation of achieving net-zero.

The regulatory framework to decarbonise the real estate sector is tightening across the UK, implicating both occupiers and landlords. Organisations are being encouraged to provide greater transparency over green credentials, with disclosure of carbon emissions required through policy vehicles such as Streamlined Energy and Carbon Reporting (SECR), the Energy Savings Opportunity Scheme (ESOS), and the Task Force on Climate related Financial Disclosures (TCFD), among others. Meanwhile, review of buildings Minimum Energy Efficiency Standards (MEES) will encourage greater investment in building fabric. Mandatory requirements for Energy Performance Certificates (EPC) are tightening to a minimum B rating by 2030 in England and Wales.

Additionally, NABERS will soft launch in April 2022 and capture real-time building consumption performance, leaving little room for poorly operating assets to hide. The government in Scotland has also called for industry evidence to revolutionise the regulatory framework for Scottish property. This could see the requirements of property across Scotland set on a similar pathway.

What is the impact for office markets across UK cities?

Improvement of energy efficiency in all commercial building stock is essential to asset viability. The incoming MEES regulations mean that improving energy efficiency is no longer a nice to have, but soon to be legal requirement. From April 2023, it will become unlawful to continue letting space with an EPC rating of ‘F’ or ‘G’, even in the middle of lease term. Landlords must act now or face increasing risk of obsolescence, with policies designed to prevent inaction. The UK government are considering enforcement of EPC ‘C’ by 2027, with evidence of owner action potentially required as early as 2025. These ‘stepping stones’ are aimed at initiating market action ahead of 2030 when 85% of commercial stock will be within the scope of new regulation versus just 10% previously.

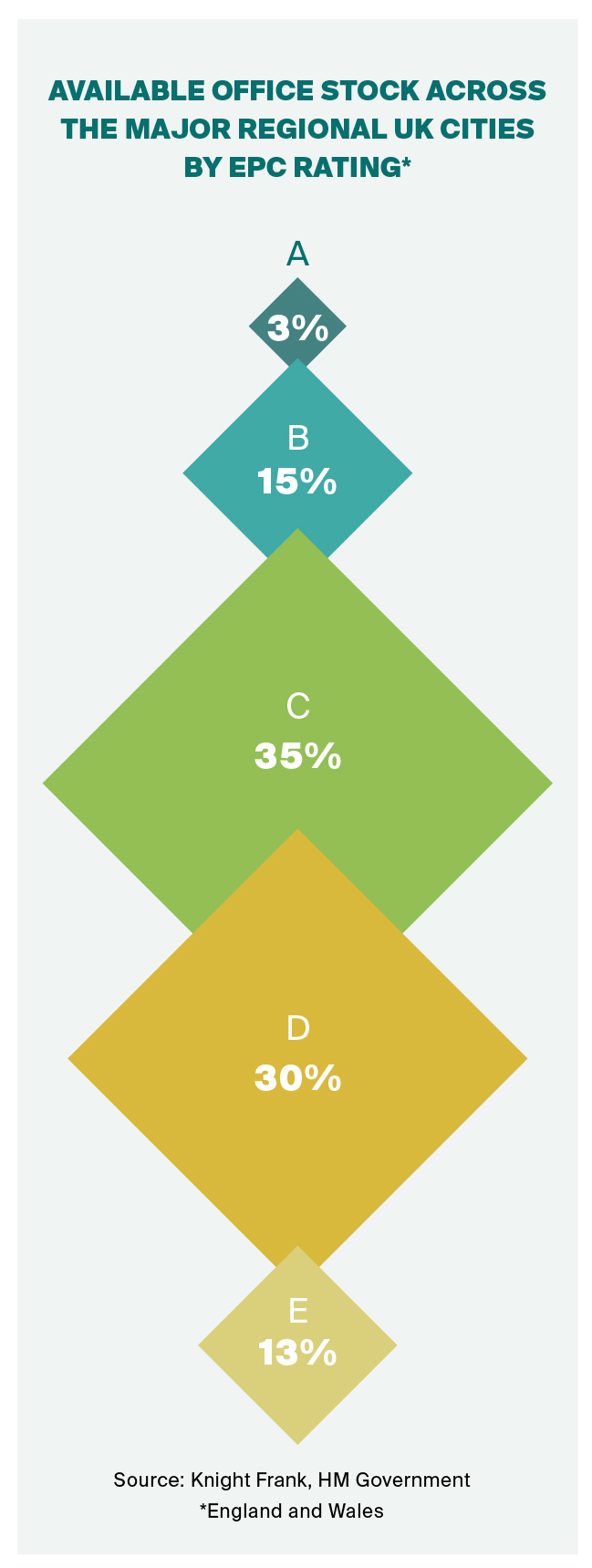

Assessing the EPC ratings of office stock showing availability for lease across major UK city office markets outside of London reveals that 82% of those offices being marketed would not meet the 2030 target of an EPC ‘B’ rating. This means that just one in five offices showing availability would meet the required standard if the ruling were to be applied today.

As organisations position net zero carbon buildings at the core of strategy in greater number, competition to secure best in-class assets is sure to mean upward pressure on rents. Rent inflation is already evident in London, where highly rated buildings are achieving rental premium. A similar projection is now set for the UK regional cities, albeit escalating costs are becoming a limiting factor on development.

Organisational focus to amplify?

Prior to the Glasgow COP26 conference, the UK government confirmed that it would become the first G20 country to make company climate disclosures mandatory from 6 April 2022. This means that many of the largest UK registered companies will now be required to make public commitments to addressing sustainability. This greater scrutiny will further magnify the role of real estate and carbon footprint, with action achieved through real estate therefore, to be part of an organisational armoury for carbon reduction.

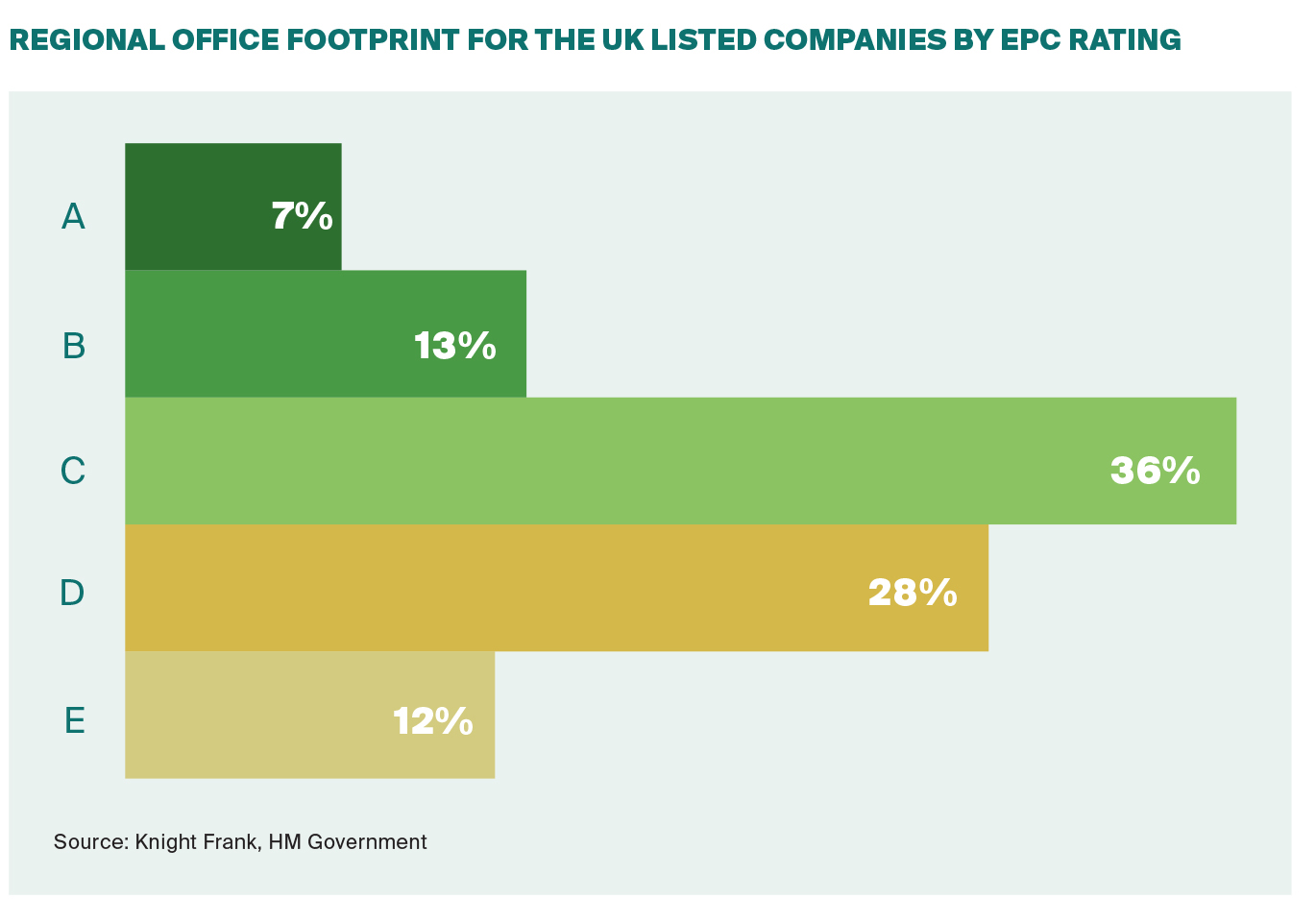

Knight Frank has analysed the office space occupied by the leading listed UK companies across the major UK office markets outside of London.

Key findings

Our analysis found just 20% of offices occupied by UK listed companies in the UK regional cities hold an EPC rating of A or B.

This means that either investment to achieve improvement will increase or space moves will be initiated to prevent real estate undermining an ESG focused strategy. Every facet of the real estate ecosystem will face scrutiny and will need to target efficiencies through design, construction and operation. This means that any initiated move would gravitate toward best in class. A flight to quality will therefore be the defining theme of leasing activity in 2022.

What next?

The main obligation is with the landlord so tenants should anticipate efforts by landlords to address risk on the terms of existing/ new leases. Conformity to the minimum standards is an established requirement, but landlords might consider ESG credentials as a point of differentiation and opportunity. Investing in ESG will mean a more attractive investment proposition and improve overall tenant experience.

Nonetheless, whether achieved through pursuing accredited certifications (Fitwel, BREEAM) and/or improving EPC ratings – specialist consultation is essential. A recent study by the IPF found improving EPC ratings by one grade could cost between 1 - 40% of the refurbishment budget, dependent on individual asset. Tenants should be aware of that upgrade works could potentially factor in pass through costs.

Our award winning Energy, Sustainability and Natural Resources team at Knight Frank would be delighted to provide you with clear insight, advice and help on ESG across all stages of the building lifecycle, stepping beyond compliance in support of the journey to net zero.

Download UK Cities 2022